Japan’s state pension fund, the world’s largest, posted a record gain of ¥18.98 trillion ($133 billion) during the three months through June on returns from domestic stocks and overseas bonds.

The Government Pension Investment Fund added 9.5% during the quarter, raising total assets to an unprecedented 219.17 trillion yen, the fund said in Tokyo Friday. Domestic stocks were the top performers, gaining 14.4% as signs of stable inflation reinvigorated Japanese markets and investors including Warren Buffett boosted equity stakes. Overseas shares rose 15.4%, while bonds abroad gained 8.1% and Japanese debt gained 0.4%

“The big profit is just a short-term result — according to our model, gains of 9.49% should appear only once in nine years,” Masataka Miyazono, president of the fund, said in a statement. “We continue to fulfill our duty by making long-term investments.”

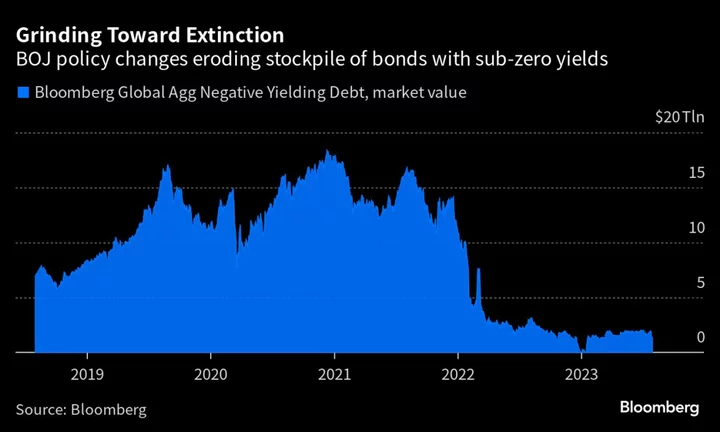

With about half of total assets invested in domestic and overseas debt, the GPIF’s performance remains vulnerable to higher yields and volatility in the yen as the Bank of Japan slowly moves away from its ultra-loose monetary policy. The prospects for fixed-income securities took an additional hit this week after Fitch Ratings stripped the US of its top-tier sovereign credit grade.

During the three months ended June, the MSCI global stock index gained 5.6% and the S&P 500 Index climbed 8.3%, while the Topix gained 14%. Yields on 10-year US Treasuries rose 37 basis points in the period, while benchmark Japanese government bond yields added 7.5 basis points. The yen slid almost 8% against the dollar.

--With assistance from Ken McCallum.

(Adds president’s quote in third paragraph, chart. Previous story was corrected to say bonds gained in first paragraph.)