Texas Instruments Inc., the biggest maker of analog semiconductors, gave a lukewarm earnings forecast for the current period, indicating that a slump in demand for key types of electronics is dragging on.

Revenue in the third quarter will be $4.36 billion to $4.74 billion, the company said in a statement Tuesday. The midpoint of that range would come in below the average analyst estimate of $4.59 billion. The report sent the shares sliding as much as 4% in extended trading.

The outlook bodes poorly for the broader industry because of Texas Instruments’ status as a bellwether. The company has the biggest customer list and product catalog among its peers, making Texas Instruments’ earnings and projections an indicator of demand across many parts of the economy. The largest portion of its revenue comes from makers of industrial machinery and vehicles.

Texas Instruments’ analog chips typically perform simple but vital functions, like registering button presses and detecting changes in temperature. They also control motors in everything from space hardware to domestic appliances. Such chips generally require less advanced production techniques than digital products.

The car industry was a bright spot in the latest quarter, Chief Executive Officer Haviv Ilan said, but the rest of the business was sluggish. “Similar to last quarter, we experienced weakness across our end markets with the exception of automotive,” he said in the statement.

The company’s customers outside of the automotive market continue to cut orders of new chips, relying on existing stockpiles instead, executives said on a conference call with analysts. The chipmaker’s own inventory is on the rise, meanwhile, according to Chief Financial Officer Rafael Lizardi. It’s climbed to about 207 days’ worth of stock and will likely grow again this quarter in terms of dollar value.

Unlike many of its peers, Texas Instruments’ chips have a long shelf life — up to a decade — and the stockpile will help the company ride out future surges in demand, Lizardi said.

“Our inventory lasts a long time,” he said in an interview. “On our shelves, we seal the bags and they can stay there for 10 years and come out still fresh.”

For now, order cancellations remain at elevated levels, a sign that customers are staying cautious, the company said.

Profit will be $1.68 to $1.92 a share in the third quarter, Texas Instruments said, compared with a prediction of $1.90.

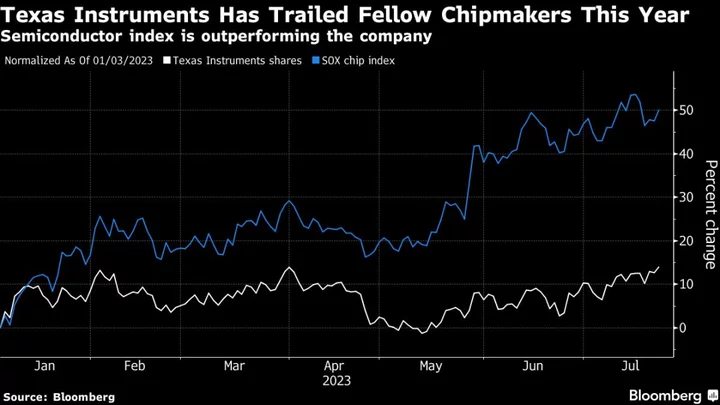

The shares earlier closed up 1.2% in regular New York trading, bringing their year-to-date increase to 13%. That’s well below the gains of many big chipmakers this year, which have benefited from rising optimism that computer sales are bouncing back.

Like some of its counterparts, Texas Instruments is building new plants — a longer-term bet that semiconductors will become ever more vital to the economy. That’s been cited as a drag on results in the short term. Executives have said that increased spending on new facilities around the company’s Dallas home base will weigh on profitability until they’re in operation.

Revenue in the second quarter fell 13% to $4.53 billion, compared with an average estimate of $4.35 billion. Earnings amounted to $1.87 a share in the period, down from $2.45 a year earlier.

(Updates with executive comments starting in fourth paragraph.)