Southern Water Ltd was forced to suspend dividend payments until at least 2025 as Fitch downgraded its debt and borrowing costs surged.

In the first sign of distress beyond Thames Water Ltd, Southern said net financing costs had increased more than 40% to £278.6 million ($355 million) in the year to April 1, largely due its inflation-linked debt. Ratings company Fitch downgraded Southern Water to ‘BBB’ on Friday and maintained a negative outlook, due to the company’s reduced ability to pay off its debts.

Fitch said the downgrade resulted in a “trigger event” under which Southern is prevented from distributing dividends. It said that the ban “could create some financial tension” for shell companies that own Southern Water. As of March 2022, two of these companies — Greensands Financing and Southern Water (Greensands) Financing — had a combined £850 million of debt, based on data reported by the group.

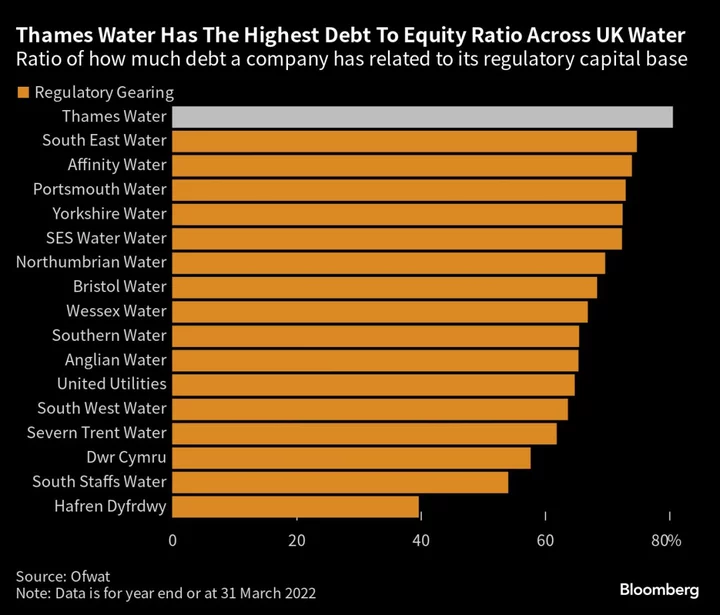

Southern is trying to raise £550 million in equity from shareholders to help maintain a “prudent gearing ratio” which is now just below 70%, having risen from 65.5%, it said.

It’s the second water company to be rocked by rising interest rates and the disclosure is likely to cause concerns about the financial health of the whole industry. Thames Water has held talks with government officials and regulators over contingency plans including a possible temporary nationalization as it tries to raise a further £1 billion.

Read More: UK Government Believes Thames Water Can Avoid State Takeover

The highly-leveraged sector is under pressure to increase equity investments and steady balance sheets but shareholders are not convinced by the outlook for future returns.

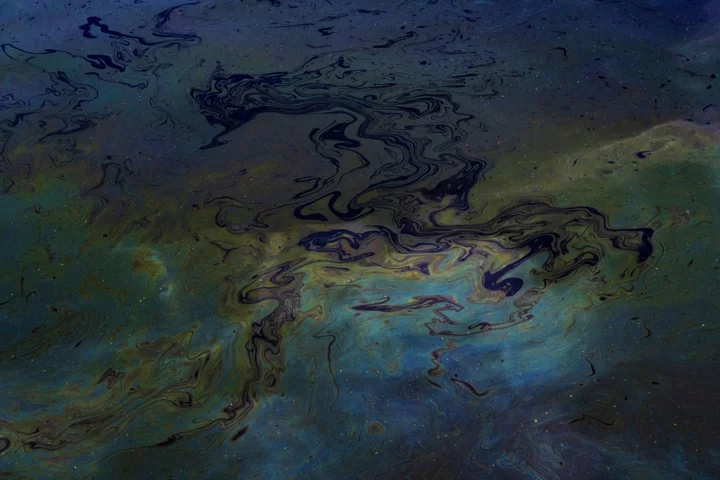

Public anger has grown due to frequent flows of raw sewage into Britain’s rivers and coastal areas. Water companies blame blockages and heavy rainfall, but ministers and regulators want more money spent on upgrades to decades-old infrastructure. The sector is also struggling with heat waves and droughts, and has imposed restrictions on households that stop people from watering gardens or washing cars.

“We have index linked debt because the whole regulatory regime sets us up to be an index linked business,” Stuart Ledger, Southern’s chief financial officer, told Bloomberg during an interview. He said large amounts of investment in infrastructure were required and it was unlikely to come from the public purse. “I think a private model is the best way of getting the capital into the water industry.”

Southern said it hasn’t paid a dividend since 2017 and doesn’t expect to for the remainder of the regulatory period which ends the year after next. The company said operating costs have increased by £74.2 million, around £30 million of which is down to inflation. The company made an operating loss of £18.4 million.

(Updates with detail throughout.)