After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”. In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers. “Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said. “The hypocrisy is stunning,” he said. Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”. “And I must admit, I do too,” he said. Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs. The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision. On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall. The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies. “During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said. “Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”. “It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said. Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions. “I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said. The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year. Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans. The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”.

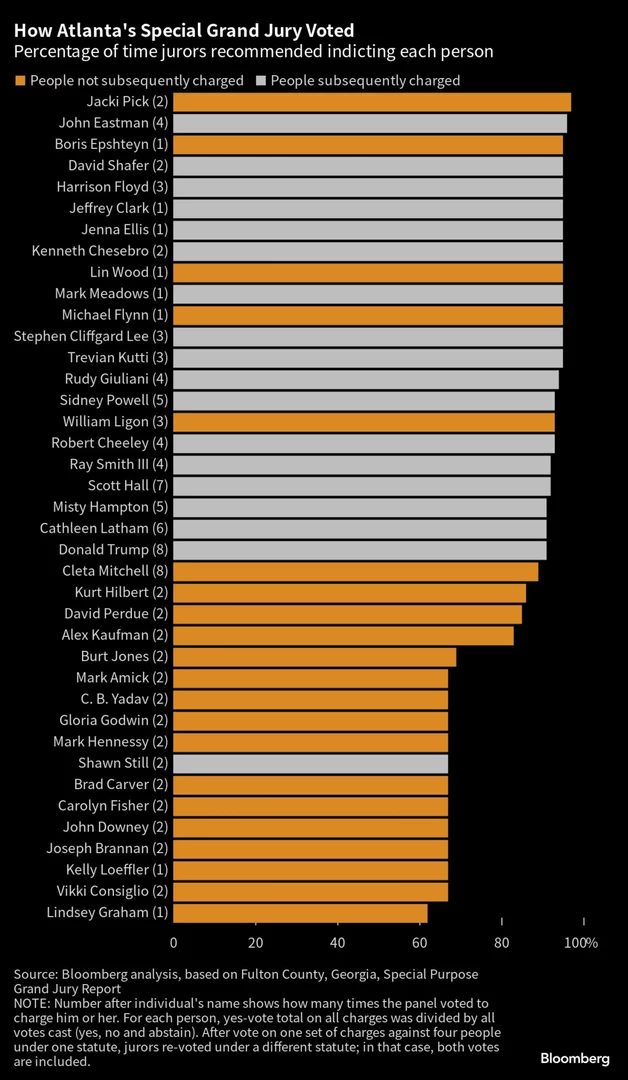

In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers.

“Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said.

“The hypocrisy is stunning,” he said.

Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”.

“And I must admit, I do too,” he said.

Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs.

The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision.

On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process.

In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall.

The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies.

“During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said.

“Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”.

“It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said.

Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions.

“I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said.

The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so.

Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief.

Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants.

Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House.

Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19.

Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent.

That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year.

Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans.

The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families.

Read More

Supreme Court strikes down Biden’s plan to cancel student loan debts

Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions

Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’

Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling