Citigroup to Hire JPMorgan Banker Al-Deweesh as Saudi CEO

Citigroup Inc. is set to hire one of JPMorgan Chase & Co.’s top bankers in Saudi Arabia as

2023-05-10 20:58

First Citizens Deposits Beat Estimates in Wake of SVB Deal

First Citizens BancShares Inc.’s deposits surpassed estimates following its rescue deal for Silicon Valley Bank after a run

2023-05-10 19:55

VW Annual Meeting Hit by Protests Over Climate Strategy, China

Volkswagen AG shareholders gathering in Berlin contended with climate protesters blocking access to the venue after gluing themselves

2023-05-10 17:52

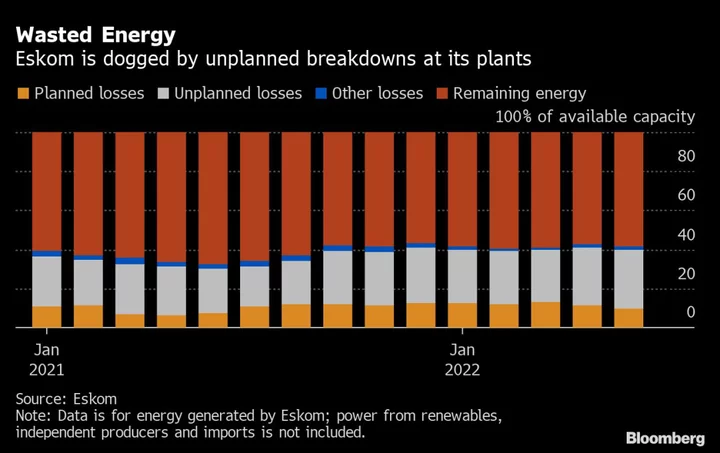

Eskom Head in China as South Africa Grapples With Acute Outages

Eskom Holdings SOC Ltd.’s acting chief executive officer traveled to China, as the South African state-owned utility implements

2023-05-10 17:48

ABN Amro Profit Beats Estimates as Lending Income Increases

ABN Amro Bank NV reported higher than expected first-quarter profit as the Dutch bank boosted lending income and

2023-05-10 14:27

China to Boost Policy Support for Large Renewable Power Projects

China will keep expanding policy support to encourage the construction of large-scale renewable energy projects in an effort

2023-05-10 10:24

HSBC Gains Assets From Former Credit Suisse Clients in Asia

HSBC Holdings Plc said it’s picking up clients and staff from Credit Suisse Group AG following the Swiss

2023-05-10 10:21

Coupang’s Sales Beat Estimates After Big Spending Pays Off

Coupang Inc., the South Korean e-commerce giant backed by SoftBank Group Corp., reported better-than-expected revenue growth after spending

2023-05-10 07:47

Bernie Sanders and Democratic Rep Ro Khanna launch campaign to wipe out medical debt

Progressives are beginning a new offensive on Capitol Hill: Taking on America’s staggering $88bn in medical debt. Headed up by the Bernie Sanders spinoff group Our Revolution, advocates around the country are gathering horror stories of instances where necessary procedures were blocked by insurance companies or, perhaps worse, approved with stipulations such as “out of network” classifications that can quickly (and often do) lead to lifesaving treatment becoming a financial death sentence. The group hosted a town hall led by executive director Joseph Geevhargese on Monday, where a number of Americans shared their own personal versions of ruin at the hands of medical debt collectors and hospital bills. Between 10 per cent and half of adult Americans are thought to carry medical debt in some form, with estimates widely varrying thanks to the complexities of tracking paid-off debts. Elizabeth McLaughlin, one woman who shared her account with participants of the town hall event on Monday, spoke about how treatment she received in 2017 has led to her taking on tens of thousands of dollars in credit card debt as she placed utility bills and other basic needs like groceries on lines of credit rather than face medical debt collectors. “I pass it from one [card] to another, and in the meantime I’m just grateful that I’m employed, and insured, and I can keep making the payments,” she explained. Another woman, Kristin Noreen, explained that she even filed for bankruptcy, only for her debt to immediately begin climbing into the thousands again thanks to tax obligations and other costs. Her treatment bills rose past $1m dollars after she was struck by a car on her bicycle and suffered grievous injuries, including the amputation of her hand, and now she explains that she has little chance of ever climbing out of her personal debt trap — even after her insurance paid for all but $60,000 of the treatment cost, and $50,000 of the remaining debt was handled by a charitable donation. The remaining $10,000 was still more than enough, coupled with the cost of years of therapy she says is “barely” covered by her Affordable Care Act plan, to leave her in financial desolation. “I’m back up to $10,000 on credit cards and as of last month, I have another $3,000 in debt to the IRS for prioritising my care over my estimated taxes. I’ve been denied disability and I work part-time from home as much as I’m able to,” she explained, while noting that if her pay increases from her part-time work, she is legally required to pay it towards Affordable Care Act subsidies rather than her own debt. Mr Sanders, along with a colleague in the House, Ro Khanna, reportedly plan to introduce legislation in the coming weeks aimed at addressing the issue — along with a nationwide campaign aimed at pressuring vulnerable lawmakers to get on board. Among the legislation’s priorities will be halting “predatory” debt collection practices and going after price gouging in medical billing. And while the demands in their upcoming legislation are small in comparison to Mr Sanders’s long-held desire to overhaul America’s for-profit healthcare system into a single-payer system aimed at affordability and access, the efforts by progressives to highlight the tragic cases of Americans consumed by medical debt likely aid in the left’s work to popularise the idea of major reforms and changes to the structure of America’s health system. Mr Sanders called for the elimination of all medical debt in the spring of 2022 after three leading credit agencies announced that they would no longer track paid-off medical debts when calculating credit ratings for Americans. “‘Medical debt’ and ‘Medical bankruptcy’ are two phrases that should not exist in the United States of America,” the senator said at the time. “Removing 70 percent of past-due medical debt from credit reports is a step in the right direction, and much more needs to be done. We must cancel all medical debt.” Read More Deal or default? Biden, GOP must decide what's on the table Black voters backing Biden, but not with 2020 enthusiasm House Republicans pressure Biden as they vote to raise debt ceiling in exchange for spending cuts

