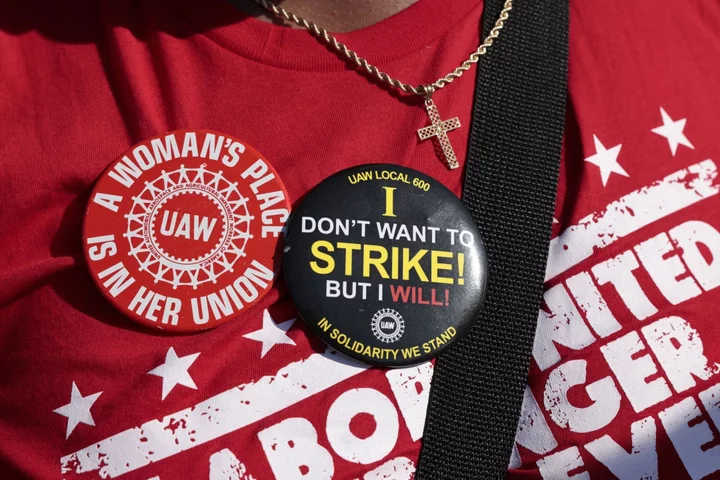

Just when US automakers and the broader economy were shaking off the effects of the pandemic and semiconductor shortages, a long strike by the United Auto Workers union could bring higher inflation and economic damage.

A strike against General Motors Co., Ford Motor Co. and Stellantis NV of just 10 days would reduce US gross domestic product by $5.6 billion and likely push the Michigan economy into a recession, according to Anderson Economic Group, an economic consultancy based in Lansing, Mich. It could also make some car models scarce and push prices up after they started coming down from record levels.

If UAW President Shawn Fain makes good on threats to strike all three companies on Thursday, it would have far-reaching effects. A long walkout would hit suppliers and their workers and soften prices of key commodities, especially steel. Damage to the economies in Michigan, Ohio and Wisconsin could make swing states a tougher sell in the 2024 election for President Joe Biden.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said Patrick Anderson, chief executive officer of Anderson Economic, which counts GM and Ford among its clients. “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected. That won’t be the case this time if the UAW goes through on its threat to strike all three companies.”

The Biden administration is on edge about the strike. The auto industry accounts for about 3% of US GDP but plays a much bigger role in the Great Lakes economies, and Democrats will rely on winning Michigan and Wisconsin to retain the White House. The President has tapped Gene Sperling, former economic adviser to Presidents Barack Obama and Bill Clinton and a Michigan native, to act as a liaison between the automakers and the union.

Michigan Gov. Gretchen Whitmer told Bloomberg News in an interview last week that she is concerned about where the negotiations are headed. She is talking to leaders of each company and the union to try and head off a strike, but added that it is “unclear” what more she and her state can do.

Of the $5.6 billion in economic impact, lost worker pay would come to $859 million and lost automaker earnings would be $989 million, Anderson said. The rest would come from layoffs and lost business at parts makers and other industries that rely on the three automakers.

Fain has demanded a defined-benefit pension and retiree health care, which went away in 2007 for new hires as the industry was headed into a crisis. He also opened talks with a request for pay raises equal to 46% over four years, a 32-hour work week and reinstatement of cost-of-living allowances. And he wants to end tiers of pay that give more tenured workers better compensation.

Automakers estimate that granting Fain’s entire wish list would drive up costs by $80 billion over four years, with most of that coming from pension costs and retiree health care.

GM offered a 16% raise and none of the retiree benefits Fain demanded. Ford made a similar proposal before that and both were rejected. Stellantis offered a 14.5% pay raise to “most” union employees, and it was turned away.

If the workers wind up seeing strong wage gains, with or without a strike, it will push up labor costs nationwide after a summer of impressive pay gains won by Teamsters at United Parcel Service Inc. and pilots at American Airlines Group Inc. Higher pay could also result from the ongoing strikes by Hollywood actors and writers.

