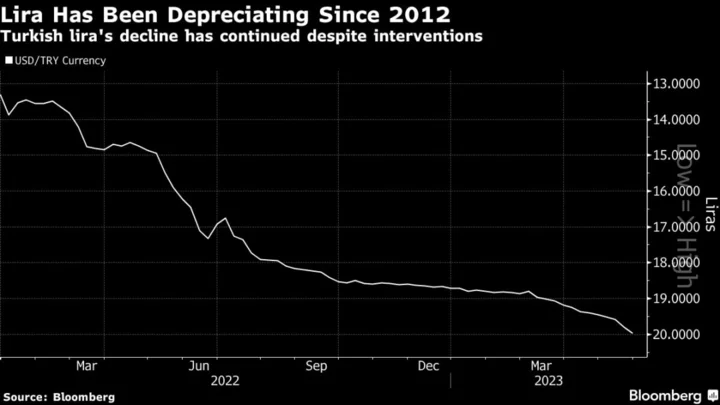

Turkey’s lira weakened after Recep Tayyip Erdogan won a presidential runoff election on Sunday, extending his time as the nation’s longest-serving leader and leaving investors looking for any signs he’ll start to relax the state’s tight grip over markets.

The lira declined as much as 0.3% to 20.03 per US dollar, near a record low, before trading at 20.01 as of 6:40 a.m. in Istanbul.

Wall Street sees more weakness ahead for the lira, with Morgan Stanley warning that it may reach 26 per dollar sooner than earlier expected and slide toward to 28 by the end of the year, should Erdogan stick to his policy of keeping interest rates low. Wells Fargo & Co expects the currency to hit 23 by the end of the quarter.

“An Erdogan win offers no comfort for any foreign investor,” said Hasnain Malik, a strategist at Tellimer in Dubai. “With very high inflation, very low interest rates, and no net foreign reserves, a painful crisis affecting all assets could be on the way.”

Erdogan easily cinched victory in the second round, winning 52% of the vote according to the unofficial count, and shortly after 8 p.m. on Sunday was delivering a victory speech from the top of a bus in Istanbul.

Erdogan’s unorthodox approach to interest rates — he believes lower rates lead to lower inflation — has left markets beholden to an unpredictable mix of ad-hoc regulations and interventions, with new measures introduced informally and on a near-daily basis. They’ve also sent investors fleeing, with total foreign holdings of Turkish stocks and bonds decreasing by about 85%, or nearly $130 billion, since 2013.

“It’s obvious that the current economy model doesn’t work,” said Burak Cetinceker, a money manager at Strateji Portfoy in Istanbul. “Erdogan is probably also aware of that, and a modest transition to an orthodox policy in the near future is likely because otherwise, it is not sustainable. Any signal toward this would be welcomed by the market.”

READ MORE: Turkish Vote Gives $900 Billion Emerging Market a Comeback Shot

The policies have also been expensive, with the central bank spending nearly $200 billion over the past year and a half to prop up the lira, net foreign-exchange reserves turning negative, and inflation soaring above 80% last year before falling to 44% in April. Going into the weekend, traders were more bearish than ever on the Turkish currency, betting that market forces will eventually overwhelm government controls.

The first signs of any revision to the current policy mix is likely to come with appointments to key economic positions, including the Ministry of Treasury and Finance, and to the central bank. All of the current ministers won seats in parliament two weeks ago, which they would have to relinquish if they were to be reappointed to a cabinet position.

READ MORE: Turkey’s Elections Likely a Harbinger of Policy Change

The opposition’s weaker-than-expected effort in the first round of the presidential elections on May 14 led to a steep surge in credit-default swaps, a more than 20% slump in banking stocks and a retreat in the Turkish currency.

“Some corrections have to be made to avoid running out of FX reserves at least,” said Viktor Szabo, an investment director at Abrdn in London. Policy announcements will be awaited, because “the current heterodox policies are unsustainable.”

--With assistance from Karl Lester M. Yap.