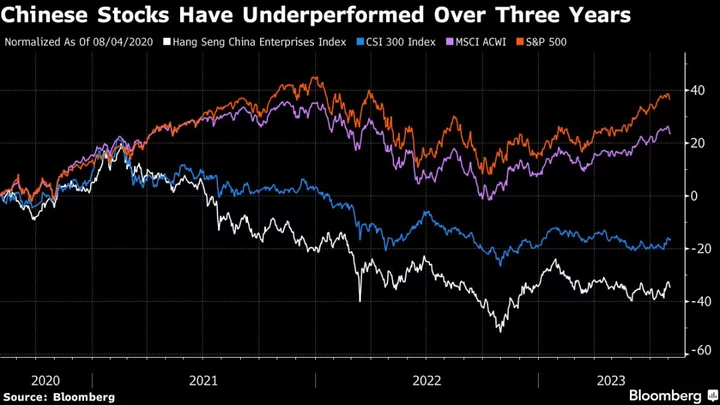

A $3.2 billion fund focused on Asian equities is avoiding the region’s two biggest stocks, saying their valuations fail to reflect economic and political challenges.

Taiwan Semiconductor Manufacturing Co. is “priced like it’s a secular business” rather than a cyclical one, while valuations of Tencent Holdings Ltd. “would have to be extraordinary” to be attractive as it’s at the forefront of US-China tensions, said Jonathan Pines, who manages the Federated Hermes Asia Ex Japan Equity Fund.

His comments come even as both stocks are trading below 10-year average valuations.

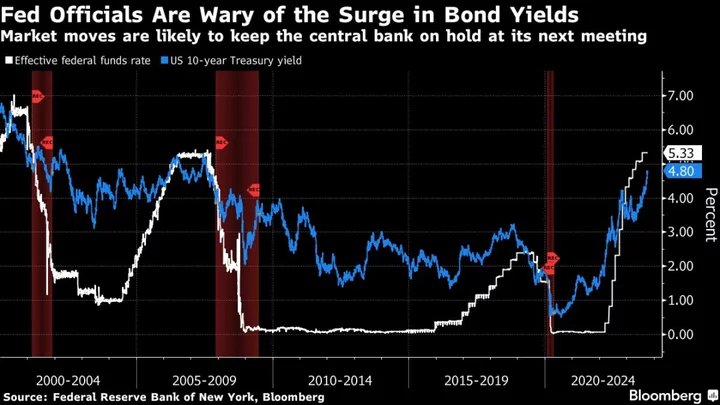

A number of Asia’s heavyweight stocks — many in the tech sector — have rebounded this year amid speculation global central banks may be near the end of interest-rate hikes. That was after valuations were dragged lower in 2022 due to geopolitical tensions and a downbeat semiconductor cycle, although some investors remain cautious.

Pines’ fund — which beat 88% of its peers over the past three years — no longer has stakes in either TSMC or Tencent, he said. It exited the last of its positions either late last year or early in 2023, the London-based fund manager said in an interview.

Read More: Top Greater China Fund Raises Concern Over TSMC After Buffett

TSMC is currently trading at about 4.2 times book value, whereas one of its main rivals Samsung Electronics Co. is at just 1.1 times.

Shares in TSMC would need to fall about 15% to 20% before the fund considers investing in them, given the impact of a potentially recessionary environment on its logic-technology business, with geopolitics another possible negative, Pines said.

The Taiwanese chipmaker reaffirmed its target for capital spending in its latest earnings announcement last month but warned demand from mobile and PC industries remains soft.

Growing Competition

Meanwhile, Tencent’s growth has slowed but its shares continue to trade close to 20 times forward earnings, Pines said. The company’s reliance on the international expansion of its gaming unit may be tenuous given it’s a “lightning rod” for US-China geopolitics and there’s growing competition from TikTok Inc., he said.

Pines’ fund has been increasing its overweight in South Korean stocks over the past three-to-six months, given its view that earnings for chip heavyweight Samsung Electronics Co. are bottoming, and corporate governance in the market is improving.

“Samsung has the ability to heavily influence the profitability of the industry,” Pines said. When the company announced a production cut, “suddenly the market began to factor in rising profitability,” he said. “When you have a consolidated industry, even in the face of recession, you have some power to withstand the downturn.”