JetBlue decides not to appeal American Airlines alliance court ruling

By Rajesh Kumar Singh CHICAGO JetBlue Airways Corp said on Wednesday it will not appeal a U.S. judge's

2023-07-06 04:46

Truth Social’s merger partner reaches $18m settlement with SEC

A financial firm linked to Donald Trump’s Truth Social platform has reached an $18m settlement with the Securities and Exchange Commission (SEC) in order to bring an end to the investigation into its merger with the company. Digital World Acquisition Corp (DWAC) announced the tentative settlement on Monday, saying that the payment would “remove the cloud of uncertainty lingering over DWAC and would allow DWAC to move forward in achieving its objective of delivering a strategic merger”. The SEC had been looking into whether DWAC held talks with Truth Social’s parent company before going public, which would be a violation of certain antifraud provisions of the Securities Act and the Exchange Act. The settlement means once DWAC has paid the civil penalty it can move forward with the merger, which would see Truth Social become a public company. News of the settlement comes after three people involved in the merger were indicted for insider trading last week. Michael Shvartsman, Gerald Shvartsman and Bruce Garelick were named in a federal indictment unsealed last Thursday (29 June) in Manhattan federal court. All three were charged with trading in securities of Digital World Acquisition Corporation (DWAC) based on non-public information about the company’s planned business combination with Trump Media & Technology Group — founded by former president Mr Trump — the parent company of social media platform Truth Social. They were arrested on Thursday morning in Florida. In 2021, the three investors were invited to invest in DWAC and another SPAC. After signing non-disclosure agreements, they were provided with confidential information, including the planned deal with Trump Media. They were prohibited from using this knowledge in the open market. According to the indictment, after making initial investments into DWAC through the initial public offering process, Mr Garelick was given a seat on the board of directors, which gave him access to valuable non-public information about the planned merger. He provided these updates to his co-conspirators, calling it “intelligence”. The defendants bought millions of dollars of DWAC securities on the open market before the news of the Trump Media business combination was public. In addition to their own purchases, they also passed the information to their friends on a trip to Las Vegas, to Michael Shvartsman’s neighbours, and to Gerald Shvartsman’s employees at a furniture supply store. After DWAC’s merger with Trump Media was announced publicly on 20 October 2021, the stock and warrant holdings significantly increased in value. The defendants and the individuals they tipped then sold their DWAC securities for a significant profit. Michael Shvartsman and Bruce Garelick have been charged with five counts of securities fraud under Title 15, each of which carries a maximum sentence of 20 years in prison; Gerald Shvartsman has been charged with three counts. All three defendants have also been charged with one count of securities fraud under Title 18, which carries a maximum sentence of 25 years in prison; and one count of conspiracy, which carries a maximum sentence of five years in prison. Read More Trump news – live: Truth Social SPAC agrees to SEC settlement as Trump’s past comments on indictment resurface Why isn’t Twitter working? How Elon Musk finally broke his site – and why the internet might be about to get worse Trump mocked for ‘weird apocalyptic’ campaign video Trump marks Independence Day by sharing vulgar attack on Biden Truth Social SPAC reaches SEC settlement as Trump indictment comments reemerge – live Trump sparks speculation by ranting about ‘charges against me’ in Georgia

2023-07-05 00:27

For these Americans, the recession is already here

Wall Street bankers, investors and economists have for months waffled over whether a US recession is coming. But for some Americans, the unforgiving economic pain typical during recession has already set in.

2023-07-03 21:45

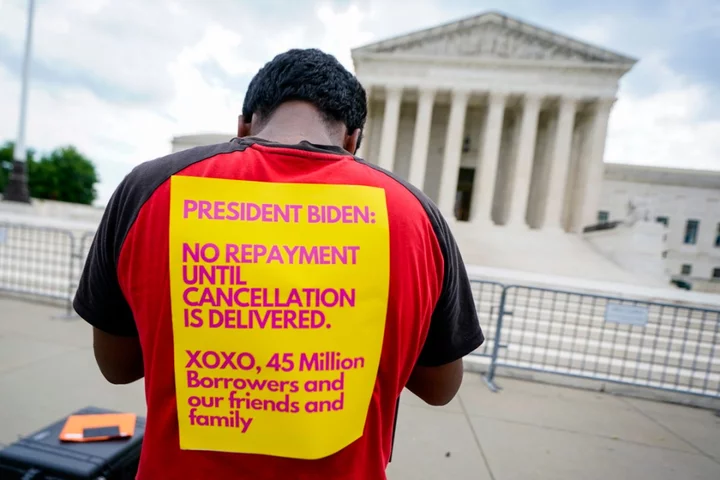

New York Times under fire for including ‘death’ on list of six ways to cancel student debt