2023-05-10 06:25

McCarthy says ‘no movement’ from meeting over debt ceiling with Biden as GOP continues holding US economy hostage

House Speaker Kevin McCarthy said Tuesday’s meeting between him, other Congressional leaders and President Joe Biden had produced no forward progress on an agreement to stave off what economists say would be a catastrophic default on America’s sovereign debt. Mr McCarty, who has kept the House in recess for the last two weeks and for a majority of the days since he and Mr Biden last met on 1 February, told reporters outside the White House that Mr Biden and both Republican and Democratic leaders had merely reiterated the positions they held when the House Speaker and the President met 97 days before. “Nothing has changed since then ... everybody in this meeting reiterated the positions they were at. I didn't see any new movement,” he said. The California Republican’s last meeting came just a few weeks after he eked out enough votes to claim the Speaker’s gavel with support from extremist and white nationalist members of the House Republican Conference, many of whom demanded that he use the need to lift the government’s century-old statutory debt ceiling as leverage to force Mr Biden to roll back much of the legislative record he and Democrats accomplished over the prior two years. Since that February meeting, the White House and the House of Representatives have remained far apart on what is needed before legislation allowing the US to resume issuing new debt instruments can reach Mr Biden’s desk for his signature. For his part, the president’s view has remained consistent since the beginning of the year. Mr Biden has repeatedly said that Congress should pass a “clean” debt ceiling increase and negotiate on spending cuts desired for next fiscal year when Congress begins work on a budget. Mr McCarthy characterised Mr Biden’s insistence that the Congress lift the debt ceiling on its’ own and address the spending cuts Republicans covet during the regular budgeting process as intransigent even though Republicans have not introduced a budget proposal for the next fiscal year. He also accused Senate Majority Leader Check Schumer of trying to stymie negotiations so Congress would be left without a choice but to pass the “clean” debt ceiling increase desired by Democrats and Mr Biden. “Chuck's whole idea before was to take us to the brink and someone's going to have to break right. I don't want to play politics with this. I think this is too important,” said the Speaker, who suggested the only reason Mr Biden had called a meeting was because the GOP-led House had passed a bill to raise the debt limit while enacting drastic cuts to government programmes favoured by Democrats. That legislation, which passed the House with a bare majority of GOP votes last month, would provide just a year’s worth of relief coupled with spending provisions that slash non-defence spending by as much as 20 per cent. Among the programmes on the chopping block: President Joe Biden’s student debt relief initiative, as well as funding for new IRS personnel. The plan would also add new work requirements for adults on Medicaid, cap the growth of the federal government, and impose 2022 limits on discretionary spending. The White House said in response to the bill’s passage that Republicans were attempting to “strip away health care services for veterans, cut access to Meals on Wheels, eliminate health care coverage for millions of Americans and ship manufacturing jobs overseas”. While the House-passed bill is unlikely to go anywhere in the Democratic-controlled Senate, thus far Mr McConnell and Senate Republicans have backed up Mr McCarthy’s demand for Mr Biden to sign off on GOP-endorsed austerity measures in exchange for Republican votes to allow the US to continue paying its’ debts. Prominent GOP figures frequently claim that raising the statutory debt limit to enable the US to continue meeting financial obligations — a practice that was once routine under presidents of both parties and met no objections when it was done under Mr Biden’s predecessor — is akin to authorising new spending. That claim, however, is not how the debt limit works. Raising the debt limit does not increase or decrease the amount of money that is spent on programmes that have already been authorised by Congress and have had funds allocated to them in appropriations legislation. Experts say a failure to raise the debt limit would force the government to default on its debt and precipitate a worldwide financial crisis. The last time the US flirted with that disastrous outcome was 2011, when Republicans controlled the House and Democrats controlled the Senate and the White House. Mr Biden, then the vice president under Barack Obama, led the negotiations with congressional leaders that headed off a default, but not before the US had its credit rating decreased for the first time in history. That 2011 dispute ended with Republicans suffering a drop in their approval ratings and facing accusations of endangering the US economy for political reasons. It also came along with an unprecedented downgrade in America’s credit rating. Those same charges are being raised again now by the White House and the president’s allies in Congress, who are holding firm on Mr Biden’s call for a clean debt limit boost. Earlier this month, Treasury Secretary Janet Yellen warned that unless Congress acts, the US will by 1 June cease having the legal ability to issue debt instruments that allow the government to pay for spending already authorized and incurred. Despite attempts by reporters to get Mr McCarthy to guarantee that the US would not default, the House Speaker repeatedly refused to make such a promise.

