Thailand’s central bank raised its benchmark interest rate to the highest level in nine years, amid concerns about upside risks to prices.

The Bank of Thailand’s Monetary Policy Committee voted unanimously to raise the one-day repurchase rate by 25 basis points to 2.25% on Wednesday, as seen by 19 of 21 economists in a Bloomberg survey, with the remaining two predicting no change. The key rate was at 2.25% back in January 2014.

Although headline inflation has eased every month since January and fell below BOT’s 1%-3% target in the past two months, the central bank has underlined that it’s focus is to ensure inflation stays that way durably.

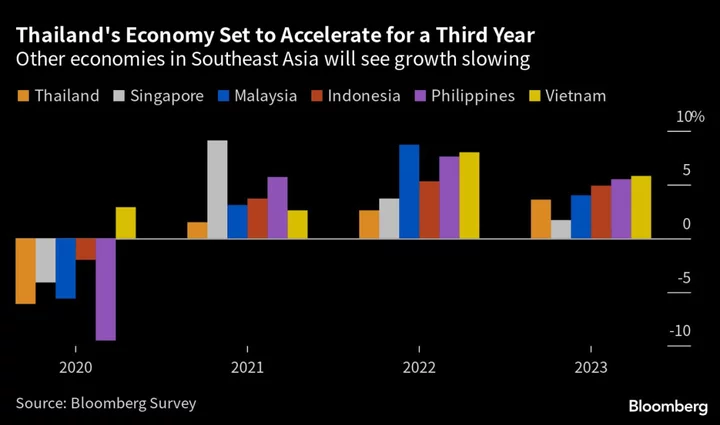

Despite political uncertainty clouding the economic outlook, Thailand is still set to experience a third straight year of growth acceleration amid a rebound in tourism. That’s given the BOT room to normalize policy settings further.

More than two months after a general election, Thailand is yet to get a new government after conservative parties and military-appointed senators blocked attempts by pro-democracy leader Pita Limjaroenrat to lead the next administration. A caretaker government under Prime Minister Prayuth Chan-Ocha has limited power to pass policies or approve spending, which could hurt business and investment activity in Southeast Asia’s second-largest economy.

The baht has been volatile this year mainly because of the dollar’s movements. The local currency gained over 3% in the past month, the strongest currency in Asia tracked by Bloomberg. Governor Sethaput had earlier said the baht’s strength was due to a weaker US dollar and domestic political sentiment. Higher foreign tourist arrivals and current account surplus also support baht outlook.

--With assistance from Tomoko Sato.