The New York Times has been roasted on social media for listing “death” as a means to escape crippling student loans, after the Supreme Court struck down the Biden administration’s plan to cancel debt for millions of Americans. In an article soon after the Supreme Court’s ruling was released on Friday, the Times explained six ways “to get your student debt wiped away”. The suggestions included making an income-driven repayment, appealing for public service loan forgiveness, and bankruptcy and disability discharges. Under a subhead “death”, the Times wrote: “This is not something that most people would choose as a solution to their debt burden”. It went on to explain that federal student loan debt “dies with the person or people who take it on”. The macabre phrasing drew a swift backlash on social media. “That's a little dark, NYT,” writer Parker Molloy tweeted. “We’ve reached the point where The New York Times is suggesting death as a viable solution to crushing student debt,” wrote former Secretary of Labor Robert Reich. “I’ll try it out and tell u guys how it went,” another posted. The article was later revised, with the “death” subhead being changed to “debt won’t carry on”. The Times did not respond to a request for comment by The Independent. In a 6-3 decision, the Supreme Court ruled that the Biden administration had overstepped its authority in implementing a sweeping $400bn student debt relief plan. The decision means an estimated 43 million Americans will be back on the hook for student loan repayments later this year. In a press conference on Friday, President Joe Biden insisted the fight was not over, and promised a “new path” for relief that would be legally sound. He has tasked Secretary of Education Miguel Cardona with coming up with a new forgiveness plan that was consistent with the Supreme Court’s ruling. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan An Area 51 blogger was raided at gunpoint by federal agents. He says the US Government is trying to silence him Trump makes brash Georgia 2020 case prediction as DoJ ‘prepares new charges’ – live Biden reveals ‘new path’ to student debt relief Army combat veteran to take over key election security role working with state, local officials

2023-07-01 05:26

Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan

After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”. In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers. “Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said. “The hypocrisy is stunning,” he said. Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”. “And I must admit, I do too,” he said. Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs. The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision. On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall. The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies. “During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said. “Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”. “It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said. Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions. “I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said. The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year. Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans. The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