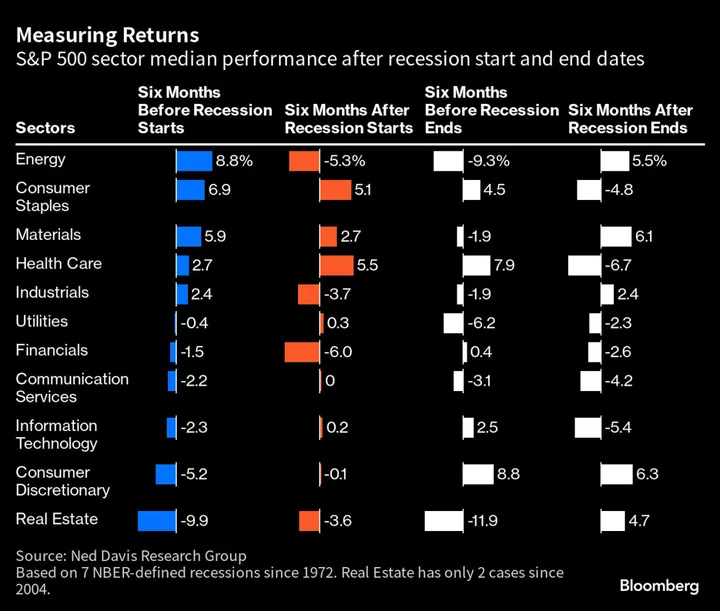

Wages and Inflation

The Federal Reserve factors rising wages into its battle against inflation, which has spurred the central bank to raise interest rates 11 times since early 2022. US average hourly earnings rose 4.3% last month from a year earlier. That’s down from their 5.9% peak last year but still high historically. The Fed has been trying to push inflation, currently 3.3% in July, back to its long-term target of 2%.

“At least in sectors where workers are scarce, average pay rises of 5%+ annually are to be spread over a number of years - meaning labor costs will continue to rise at rates above those consistent with 2% inflation for some years to come,” economists at Citigroup said in a note this week.

Read More: What’s at Stake as US Auto Workers Threaten to Strike: QuickTake

A strike also would certainly ripple its way through the auto industry’s parts network. When GM workers went on strike for six weeks in 2019, American Axle & Manufacturing Holdings said its fourth-quarter earnings fell 25% to $194 million in earnings before interest, taxes depreciation and amortization based on the walkout alone.

American Axle is heavily reliant on GM, but get as much as 65% of its revenue from domestic automakers. Seat maker Lear Corp. and Canadian parts maker Magna International Inc. both get at least 30% of revenue from the three automakers as well, said Barclays analyst Dan Levy, in a research note.

Hit to Steel

A UAW strike would be a major blow to steel producers, at least in the short term. During the 2019 GM strike, prices for hot-rolled steel fell 17% to $500 a ton over the six-week period. Prices did rebound by the end of the year, according to Bloomberg Intelligence research. A new UAW strike against one of the Big Three automakers might spur a similar 17% drop in steel prices to around $670 a ton, while a strike against multiple automakers would prompt a quicker decline, said Richard Bourke, a senior analyst who follows basic materials for BI.

Meantime, steel production might slip by 76,000 to 98,000 tons a month, assuming one ton of steel per vehicle, and depending on which automaker were targeted, Bourke said.

There’s about 1 ton of steel per car produced in the U.S. If the strike were to last for an extended period of time — for about 3 or 4 months — researcher CRU Group warns that this may force the idling of some steel mill production. Most of the 90,000 tons of steel would hit the spot market, which Wolfe Research said would likely be snapped up by other automakers who aren’t experiencing a labor stoppage. The impact of a prolonged strike to the steel industry would also push up price in the first half of 2024 — due to supply cuts from idling steel plants.

Supply on Hand

If the strike ends quickly, the automakers will suffer minimal harm, said Charlie Chesbrough, senior economist at Cox Automotive. Automakers have a solid supply of vehicles with about 58 days’ worth of inventory. All three companies have strong supply of full-size pickup trucks, their biggest moneymakers.

The Ram 1500 has a 107 days’ supply, followed by the Ford F-150 at 98 days’ supply. GM has about 80 days’ worth of Chevrolet Silverado and GMC Sierra trucks, Cox said.

“I don’t know that a couple weeks would have noticeable impact in the marketplace,” Chesbrough said in an interview. “If it goes on for a couple months, we’ll be back to where we were in 2021 with semiconductor-related shortages.”

Ultimately, some of the economic damage from labor strikes can be recovered. Anderson said the bigger risk is that automakers agree to some of Fain’s more expensive demands, like a return to guaranteed pensions and retiree health care, both of which played a role in the 2009 bankruptcy filing by GM and the former Chrysler LLC, which is now part of Stellantis.

If automakers take on too many costs, they will become uncompetitive, he said. Other unions may make similar demands. The Teamsters won a $30 billion contract from UPS that will eventually pay drivers $49 an hour, compared to an autoworkers’ top hourly wage of $32. UPS later raised average prices 6.9% this year and plans to increase them another 5.9% in December.

If the UAW settles for better wages, the new contract shouldn’t impact inflation much, said Chris Low, chief economist at FHN Financial. Autoworkers were locked into contracts they signed before the pandemic, so missed out on the big wage gains others saw in the last couple years.

“I don’t think they see this as an alarm bell for inflation” Low said, speaking of the Federal Reserve. Still, “if there is a prolonged strike, it’s going to have some effect on growth.”

--With assistance from Joe Deaux and Thomas Black.