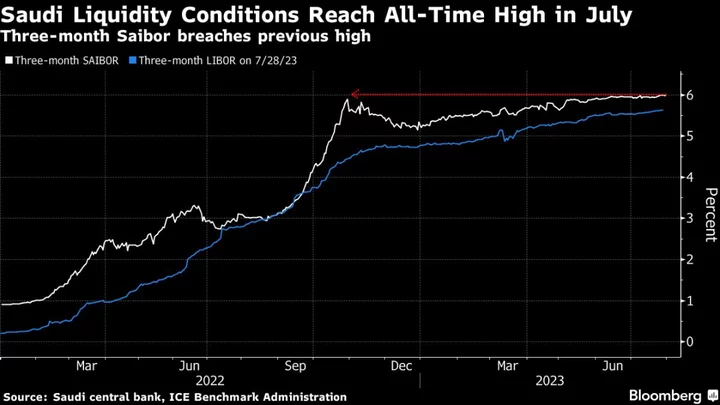

A key gauge of borrowing costs in Saudi Arabia has risen to a record, potentially hitting businesses and individuals at a time oil-production cuts are slowing economic growth.

The cost of money as measured by the three-month Saudi Interbank Offered Rate, or Saibor, has climbed above 6%, even higher than it was during the 2008 global financial crisis and after oil prices collapsed in 2020.

The rate was below 1% only 18 months ago. Its rise has come as the US Federal Reserve has hiked interest rates to lower inflation, with its latest move of 25 basis points coming last week. The riyal is pegged to the dollar and the kingdom’s central bank has to follow the Fed’s decisions closely, even though Saudi inflation has been well below that of the US in the past two years.

“Rising oil prices mitigate some pain but a prolonged period of higher rates is clearly negative,” said Tarek Fadlallah, head of Nomura Holdings Inc.’s asset management arm in the Middle East.

Saudi officials have repeatedly played down concerns about tight liquidity, saying the central bank has all the necessary levers needed to support lending. SAMA, as the monetary authority is known, has resorted at times to open market operations — transactions that provide short-term liquidity to lenders.

A series of oil production cuts and lower prices may lead the kingdom’s economy to contract this year. Last week, the International Monetary Fund gave Saudi Arabia the steepest growth downgrade among major economies for this year.

Those cuts have started to boost crude prices, with Brent rising above $85 a barrel from around $72 in mid-June. Still, concerns remain that higher interest rates could stifle economic activity in the US and Europe, and Brent remains well below levels from last year, when it averaged $100 as Russia’s invasion of Ukraine upended energy markets.