2023-07-01 04:50

Supreme Court strikes down Biden’s plan to cancel student loan debts

The US Supreme Court has struck down President Joe Biden’s plan to cancel student loan debts for millions of Americans, reversing his campaign-trail promise as borrowers prepare to resume payments this summer. Chief Justice John Roberts delivered the 6-3 decision from the court’s conservative majority on 30 June. The ruling, which stems from a pair of cases challenging the Biden administration and the US Department of Education, argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Within 30 minutes on the last day of its term, the court upended protections for LGBT+ people and blocked the president from a long-held promise to cancel student loan balances amid a ballooning debt crisis impacting millions of Americans. Under the plan unveiled last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts canceled completely, according to the White House. Roughly 16 million already submitted their applications and received approval for debt cancellation last year, according to the Biden administration. The long-anticipated plan for debt cancellation was met almost immediately with litigation threats from conservative legal groups and Republican officials, arguing that the executive branch does not have authority to broadly cancel such debt. Six GOP-led states sued the Biden administration to stop the plan altogether, and a federal appeals court temporarily blocked any such relief as the legal challenges played out. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Justice Roberts wrote that the law allows the secretary to “waive or modify” existing provisions for financial assistance, “not to rewrite that statute from the ground up.” The Supreme Court’s final decision of its 2022-2023 term also comes one day after another major education ruling, as the same conservative majority upended decades of precedent intended to promote racially diverse college campuses, what civil rights groups and the court’s liberal justices have derided as the court’s perversion of the 14th Amendment and the foundational concept of equal protection. Moments before its decision in the student debt plan, the Supreme Court decided a case involving a website designer who refused to cater to same-sex couples, but the case did not involve any such couple. Likewise, the case at the centre of the court’s decision on student loans involved an independent loan servicer in Missouri that did not want to be associated with the lawsuit. The six GOP-led states that led the challenge – Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina – opposed the Biden administration’s plan for a range of reasons that amount to “just general grievances; they do not show the particularized injury needed to bring suit,” Justice Elena Kagan wrote in her dissent. “And the States have no straightforward way of making that showing – of explaining how they are harmed by a plan that reduces individual borrowers’ federal student-loan debt,” she added. “So the States have thrown no fewer than four different theories of injury against the wall, hoping that a court anxious to get to the merits will say that one of them sticks.” She admonished a decision in which “the result here is that the Court substitutes itself for Congress and the Executive Branch in making national policy about student-loan forgiveness.” “The Court acts as though it is an arbiter of political and policy disputes, rather than of cases and controversies,” and by deciding the case, the court exceeds “the permissible boundaries of the judicial role,” Justice Kagan wrote. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That Covid-19-pandemic era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year – until the Education Department is allowed to cancel debts under the Biden plan, or until the litigation is resolved, but no later than 30 June. Payments would then resume 60 days later. The amount of debt taken out to support student loans for higher education costs has surged within the last decade, alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. The crisis has exploded to a total balance of nearly $2 trillion, mostly wrapped up in federal loans. Millions of Americans also continue to tackle accrued interest without being able to chip away at their principal balances, even years after graduating, or have been forced to leave their colleges or universities without obtaining a degree at all while still facing loan repayments. Borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that exceed the original loan. One analysis from the Education Department found that nearly 90 per cent of student loan relief would support people earning less than $75,000 per year. The median income of households with student loan balances is $76,400, while 7 per cent of borrowers are below the poverty line. That debt burden also falls disproportionately on Black borrowers and women. Black college graduates have an average of $52,000 in student loan debt and owe an average of $25,000 more than white graduates, according to the Education Data Initiative. Four years after graduating, Black student loan borrowers owe an average of 188 per cent more than white graduates. Women borrowers hold roughly two-thirds of all student loan debt, according to the American Association of University Women. Mr Biden’s announcement fulfilled a campaign-trail pledge to wipe out $10,000 in student loan debt per borrower if elected, though debt relief advocates and progressive lawmakers have urged him to cancel all debts and reject means-testing barriers in broad relief measures. In November 2020, the president called on Congress to “immediately” provide some relief for millions of borrowers saddled by growing debt. “[Student debt is] holding people up,” he said at the time. “They’re in real trouble. They’re having to make choices between paying their student loan and paying the rent.” ReNika Moore, director of the Racial Justice Program with the ACLU, among civil rights groups that filed briefs with the Supreme Court to defend the loan cancellation plan, said the “one-two punch” to end affirmative action and block debt relief will lock Americans out of economic oppurtunity and worsen wealth equality. “We urge the Biden administration and the Department of Education to move quickly to explore other pathways to ease the debt load on student loan borrowers once payments resume after a pandemic-related pause, including new executive action under the Higher Education Act, a law that allows for student loan relief for certain groups,” she added. Read More Supreme Court allows Colorado designer to deny LGBT+ customers in ruling on last day of Pride Month Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling The Supreme Court’s ruling on affirmative action is ugly and frustrating – but no surprise

2023-07-01 01:49

Trump Media investors charged in $22m insider trading case

Three investors in the special purpose acquisition company (SPAC) that took Trump Media public have been indicted for insider trading concerning the deal, making $22m in illegal trades. Michael Shvartsman, Gerald Shvartsman and Bruce Garelick were named in a federal indictment unsealed on Thursday (29 June) in Manhattan federal court. All three were charged with trading in securities of Digital World Acquisition Corporation (DWAC) based on non-public information about the company’s planned business combination with Trump Media & Technology Group — founded by former President Donald Trump — the parent company of social media platform Truth Social. All three were arrested this morning in Florida. More follows… Read More 3 charged in insider trading case related to taking ex-President Donald Trump's media company public White House reveals Biden uses CPAP machine for sleep apnea Jesse Watters confuses Ukraine and Iraq in attempt to mock Biden

2023-06-29 23:29

Anheuser-Busch boss says no regrets over Dylan Mulvaney’s Bud Light ad despite uproar on right