2023-05-10 06:15

Virgin Galactic Misses on Revenue as It Plans Return to Flight

Virgin Galactic Holdings Inc. broadly missed estimates for the first quarter as the space-tourism company plans commercial flights

2023-05-10 04:47

Ex-Coinbase Manager Gets 2 Years for Insider Trading

A former Coinbase Global Inc. manager was ordered to spend two years in federal prison for trading on

2023-05-10 00:18

You Might Like...

IMF says Latam, Caribbean region needs to spend with discipline, grow revenues

Kissinger Says Putin Survival ‘Improbable’ If Ukraine Prevails

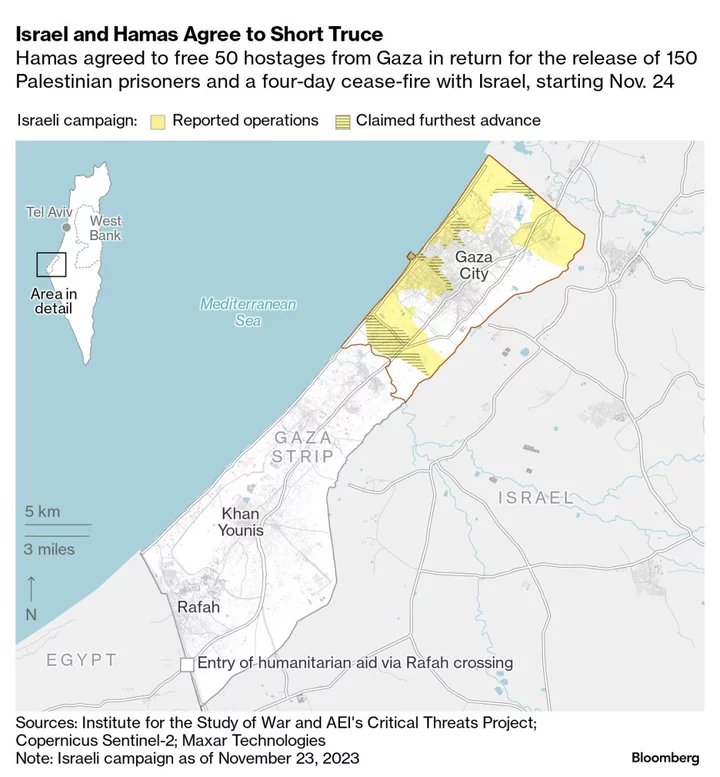

Hamas Says Next Hostage Release to Israel Is Back On After Delay

House GOP Sees Speaker Vote on Track as Israel Adds to Urgency

Trump-tied SPAC Digital World names Swider as permanent CEO

Columbia, MIT Discipline Student Groups for Anti-Israel Protests

Ecuador Presidential Hopeful Wants Violent Prisoners Put to Sea

Your Sunday UK Briefing: CBI’s Crucial Vote; Sunak Visits Biden