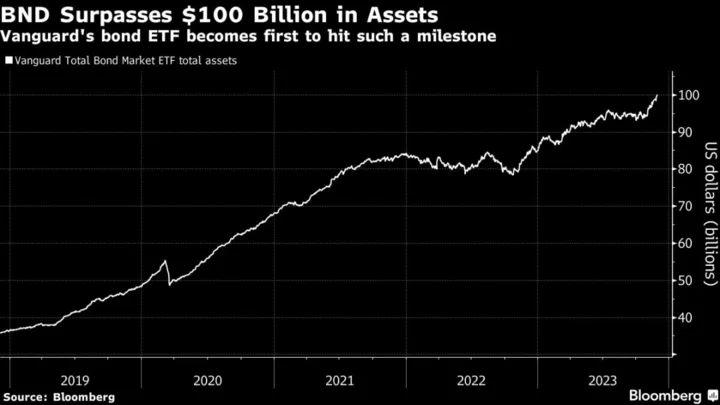

A bond exchange-traded fund crossed $100 billion for the first time since such products launched over two decades ago.

A $14 million inflow Wednesday pushed assets in the Vanguard Total Bond Market ETF (ticker BND) above $100 billion for the first time ever, data compiled by Bloomberg show. BND has absorbed $15.6 billion so far this year.

The milestone marries two of 2023’s biggest trends: The highest yields in years have made fixed-income more appealing, while relatively low-cost, tax-efficient ETFs have consistently stolen market share from their more expensive mutual fund brethren.

“There’s likely a large portion of flows coming from mutual funds too, as a source of growth,” said Todd Sohn, ETF and technical strategist at Strategas Securities, adding that since the interest-rate liftoff in March 2022 through last month, fixed-income mutual funds have lost $500 billion.

BND’s milestone comes amid a turbulent year for fixed-income. Stubborn inflation and the Federal Reserve’s campaign to cool it unleashed volatility across asset classes, sending Treasury yields soaring to decade-plus highs. Growing conviction that the central bank has reached the end of its tightening cycle ignited a fierce bond rally over the past month.

All the while, BND — which charges 0.03% per year — has steadily taken in cash over the course of 2023.

“It’s not surprising when you offer up 18,000 bonds for three basis points that’s going to get weatherproof flows,” said Bloomberg Intelligence senior ETF analyst Eric Balchunas. “That’s money coming in rain or shine, because it’s that good of a deal.”

Money has poured into bond ETFs of all stripes this year as investors continuously recalibrate expectations for both the Fed and the economy amid a still-strong labor market and robust economic growth. The $46 billion iShares 20+ Year Treasury Bond ETF (TLT) has been the biggest beneficiary of that speculation, attracting nearly $23 billion in 2023 amid a record drawdown.

BND, which tracks everything from Treasuries to corporate credit to securitized assets, has fared better. The fund has gained about 2.4% on a total return basis so far in 2023, and hasn’t posted a monthly outflow since May 2022.

While BND was the first bond ETF to break $100 billion, BlackRock Inc.’s rival product, The iShares Core U.S. Aggregate Bond ETF (AGG), is close behind. AGG, which also tracks a wide basket of debt securities and charges 0.03% annually, has amassed roughly $96 billion in assets.

However, Vanguard’s client base of financial advisors and retail clients is known for their steady allocations even in rocky market environments, according to Strategas’ Sohn.

“Vanguard is the king of ‘staying invested’ so perhaps no surprise that BND gets the mark first, even if the asset class has been in a major drawdown,” Sohn said.