The Middle East has long been a global crossroads for air travel, with hundreds of aircraft bisecting the region every day on long-distance journeys connecting the US, Europe and Asia.

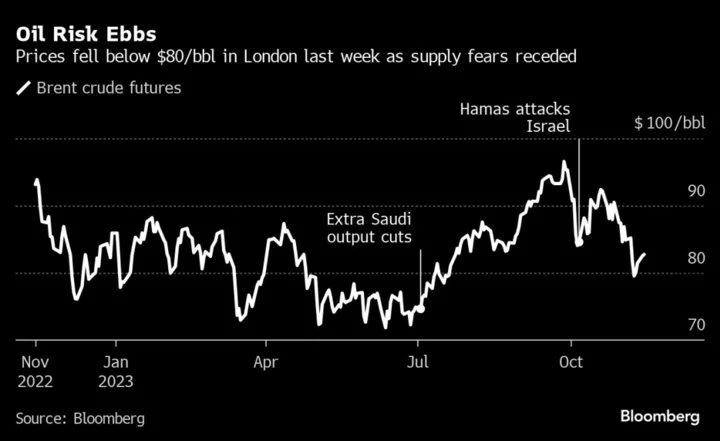

Plying those routes has become more challenging, with rising tensions forcing airlines to curtail services as a safety precaution. The war between Israel and Hamas, in a region already studded with hot zones, has added to the complications of flying between east and west.

That’s after Russia’s invasion of Ukraine already added hours to many journeys by shutting down vast airspace to many transnational operators — including the Great Circle routes through Siberia, a popular gateway between the continents.

Israel’s El Al has stopped flying over much of the Arabian peninsula, citing safety concerns, swinging wide at a cost of several hours on flights to Bangkok. The carrier also postponed services to India, while canceling seasonal routes to Tokyo.

Most other airlines stopped flying to Tel Aviv after the outbreak of hostilities. Deutsche Lufthansa AG also quit Beirut for now, while Air France-KLM said it has seen a slight reduction in passenger demand for trips to the region.

The wars also create potential issues for people traveling on carriers that still fly over contentious areas. Globally, demand for international travel has fallen by 5 percentage points since the Oct. 7 Hamas attacks, according to ForwardKeys, a travel analytics firm.

Local conflicts in the Middle East have long made Yemen, Syria and Sudan no-fly zones for most airlines. US and UK operators avoid Iranian airspace, pushing long-distance traffic toward the west, over Iraq.

While the recent outbreak hasn’t caused major delays to date on overflights through the region, the Iran and Iraq pathways each face further strains. Attacks on US and coalition forces have increased in Iraq and Syria, while Iran has warned that new fronts could open as Israel moves ahead with its ground invasion of the Gaza Strip.

Should airspace closures spread in the Middle East, about 300 daily flights between Europe and destinations in South Asia and Southeast Asia would be most affected, according to aviation analytics firm Cirium. Carriers have alternatives, though expensive and not entirely without risk — heading south over Egypt, at the cost of several hours, or to the north, over areas of recent conflict like Armenia and Azerbaijan, and then either around or over Afghanistan.

“An airspace closure of this magnitude would be really challenging for airline operations planning and revenue management teams,’’ said Anne Agnew Correa, senior vice president of forecasting & modeling at advisory firm MBA Aviation.

Carriers in the European Union, UK, US and Canada have already been contending with costly detours around banned Russian airspace on flights to Asia. It’s forced Finnair Oyj to overhaul its long-distance strategy and write down aircraft that no longer had enough range. Air France-KLM ordered longer-range A350 jetliners, in part to cope with Russia’s ban.

Each extra hour of flight added $7,227 to the variable cost of a typical widebody journey in 2021, based on Federal Aviation Administration estimates. Expenses such as fuel and labor have only increased since then, said John Gradek, an expert on aviation operations and lecturer at McGill University in Montreal.

