Record exports of power from the Nordic region will be vital to keeping the lights on in Europe’s second-largest economy this winter.

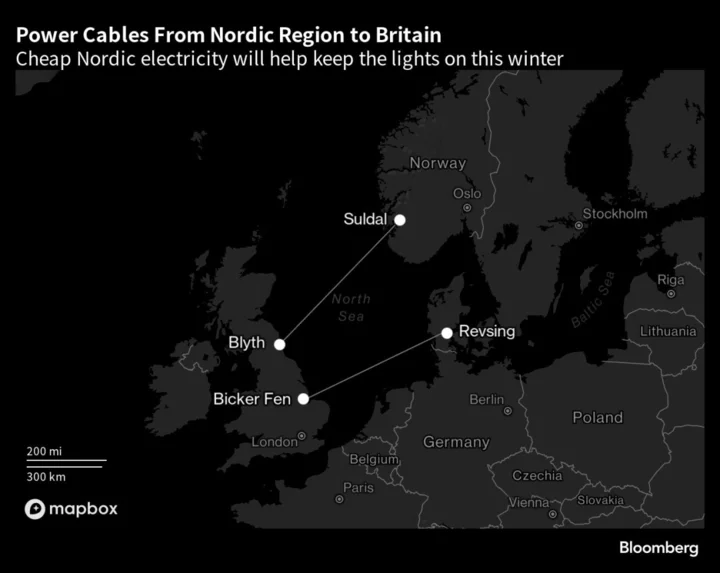

As fears of pipeline sabotage are revived across Europe, an undersea cable from Norway will provide an energy lifeline for the UK on winter days when wind farms can’t generate enough power. With a small risk of shortages in January — when peak demand coincides with planned nuclear reactor halts — Britain is reliant on electricity imports.

Read More: UK Risks Power Supply Crunch in January as Nuclear Plants Halt

From next year, a second Nordic interconnector — the Viking Link from Denmark — will join the North Sea Link from Norway, a milestone that will help safeguard UK energy security. Net electricity exports from Norway’s hydropower reserves have more than doubled this year, helping the country leapfrog France as the UK’s biggest foreign power supplier.

“Norwegian power exports for the UK will be very high all winter,” said Sigbjorn Seland, chief analyst at StormGeo AS in Oslo, who’s tracked the market for more than two decades.

The strategic importance of Nordic energy was highlighted by a suspected act of sabotage on an undersea gas pipeline in the Gulf of Finland this week. Norway’s police are tightening security around energy installations on the west coast after the rupture revived concerns about the safety of infrastructure in Europe following explosions last year on Nord Stream gas link in the Baltic Sea.

Read More: NATO Pledges Response If Finland Pipeline Damage Intentional

Following Russia’s invasion of Ukraine, Norway supplies 30% of the natural gas consumed in the UK. Total energy exports from Norway to the UK climbed to a high of £41 billion ($50 billion) last year.

Under its base case scenario for this winter, National Grid Plc’s Electricity System Operator assumes that interconnectors can provide 5.1 gigawatts of net imports to meet demand.

Britain already has established links that connect its grid to France, Belgium, Ireland, and the Netherlands. However, higher prices in those markets this winter are set to spur power exports from the UK.

Read More: UK to Boost Power Exports, Helped by Cheaper Polluting Costs

By contrast, the Nordic inflows are underpinned by the widening gap between prices in the UK and Scandinavia. The spread between Britain and Nordic markets for the first quarter of next year has gained almost 60% from a June low, according to exchange data on Bloomberg.

“If you look at the price expectations going forward, the export flow will in general continue to move from Norway to the UK on a daily basis,” said Lene Hagen, an analyst at Volue.

Norwegian prices are much lower than those in the UK after the rainiest summer in decades bolstered the country’s dominant generating source, hydropower. Reservoir levels in the market area known as NO2, where the UK cable lands, were 84.2% full, the latest data show, compared with just 59.2% a year earlier.

In the first three quarters of this year, Norway exported 7.3 terawatt-hours of electricity. Full-year exports will exceed 10 terawatt-hours, more than triple 2022, according to Fabian Ronningen, senior analyst at industry consultant Rystad Energy A/S. He expects the UK to be the biggest importer of Norwegian power this quarter.

The UK’s dependency on Norwegian power will be cemented by the opening of the world’s longest interconnector cable from Denmark next year. The 765-kilometer (475 miles) Viking Link will have the same 1.4-gigawatt capacity as the existing cable from Norway to the UK.

Lower prices in Norway will mean that electricity will mainly flow from Denmark to the UK for the first five years, according to Per Obbekaer, project director for the cable at Energinet, which built the €1.6 billion interconnector with the UK’s National Grid.

--With assistance from Todd Gillespie and Elena Mazneva.