The CEO of Anheuser-Busch InBev, the parent company of Bud Light, said the beer should be about bringing people together after it faced months of backlash following its brief partnership with transgender influencer Dylan Mulvaney. In an appearance Wednesday on the programme CBS This Morning, CEO Brendan Whitworth said the company has become entangled in “divisive” conversations it should not be a part of. “I think the conversation surrounding Bud Light has moved away from beer, and the conversation has become divisive,” Mr Whitworth said. “And Bud Light really doesn’t belong there. Bud Light should be all about bringing people together.” At the moment, that is not what’s happening. Bud Light last month lost its spot at the top of the beer sales charts to Modelo as some conservative customers continue to boycott the beer following the advertisements featuring Ms Mulvaney. Mr Whitworth declined to answer directly when asked whether the campaign featuring Ms Mulvaney was a mistake. “There’s a big social conversation taking place right now, and big brands are right in the middle of it and it’s not just our industry or Bud Light,” Mr Whitworth said. “It’s happening in retail, happening in fast food. And so for us what we need to understand — deeply understand and appreciate — is the consumer and what they want, what they care about, and what they expect from big brands.” Despite being given ample opportunity to do so, Mr Whitworth did not directly defend the corporation’s decision to partner with a trans influencer or to support the trans community more broadly at a time when that community is facing a barrage of legislation targeting its rights in states across the country. “Bud Light has supported LGBTQ since 1998, so that’s 25 years,” Mr Whitworth said. “And as we’ve said from the beginning, we’ll continue to support the communities and organisations we’ve supported for decades. But as we move forward, we want to focus on what we do best: which is brewing great beer for everyone.” The controversy over corporations’ politics is not limited to Bud Light. Disney, Target, Nike and a number of other brands have also been the target of the right’s ire in recent years for taking stances on social issues at odds with conservatives. Target recently announced its decision to remove some Pride month merchandise from its stores after facing criticism from conservatives for its relative support of the LGBTQ+ community. The Starbucks Workers Union, meanwhile, accused Starbucks of restricting Pride decorations from certain stores. Read More I came out as a teen in the 90s — there’s still a long road ahead for LGBT+ youth Starbucks workers at 150 stores to strike over alleged ban on Pride decor

2023-06-29 09:47

Biden touts his economic record in fiery speech: ‘Guess what – Bidenomics is working’

President Joe Biden touted his economic record amid continuing dissatisfaction among Americans with the state of the US economy by saying his policies have proven effective. Mr Biden delivered a fiery speech on Wednesday in Chicago where he sought to flip a term that the Wall Street Journal outlets have used against him--Bidenomics--into a plus. “I didn’t come up with the name,” he said. “I think it’s a plan I’m happy to call Bidenomics.” The president, who is seeking re-election in 2024, said that the US economy has largely recovered from the recession caused by the Covid-19 pandemic and had sought to refute Republican economics. “Guess what? Bidenomics is working,” he said to applause. “When I took office, the pandemic was raging and the economy was reeling. Supply chains were broken. Millions of people were unemployed.” Despite low unemployment, many Americans continue to see inflation as a top priority. A survey from the Pew Research Center last week showed that 52 per cent of Democrats and 77 per cent of Republicans say inflation is still a “very big problem.” Mr Biden sought to soothe those concerns by saying he continues to prioritise lowering prices and noted how inflation is less than half of what it was one year ago. “Bringing down inflation remains one of my top priorities today,” he said. Mr Biden also mentioned the progress that his signature Inflation Reduction Act has made, such as allowing Medicare to negotiate drug prices. “We’ve been trying to get this done for decades and this time we finally beat big pharma for the first time,” he said. Read More Watch as Biden makes statement on economic policy in Chicago Cambodian leader Hun Sen, a huge Facebook fan, says he is jumping ship to Telegram Paul Ryan says Trump is only Republican candidate who would lose to Biden in 2024

2023-06-29 02:29

Cuban entrepreneurs get business training from the US, and hope that Biden lifts sanctions

