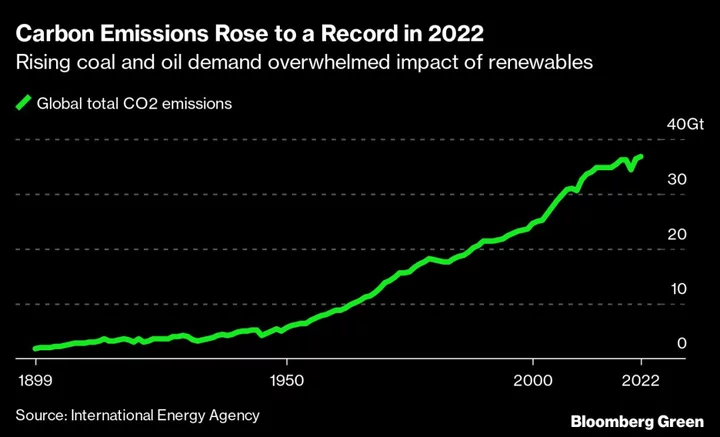

Much of the fossil fuel industry may be facing an era of credit downgrades if producers prove too slow to adapt to a low-carbon future, according to Fitch Ratings.

Oil and gas companies stand out as the most vulnerable issuers in an analysis by Fitch, which sought to gauge how businesses will cope with climate risks such as increasingly stringent emissions regulations.

Fitch’s models show that more than a fifth of global corporates across regions and sectors face a material risk of a ratings downgrade due to an “elevated” level of climate vulnerability over the coming decade. Half of those issuers are in the oil and gas industry, while coal and utilities also stand out as being particularly exposed to the risk of downgrades, the analysis shows.

What’s more, over half the global issuers potentially facing downgrades due to climate risk are currently investment grade, according to FItch, which based its report on a sample of 715 companies.

The International Energy Agency estimates that global demand for oil will peak this decade. But other researchers warn that the tide may turn even sooner. According to Inevitable Policy Response, a forecasting group whose data was used in the Fitch analysis, peak oil may come in 2025, after which demand will sink more than 60% over the next two-and-a-half decades.

The scale of the demand slump ahead “is a very big number,” Sophie Coutaux, head of ESG for corporate ratings at Fitch, said in an interview. There’s now a “big question mark” as to whether producers will “be able to adapt,” she said.

The warning comes as much of the oil industry doubles down on its core business, after the war in Ukraine spurred an energy crisis that fanned fossil fuel prices. Oil majors have used cash flows inflated by temporarily higher prices to enrich shareholders with buybacks, and expand within their sectors through acquisitions.

But outsize fossil fuel profits are showing signs of waning. This week, BP Plc saw its share price slide after posting results that fell short of analyst estimates, due to weak gas earnings. And oil at $100, which some analysts had predicted just a few months ago, is now looking more remote.

BP’s interim chief executive officer, Murray Auchincloss, said on Tuesday that the company expects to “grow earnings through this decade.” He also said more of that growth now needs to come from clean energy, and “not the oil and gas side.”

Fitch pointed to Shell Plc as an example of an integrated oil and gas company with “average” industry exposure to transition risk. Shell has formulated a low-carbon strategy, but because most of its operating profit (measured as Ebitda) will still come from fossil fuels by the end of the decade, it “remains exposed to possible increases in funding costs,” according to Fitch. Its “low levels of financial leverage” may mitigate that risk, Fitch also said.

A spokesperson for Shell declined to comment.

A number of the world’s biggest oil and gas companies are hoping they’ll be able to achieve future emissions reductions by using carbon-capture technology that’s yet to be fully developed. However, Fitch warns that time may be running out for some in the industry to produce feasible emissions-reductions plans.

Some investment-grade issuers “have started to invest in low carbon,” but “the pace needs to be accelerated,” Coutax said.

The credit ratings industry has so far struggled to figure out how best to incorporate climate risk in its models, leaving fixed-income investors to largely navigate their own way through the new landscape. But according to the Institute for Energy Economics and Financial Analysis, there’s an ongoing debate inside the biggest ratings firms.

“Alarm bells have been sounding for months,” Hazel Ilango, an energy finance analyst focused on debt markets at IEEFA, said in a recent interview.

Amid criticism about the rating companies’ perceived foot-dragging, there are signs that climate risk has already been affecting credit scores.

Researchers at the European Central Bank have found that since the Paris agreement, companies most exposed to climate transition risk experienced a greater deterioration in their ratings compared with peers who were adapting at a faster pace. The ratings impact was greater in Europe than in the US, as Brussels pushes ahead with more aggressive climate regulations.

Separately, a report published by the Bank of Canada in July showed that investors pay a substantial premium when buying credit protection for companies facing a high level of credit transition risk. The premium ranges from 12 basis points to 20 basis points, with longer maturities resulting in a bigger extra cost.

“Firms that are better prepared for the transition to a low-carbon economy have a lower cost of capital and are more sheltered from the effects of transition policies,” the authors of the Bank of Canada study wrote.

Other ratings firms are also increasingly incorporating climate risk into their models. S&P Ratings says it currently considers “regulatory and policy risk as the most relevant to a company’s credit profile,” according to an Oct. 25 statement. Technology and consumer behavior “may take longer to evolve at a scale that disrupts a whole sector, whereas regulation can quickly change the landscape.”

Meanwhile, international alliances are forming to demand drastic cuts in fossil fuel production, with the issue set to become a central debate at this year’s COP28 climate summit in Dubai.

The High Ambition Coalition — which counts the Marshall Islands, Austria and France among its members — is the latest to make such calls in the name of fighting climate change.

“Fossil fuels are at the root of this crisis,” the High Ambition Coalition said in a statement. “We must phase out all international public finance for fossil fuel development and power generation.”

(Adds Shell reference in 10th paragraph.)