Rakuten Group Inc. plans to issue new shares to raise as much as ¥300 billion ($2.2 billion) to shore up capital depleted by its loss-churning mobile unit, people familiar with the matter said. The move may mean a 30% dilution, analysts said.

The Japanese e-commerce company seeks to raise about ¥50 billion through a third-party issue of new shares and raise the rest through a public sale, one of the people said. The total amount may fall short of ¥300 billion, depending on market conditions, the person said.

Daiwa Securities Group Inc. will be the lead underwriter, and an announcement is expected Tuesday, the people said, declining to be named as the talks are private.

Representatives from Rakuten and Daiwa declined to comment.

Rakuten’s shares extended losses on Tuesday, falling as much as 6.7%. The company has shed about $1.2 billion in market cap after Reuters reported the internet company was in the final stages of talks to raise money through an offering of new shares.

The move indicates a sale of a minority stake in the mobile business is unlikely, according to Amir Anvarzadeh, strategist at Asymmetric Advisors. “Disappointing,” he said.

Rakuten Slides as Share Sale May Mean 30% Dilution: Street Wrap

Rakuten’s foray into Japan’s saturated mobile market is bleeding cash from expensive promotions to entice users to switch from bigger rivals NTT Docomo Inc., KDDI Corp. and SoftBank Corp. The three heavyweights together command more than 95% of Japan’s market, and have been cutting prices, limiting Rakuten’s appeal as a low-cost carrier.

The Tokyo-based company reported its eleventh consecutive loss in the quarter just ended, dragged down by a ¥103 billion loss on its mobile arm. Its target to break even in the fourth quarter could be far-fetched, Bloomberg Intelligence’s Marvin Lo said.

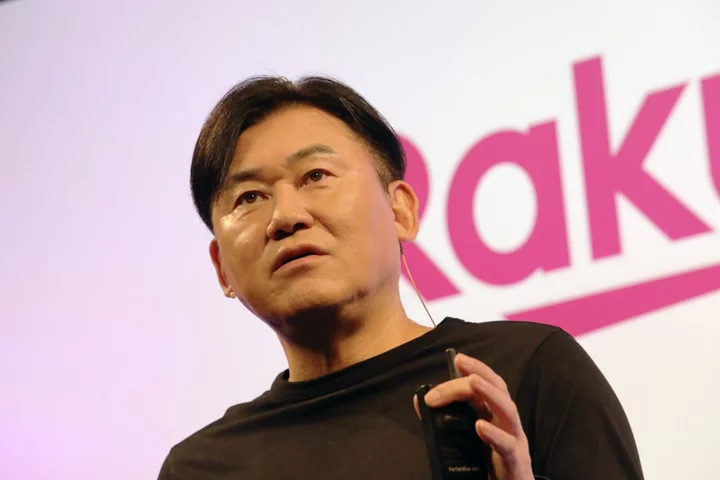

Helmed by billionaire founder Hiroshi Mikitani, Rakuten has begun cashing in on its other profitable operations, listing its banking unit on the Tokyo Stock Exchange in April. Mikitani’s also spoken of plans to list the firm’s securities arm and last week announced the sale of the conglomerate’s stake in retailer Seiyu Holdings Co.

Rakuten has cut capital spending on its carrier business, but further costs loom. The mobile venture has yet to secure spectrum allocation best-suited for connectivity inside buildings and is facing the high cost of building out 4G base stations.

--With assistance from Takako Taniguchi, Takahiko Hyuga and Kurt Schussler.