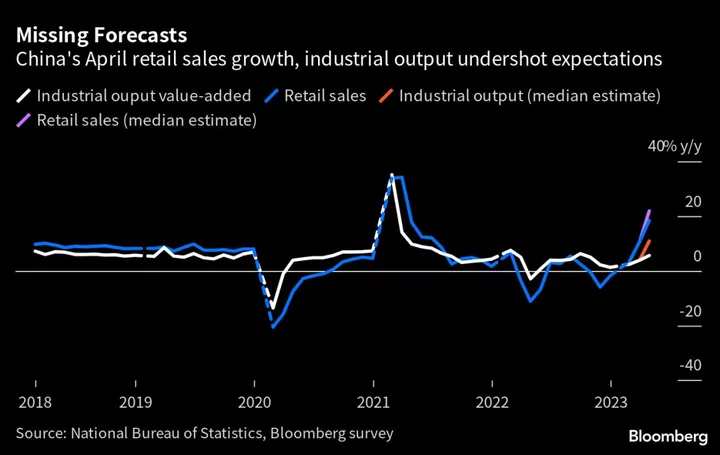

China’s consumer spending and industrial activity grew at a slower pace than expected in April, adding to signs the recovery in the world’s second-largest economy is losing momentum.

Industrial production rose 5.6% from a year earlier, the National Bureau of Statistics said Tuesday, lower than the 10.9% median estimate in a Bloomberg survey of economists. Retail sales climbed 18.4%, worse than forecasts for a 21.9% surge.

Growth in fixed-asset investment slowed to 4.7% in the first four months of the year, weaker than the 5.7% forecast by economists. The urban jobless rate eased to 5.2% from 5.3% in March, but unemployment among young people reached a record high of 20.4%.

The headline figures were boosted by comparisons with April 2022, when Shanghai was in lockdown, resulting in a plunge in business and consumer activity at the time. Even so, the numbers were disappointing and suggest policymakers may need to step up support for growth.

Chinese stocks edged lower. The benchmark CSI 300 Index fell as much as 0.4% in early trading, underperforming a broader Asian equity gauge.

The NBS highlighted global and domestic risks to growth, saying “the global environment is still complex and grim, and domestic demand still looks insufficient.” The economy’s “internal driver for rebound is still not strong,” it said.

Other indicators in recent weeks showed the economic recovery may be easing after a strong start to the year. Property sales during the Labor Day holiday remained below pre-pandemic levels and consumers have cut back on mortgages. Consumer prices barely grew in April, while imports plunged, a sign of subdued domestic spending. Borrowing by households and companies also slumped last month.

Economists are debating whether the central bank will add more stimulus to spur growth. The People’s Bank of China hinted Monday it will keep policy supportive, pledging “appropriate” levels in money supply and credit. Earlier Monday, it injected more long-term liquidity into the financial system, while keeping the rate on its one-year policy loans unchanged.

--With assistance from Shikhar Balwani.

(Updates with additional details.)