Nestle shares were under pressure on Friday as investors weighed the potential impact of Novo Nordisk's blockbuster weight-losing drug Wegovy and how it could reduce spending on food.

The KitKat and Nescafe coffee maker's shares were down 2% and headed for their lowest level in more than two years. The pan-European food, beverage, and tobacco index fell 1.7%.

Nestle declined to comment on the stock performance. Peers Danone and Unilever were also down, 1.5% and 2% lower respectively.

"I think it comes after Walmart's comments regarding the impact on weight loss drug consumers perhaps buying less," the head of European consumer equities at Kepler Cheuvreux, Jon Cox, said.

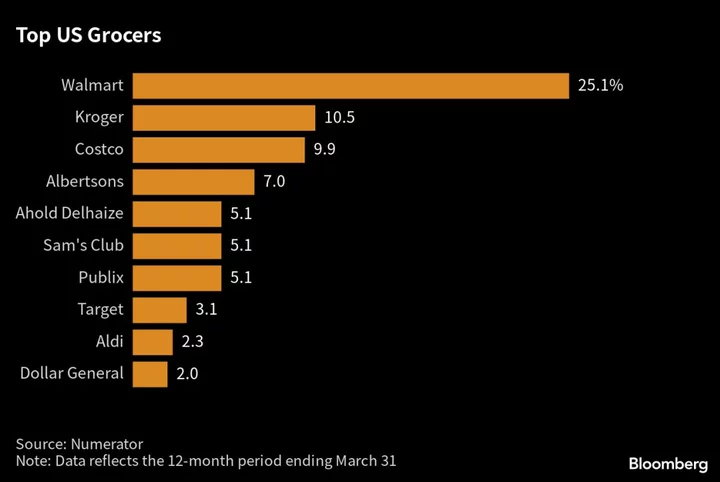

Walmart's U.S. branch CEO John Furner told Bloomberg on Wednesday that the company saw a slight pullback in food consumption with people taking appetite-surpressing drugs such as Wegovy.

However, Cox does not regard this as a substantial risk to Nestle and the broader food industry in the long term.

Bruno Monteyne from Bernstein also pointed to the Wegovy impact, but saw little logic in the sell-off.

"Danone sells water, baby milk powder, and yogurt: not sure how those would be negatively impacted by GLP1 / Wegovy?" he said, referring to a broader class of drugs.

Vontobel analysts also only see limited risks for some categories of Nestle's products.

"We see some potential risks in some of the company’s product categories, such as frozen food in the US or confectionery, but less so in the other key categories, such as coffee, pet food, infant nutrition, culinary, water, or Nestlé Health Science," they wrote a note.

(Reporting by Andrey Sychev and John Revill; Editing by Mark Potter)