Consumer stocks, one of the brightest corners of the market this year, are about to lose their shine as risks build for the sector, according to Morgan Stanley’s Michael Wilson.

The faltering rally is in keeping with the view of Morgan Stanley economists that household spending probably can’t sustain the surprising strength of the first three quarters, the strategist said.

Assigning an equal weighting to members of the consumer discretionary sector shows performance is breaking down, while 44% of stocks trading below their 200-day moving average also points to weakness, Wilson wrote in a note.

“This price action is picking up on slowing consumer spend, student loan payments resuming, rising delinquencies in certain household cohorts, higher gas prices and weakening data in the housing sector,” he said.

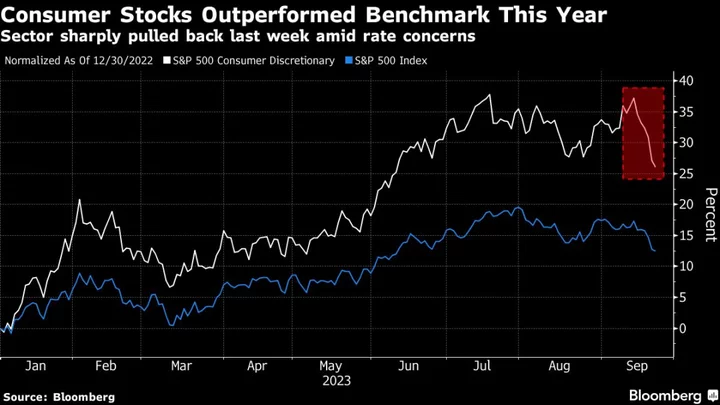

US consumer discretionary stocks, a group that includes Amazon.com Inc. and Tesla Inc., have gained nearly 27% this year, double the 13% advance in the S&P 500.

The sector rose slightly on Monday after hitting a wall last week, tumbling more than 6% in rough trading for risk assets as the Federal Reserve signaled interest rates will be higher for longer in the fight against inflation.

Wilson is not alone in souring on the sector. Goldman Sachs Group Inc. analysis shows that on an equal-weight basis, the consumer discretionary sector will underperform the S&P 500 by seven percentage points over the next 12 months. Moreover, Jefferies Financial Group Inc. analysts downgraded retailers Foot Locker Inc., Urban Outfitters Inc. and Nike Inc. on expectations US consumers are set to curb spending.

The Morgan Stanley strategist — whose bearish outlook on stocks is yet to materialize this year — said investors should avoid rotating into early-cycle winners like consumer cyclicals and housing-related as well as interest-rate sensitive sectors, and small caps. Instead, his team recommends balancing large-cap defensive growth with “late-cycle” cyclical winners like energy and industrials.

Read more: Stocks Flash Recession Warning as Trouble Spreads to Industrials

Meanwhile, JPMorgan Chase & Co. strategist Mislav Matejka said defensives can outperform into the end of the year and recommends a less negative call on mining and energy sectors.

--With assistance from Sagarika Jaisinghani and Alexandra Semenova.

(Updates with consumer discretionary sector move in sixth graf.)