Traders accustomed to aggressive interest-rate hikes across Asia are now seeking to gauge when the region’s central banks will begin cutting, a pivot that would potentially support a nascent rally in bonds.

Central banks across emerging Asia raised rates forcefully over the last year to combat stubborn inflationary pressures, with borrowing costs in economies such as South Korea and the Philippines rising beyond their highest levels in a decade.

Amid signs that inflation in the region is now slowing, the narrative among market participants has shifted from “peak rates” to rate cuts, which should help drive a rebound in sovereign debt.

“We now believe all Asian central banks are done hiking rates, in line with the deep slump in exports and easing inflation,” said Rob Subbaraman, Singapore-based head of global markets research at Nomura Holdings Inc. The bank’s analysts see cuts as early as August and October for South Korea and India, respectively.

Prospective rate cuts will spur further gains in fixed-income instruments, with a Bloomberg index of emerging Asia bonds having already gained 3% this year amid signs that the Federal Reserve may be nearing the end of its rate-hike cycle. That’s after a loss of 7.6% last year, the worst on record in data going back to 2008.

The pivot toward cuts across Asia can be a risky gambit for emerging economies that will likely be front-running a possible Federal Reserve loosening — thus widening the interest-rate gap and potentially triggering capital outflows. However, a milder run-up in price growth and a relatively more stable banking system than the US and Europe could shield emerging Asian economies.

Here’s a look at how those rate bets are shaping up across several emerging Asian markets:

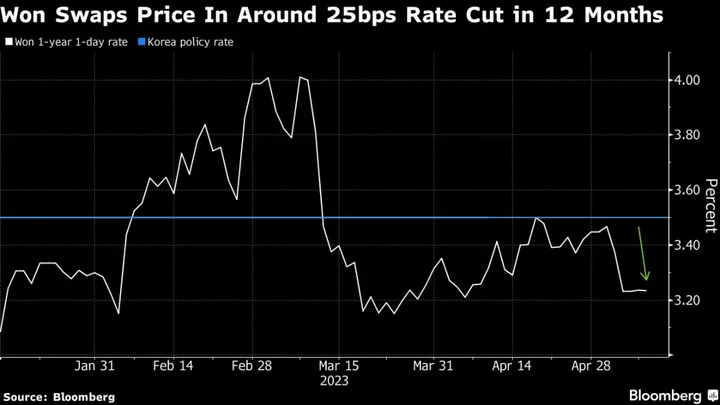

1. South Korea

South Korean swaps are pricing in a 25-basis-point rate reduction over the 12-month horizon. The Bank of Korea pushed back against rate cut expectations at its April 11 policy decision citing its goal to combat inflation. However, April inflation data released at the start of May eased, providing evidence for the central bank that price pressures are easing. Faster-than-expected rate cuts from Korean policymakers may add pressure on the won, already the worst-performing currency in Asia this year.

2. Malaysia

Bank Negara Malaysia’s decision to resume policy tightening this month with a 25-basis-point increase took investors by surprise. But this may have been the final hike as ringgit swaps last week priced as much as 25-basis points of easing over a 12-month horizon. Still, a rate reduction looks far from certain, with the March core inflation rate of 3.80% significantly higher than the five-year average and a potential reduction in energy subsidies likely to add to price pressures.

3. India

The Reserve Bank of India surprised markets by choosing to remain on hold in April after hiking in six straight previous meetings. Markets are pricing in as much as 70 basis points of rate cuts by June 2024, said Jennifer Kusuma, a senior Asia rates strategist at Australia & New Zealand Banking Group Ltd. in Singapore. Still, ANZ doesn’t expect a rate cut any time soon as it forecasts that the RBI would want to see inflation stabilizing at the midpoint of its target range before easing.

4. Indonesia

The spread between the two-year Indonesian bond yield over the policy rate has narrowed to less than 30 basis points, heralding expectations for policy easing. Back in 2019, the spread fell below that level on July 16 before Bank Indonesia started its easing cycle later in the same month.

READ: Bank Indonesia Seen to Bide Its Time Before Cutting Policy Rate

Indonesia and the Philippines are the only countries that are forecast to see rate cuts in Southeast Asia this year, said Bloomberg Asean Economist Tamara Henderson. “Indonesia has inflation under control and the rupiah has proven resilient so far to bouts of selling pressure from market volatility this year,” she said.

Bangko Sentral ng Pilipinas is likely to leave its key interest rate unchanged at a policy review Thursday this week, Governor Felipe Medalla said on Monday.

(Updates with Philippine central bank decision in the final paragraph.)