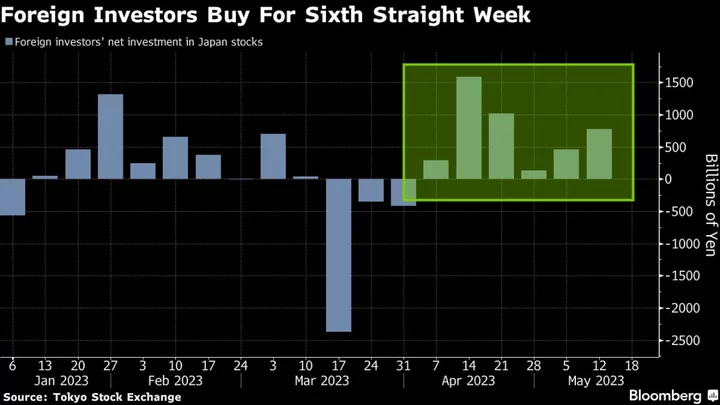

Foreign investors were net buyers of Japanese equity for a sixth-straight week, helping to fuel one of the world’s best rallies of 2023.

Overseas traders bought a net ¥781 billion ($5.7 billion) worth of stocks and futures in the week ended May 12, according to exchange data. Helped by the inflow of funds from abroad, Japan’s Topix has climbed to its highest level in nearly 33 years, outperforming all Asian peers as well as US and European equity benchmarks.

Renewed interest from Warren Buffett, a weak yen, corporate reforms and supportive central bank policy have all helped drive the market higher. While some technical signals are flashing signs of overheating, Wall Street firms from Goldman Sachs Group Inc. to Morgan Stanley are saying that there is still more upside.

Wall Street Touts Japan Stocks as Topix Hits Highest Since 1990

“With the US and Europe continuing to tighten monetary policy in order to curb inflation, it seems funds are flowing into Japan in expectation of interest rates remaining low,” Masao Muraki, a strategist at SMBC Nikko Securities Inc., wrote in a note. “Other attractive themes include prospects for better capital efficiency at Japanese firms, post-Covid reopening, and political, financial and geopolitical stability.”

--With assistance from Winnie Hsu.