Musicians Ana María Torres and María Carla Puga started making bracelets and necklaces at home in Cuba during the pandemic, and they now have a flourishing business. On an island that for decades prohibited private enterprise, they have had an unlikely adviser: the U.S. Embassy. Torres and Puga are part of a small group of entrepreneurs benefiting from a business training program the embassy is offering in Cuba, where many young entrepreneurs are less wary of the American government than those in previous generations. “We see it as a great opportunity,” says Torres, 25, who co-founded a store and workshop named Ama, which has a cafeteria and employs 12 people. Ama is one of almost 8,000 small- and medium-sized companies that were legally authorized to operate in Cuba over the past year and a half. The embassy training featured weekly online meetings covering everything from marketing tools and brand management to basic finances and the creation of web pages. The owners of Ama were among 30 entrepreneurs the embassy selected from 500 applicants. Torres and Puga recall the look of fear — and surprise — in an older driver’s face when, on their way to exhibit some of their products, they asked him to drop them at the U.S. Embassy. The driver suggested he drop them off one block away instead. “Our generation doesn't really have so much limitation with respect to daring to take part in these kinds of things with the U.S. embassy, because the context is different,” says Puga, 29. “We know there are some conflicts, but we also know there is a lot that is being tried, especially with Cuban entrepreneurs, and we’re really not afraid.” In 1968, the Cuban government shut down the few remaining private businesses that were left on the island after the 1959 revolution. In 2010, however, then-President Raúl Castro initiated a reform to boost the local economy and allowed independent workers to work in activities like rental houses, restaurants and transportation. These were further developed amid a 2014 rapprochement with the U.S. during the administration of President Barack Obama. Sanctions also were eased during that period. Policy towards the island hardened during the administration of President Donald Trump, and the economy has yet to recover from its 11% contraction in 2020. In tourism alone -- a mainstay for national income -- the island welcomed just 1.7 million visitors last year, less than half the amount of 2018. Cubans have been feeling the effects of yet another crisis, reflected by long lines to get fuel, shortages of basic goods, blackouts, inflation and record emigration. In September 2021, Cuba legalized the creation of small- and medium-sized businesses to help an economy in crisis, a decision that Cubans and observers of the nation's politics viewed as historic. Since then, 7,842 small- and medium-size companies were created, along with 65 non-agricultural cooperatives, generating some 212,000 jobs combined. However, decades living in a state-dominated economy led to the loss of business know-how, including financial administration, marketing strategies, publicity and customer relations. “I am very happy with the renewed willingness of the United States embassy to pave the way for us in terms of knowledge... that is something we were lacking,” says Adriana Heredia, a 30-year-old partner of Beyond Roots, a private enterprise that includes a clothing store, a beauty salon specializing in afro hair and various other cultural projects. Cuban entrepreneurs say they appreciate efforts like the U.S. embassy’s business training program, but they also express concern about the negative impact the U.S.-imposed sanctions have had on their economy. “There is a negative impact (of the sanctions) that is evident,” economist Ricardo Torres, a researcher at the Center for Latin American Studies at the American University in Washington, told the AP. “The United States is the dominant market, the dominant economy. So all the financial and commercial restrictions that... weigh on entities that are based in Cuba will negatively affect entrepreneurs.” Last month, representatives of 300 small- and medium-sized businesses sent a letter to President Joe Biden requesting, among other things, facilitation of financial transactions, the establishment of some sort of permit for U.S. businessmen to invest in Cuba and trade with private companies, They also requested removal of the island from U.S. list of countries that sponsor terrorism. Cuban entrepreneurs feel they are caught between two forces: U.S. sanctions and limitations within Cuba itself such as high taxes, a lack of financing and state control over imports and exports. The island also lacks permits for professionals to establish themselves as independent workers. “Unfortunately, Cuba’s private enterprises end up being subjected to a sort of crossfire,” Torres said. The Biden administration has promised several times to reverse some measures affecting the island and its fledgling entrepreneurs, but the Cuban government says Washington has yet to deliver. Benjamin Ziff, charge d’affairs at the U.S. embassy in Cuba, dismisses claims that the administration has implemented few changes. He pointed to the resumption of some flights and the sending of remittances, as well as a slew of educational and religious exchanges between both nations. The embassy's business training classes, while a small measure to boost the private sector, is one of them. “Cuba’s future lies in its private sector and those who say it is a necessary evil are completely wrong,” Ziff said in an interview. “It is an increasingly necessary good for the well-being of the people.” Read More Ukraine war’s heaviest fight rages in east - follow live Charity boss speaks out over ‘traumatic’ encounter with royal aide Sierra Leone's president wins second term without need for runoff, election commission announces Music Review: Kim Petras makes flirty Eurodance-pop in major-label debut Eni chief executive says plan for pipeline to move gas to Cyprus 'part of our discussion'

2023-06-28 01:22

Bank of America CEO: Inflation could hit Fed's 2% target by 2025

US inflation could hit the Federal Reserve's 2% target in 2025, Bank of America CEO Brian Moynihan told CNN in an exclusive interview Tuesday.

2023-06-27 23:53

Brookfield values American Equity at $4.3 billion in takeover bid

By Niket Nishant (Reuters) -Annuities provider American Equity Investment Life Holding said on Tuesday it has received a takeover offer

2023-06-27 21:46