Teten Masduki couldn’t stop talking about TikTok. In a July meeting with his team, the Indonesian minister broke from the official agenda every five to 10 minutes to complain about how the Chinese-owned social media platform was squeezing local players.

It wasn’t a once-off, according to people familiar with the internal discussions. It’s a familiar scene in meetings run by Teten, appointed Minister of Cooperatives and Small and Medium Enterprises in 2019. A former activist who took on graft and nepotism, Teten has in recent months become the public voice of a growing backlash against ByteDance Ltd.’s prized brand in Southeast Asia’s biggest retail arena.

That groundswell culminated in sweeping regulations that will force TikTok to split payments from shopping in Indonesia — an unprecedented separation that could stall TikTok’s e-commerce thrust just as it was gaining traction against Sea Ltd. and GoTo Group. It now needs to chart a new path for its fastest-growing feature, TikTok Shop, in a country of 278 million that was supposed to be a template for a global expansion from the US to Europe. And it’s now got yet another powerful government to contend with — this time, far closer to its home turf.

“We should not be late to regulate the digital economy,” Teten told a parliamentary commission on Sept. 8. “If we are, our SMEs will disappear, local e-commerce firms will disappear, and the consumers will bear the losses,” said Teten, who served as chief of staff under Indonesian President Joko Widodo.

Sea has added more than $3 billion of market value since the regulations were first outlined this week on expectations it’ll gain shoppers, while GoTo is little changed. But the regulations — which turned out far stricter than industry players expected — could chill the entire online shopping arena and potentially spook foreign firms and investors.

The new rules bar social media companies in Indonesia from handling direct payments for online purchases. TikTok is the only social media company doing so, and the ease of purchasing cosmetics, clothes and electronics on the app has been a key factor behind TikTok Shop’s explosive growth since its launch two years ago.

TikTok can advertise to more than 100 million users in Indonesia, but they now need to go on a different app or site to buy. So the company needs to break out a separate app — potentially undermining its attractiveness — or risk getting its business shuttered in Indonesia completely.

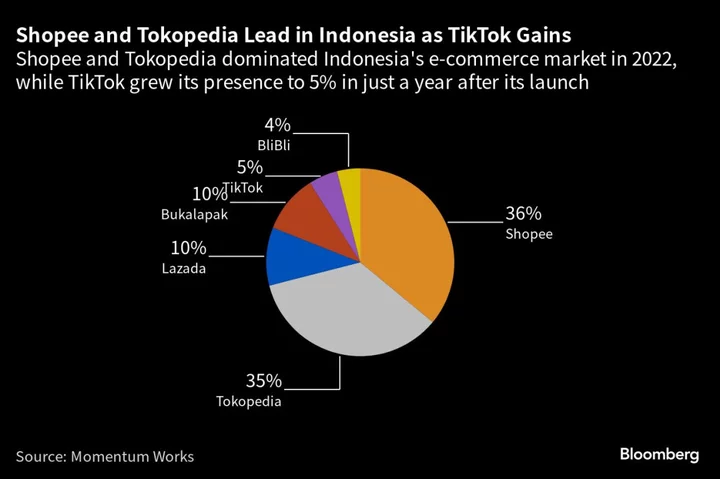

Those benefiting include local champion GoTo, whose Tokopedia online-retail unit is a key revenue generator, and Sea, which runs the Shopee app. Lazada, part of Alibaba Group Holding Ltd., is another contender.

“This development has a chilling effect on the long-term growth outlook for the e-commerce market,” warned Simon Torring, co-founder of e-commerce research firm Cube Asia. “TikTok Shop brought real innovations to Indonesia’s e-commerce market.”

The new rules also risk alienating investors, who have already criticized the country for protectionist measures in industries such as minerals.

The regulations turned out more expansive than communicated months earlier. And while the government engaged industry players in January, it kept TikTok in the dark since as it worked on the draft, the people familiar with the matter said.

TikTok has pushed back. It argues that separating social media and e-commerce hampers innovation and hurts millions of merchants and consumers. The company says some rely on its platform to make a living and that all its sellers are Indonesian or have local entities.

TikTok’s local public policy and government relations executive, Rofi Uddarojat, implored officials during an industry meeting Monday to let the firm contribute to local e-commerce, according to the people familiar with the matter. Simultaneously, Widodo convened his cabinet to discuss the curbs. TikTok officials were still trying to get a meeting with the president as of Tuesday, only to be rejected, the people said.

“Do not be fooled,” Teten wrote on his Instagram account Wednesday. “It’s not difficult: just click the link, checkout, done.”

“The sale can be directed to WhatsApp, online stores, landing pages or wherever the seller wants,” he added. “The choices become more and more.”

The restrictions open a new front in TikTok’s fight with regulators. It’s already facing possible scrutiny in the US, Europe and India on national security concerns.

More specifically, Indonesia’s curbs underscore how the pursuit of e-commerce dominance is fraught with challenges. Navigating the conflict will be pivotal for TikTok as other governments assess whether the platform harms or helps domestic merchants.

“Indonesia’s regulation could be copied by other countries in the region given TikTok’s meteoric rise in regional e-commerce,” said Adrian Akhlas, a senior analyst at BowerGroupAsia in Jakarta. “Indonesia will not be the only battleground.”

Read more: Pence Pushes TikTok Ban, Calling It Communist Party Platform

Indonesia’s young, mobile-savvy population has embraced TikTok’s in-app shopping since its 2021 launch, setting the country up to be the biggest contributor to a target of $20 billion in gross merchandise value by the end of this year. TikTok users spend more than 100 minutes on the app every day, just like those in the US.

The conflict with the government marks a turnaround from a few months ago. In June, TikTok Chief Executive Officer Shou Zi Chew visited Jakarta and promised to invest billions of dollars in Southeast Asia over the next three to five years. Wearing a traditional batik shirt, he chatted with Trade Minister Zulkifli Hasan — whose ministry is behind the new regulations — and visited mom-and-pop shops with TikTok accounts.

But then authorities adopted a tougher stance as the country targeted an ambitious growth rate and prepared for elections. Indonesia says it wants to protect the 64.2 million smaller enterprises that contribute 61% of gross domestic product — and form a major group of voters in February’s legislative and presidential elections. Allowing TikTok to flourish could also invite cheaper China-made products, officials say.

TikTok’s representatives tried to assuage the minister during a meeting in July, the people familiar with the matter said. But this month, Teten called out the country’s competition watchdog for not taking a tougher stance.

Teten, who became an activist during former President Suharto’s dictatorship, is known for fiery comments. During that era, he was arrested for trying to expose government corruption.

In past years, Shopee and Lazada have taken customers from domestic companies such as GoTo’s Tokopedia, PT Bukalapak.com and PT Global Digital Niaga’s Blibli. The government is concerned local contenders will be marginalized in a market worth $1.6 trillion by 2045, according to internal projections.

TikTok’s rivals have also lobbied for regulations to curb the new entrant’s growing influence, according to the people familiar with the matter. Its willingness to spend on growth is proving a big headache for incumbents, many of which have embarked on cost-cutting drives.

For TikTok, the challenge is to find a structure that will appease authorities while allowing it to grow.

“Banning TikTok Shop could be operationally very messy,” said Jianggan Li, founder of Singapore-based consultancy Momentum Works. “Regardless of how the ban proceeds or evolves, TikTok’s vast consumer traffic will continue to be harvested for e-commerce, through TikTok Shop or other means.”

Read more: TikTok Shop Is Turning the Platform Into Real E-Commerce Threat