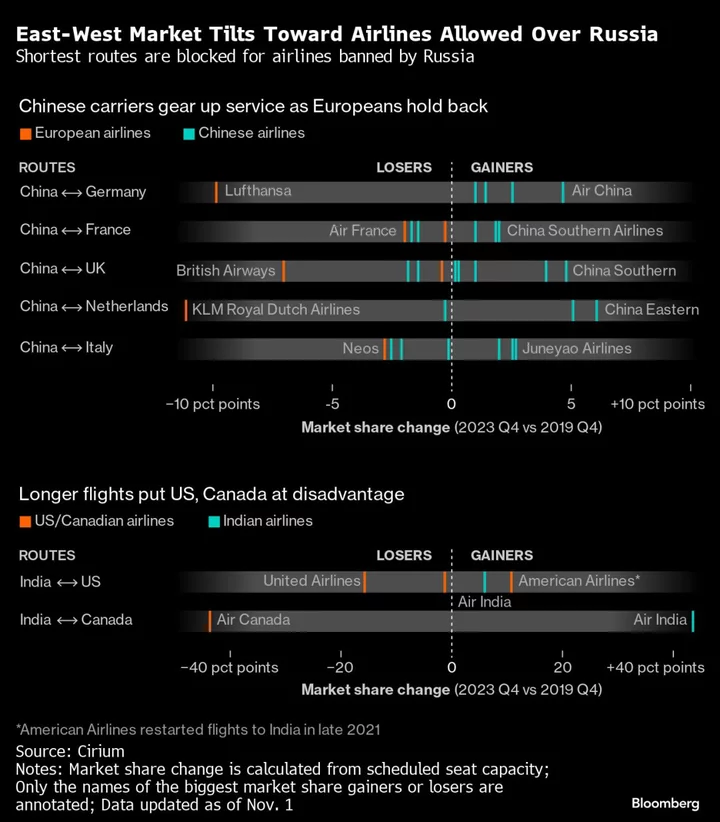

The cost advantage is showing its effect as carriers like China Eastern Airlines Corp. return to the international scene.

With seat capacity between China, the pre-Covid leader in outbound tourism, and the UK surpassing 2019 levels this quarter, Chinese carriers have taken market share at the expense of British Airways and Virgin Atlantic Airways Ltd., based on schedules tracked by Cirium. The same is true in Italy, where 20% more capacity is on offer, and Chinese airlines have also logged gains.

Scheduled capacity on flights from China to Germany, France and the Netherlands remains 20% or more below fourth-quarter 2019 levels. Chinese carriers have picked up share on services to all three countries. Air France, KLM and Lufthansa have each lost ground.

British Airways has increased frequencies to Shanghai and Beijing, but seat volumes to China remain nearly 40% below 2019 levels in the fourth quarter, according to Cirium. Parent IAG SA reported capacity to Asia-Pacific was 54% below 2019 levels in the third quarter.

Air France-KLM doesn’t consider itself at a disadvantage because most of its corporate customers won’t risk putting staff on the Chinese flights crossing Russia, Chief Executive Officer Ben Smith said on an Oct. 27 call.

Indeed, Americans were among the passengers on an Air India flight from New Delhi to San Francisco in June that had to make an emergency landing in eastern Russia because of an engine issue. “There is absolutely zero pressure on us to fly over Russia to save time,’’ Smith said.

Like Chinese airlines, Air India can still fly more-direct routes over Russia to the US and Canada. The resurgent flagship carrier has captured almost three-quarters of the market for flights between India and the US, based on Cirium data. It has almost two-thirds of the India-Canada market, with Air Canada losing the dominant lead it held in 2019.

“We're entering a world where the law of unintended consequences applies,’’ said John Grant, chief analyst at aviation tracker OAG. “There's more examples at the moment of airspace closures than in many years, and it increases the risk for the entire industry.”

--With assistance from Albertina Torsoli, Charlotte Ryan and Leen Al-Rashdan.

Author: Jinshan Hong, Anthony Palazzo, Siddharth Vikram Philip and Jin Wu