Asian stocks were set for a cautious open while major currencies traded in narrow ranges early Monday as traders braced for a week that brings interest rate decisions from the US and Europe to China and Japan.

Equity futures for Japan suggested a small gain, contracts for Hong Kong pointed to a minor loss and Australian markets were closed for a holiday. Futures for US benchmarks rose slightly in Asia after the S&P 500 inched further into bull-market territory on Friday.

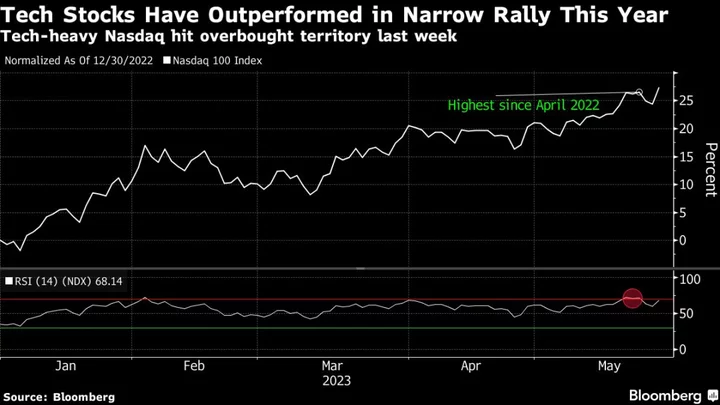

Technology shares have continued to climb amid bets the Federal Reserve is nearing the end of its hiking cycle. Positioning in rates markets suggests one more hike, with the likelihood that the move comes next month rather than this Wednesday.

Yet there is also concern that the Fed’s ten hikes have done damage, which has bond managers including Fidelity International to Allianz Global Investors forecasting an economic downturn. Meanwhile, unexpected hikes last week from the Bank of Canada and the Reserve Bank of Australia have added an extra element of uncertainty.

The European Central Bank is projected to lift its benchmark rate Thursday, there’s an outside chance of China cutting its medium-term lending facility the same day and the Bank of Japan is expected to stand pat on Friday.

Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management, cautioned against assuming the recent upswing in equities can gain momentum after the S&P 500 already rose 20% from its recent low.

“While many investors believe that passing this milestone puts markets in bull territory, it remains possible that we are seeing a bear market rally — a period of strong gains that occurs in the middle of a bear market,” she said. “Until markets reach a new all-time high, it’s impossible to know whether the bear market trough —the ultimate low of the market cycle — is behind us.”

In currency markets Monday, the dollar was little changed versus the yen, the euro and the offshore yuan.

Treasury yields rose Friday after disappointing employment data from Canada. The country’s economy ended its eight-month run of employment gains with minor job losses in May, signaling weakness in the labor market.

Key events this week:

- US CPI, Tuesday

- FOMC begins two-day meeting, Tuesday

- Eurozone industrial production, Wednesday

- US PPI, Wednesday

- FOMC rate decision, Wednesday

- IEA oil market report released, Wednesday

- China central bank meeting to decide on one-year policy loan rate, Thursday

- China property prices, retail sales, industrial production, Thursday

- ECB rate decision, Thursday

- US initial jobless claims, retail sales, empire manufacturing, business inventories, industrial production

- Eurozone CPI, Friday

- Japan BOJ rate decision, Friday

- US University of Michigan consumer sentiment, Friday

Stocks

- S&P 500 futures rose 0.1% as of 7:23 a.m. Tokyo time. The S&P 500 rose 0.1% Friday

- Nasdaq 100 futures rose 0.3%. The Nasdaq 100 rose 0.3% Friday

- Nikkei 225 futures rose 0.3%

- Hang Seng Index futures fell 0.1%

Currencies

- The euro was unchanged at $1.0749

- The Japanese yen was little changed at 139.42 per dollar

- The offshore yuan was little changed at 7.1417 per dollar

Cryptocurrencies

- Bitcoin fell 0.4% to $26,026.15

- Ether fell 0.5% to $1,762.2

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.74% on Friday

Commodities

- West Texas Intermediate crude fell 0.2% to $70.05 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Carly Wanna and Isabelle Lee.