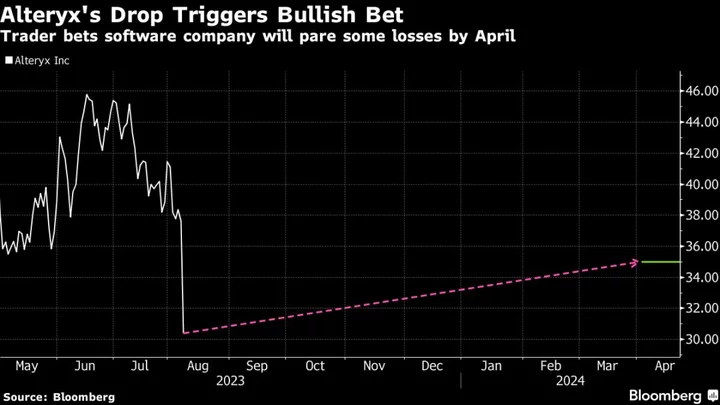

Alteryx Inc.’s plunge on Tuesday to a five-year low spurred a wave of options wagers that the software maker will rebound, even as analysts slashed their price targets.

The computer-software firm dropped as much as 23% after releasing a forecast for third-quarter revenue that fell short of analysts’ estimates. Wall Street’s average 12-month price target fell to $48.01, from $65.21 a week ago, with shares holding just above $30 at midday.

Shortly after the open of regular trading, an investor or group of investors bet that the shares will regain at least some ground by April. The wager involved selling about 10,000 $30 puts and buying the same number of $35 calls, all expiring in April, data compiled by Bloomberg show.

The trade carries the risk of having to sell shares to rebalance the position if the price drops below $30. On the other hand, there’s potential to collect about $500,000 in premium and profit if the stock rises to $35 in the next nine months.

Parsing who does what and why in the world of derivatives can be challenging, but Chris Murphy, co-head of derivative strategy at Susquehanna International Group, says the investor is likely trying to take advantage of the selloff, citing the high delta and far-off expiry date.

“The stock is off a lot and this investor willing to buy further weakness,” said Murphy, adding that the trader likely wanted “exposure to a rebound.”