The surprise launch of a sophisticated $900-plus Huawei Technologies Co. smartphone has captivated China’s technology industry, inspiring hopes that the country’s biggest firms can overcome US sanctions seemingly designed to thwart their ascendancy.

The slim-bezeled Mate 60 Pro, which appeared this week for sale on online malls with little fanfare, ignited buzz among Chinese online users who saw in the gadget Huawei’s resurgence after years of fighting American curbs on software and circuitry. Many posted screenshots and videos of the gadget’s fast wireless performance, triggering speculation Huawei had managed to achieve 5G capabilities.

Investors bought in. On Wednesday, shares in more than a dozen Chinese chip designers, gearmakers and Huawei suppliers surged between 8% and 20%. The rally grew out of hopes that Huawei had somehow managed to design, manufacture and deploy a 5G chip capable of matching some of the best America has to offer, despite a lack of access to advanced chipmaking at players including Taiwan Semiconductor Manufacturing Co.

Bloomberg News wasn’t able to verify the authenticity of those reports. The Chinese telecom regulator’s website didn’t show registration details for the model, as required of all wireless smartphones sold in the country.

But the torrent of online reports only gained momentum, in part because of Huawei’s unique status as Chinese national champion and American bugbear. On Wednesday, it topped the list of trending topics on Weibo, China’s X-like equivalent. The very idea appeared to endorse the “whole nation” narrative Beijing has espoused, where a nationwide effort can produce breakthroughs to counter the US.

The Mate 60 Pro is powered by a Kirin processor designed by Huawei’s chip arm HiSilicon, according to multiple teardown videos circulating online. Several online outlets reported the chip employed 5-nanometer node technology — just a generation behind the latest. Bloomberg News couldn’t determine the manufacturer or sophistication of the chip.

Chinese chipmakers aren’t known to have mastered technologies as advanced as 5-nm. Huawei stockpiled such chips from TSMC right before US sanctions hit, but it’s unclear whether the Mate 60 Pro might have used remnants of the company’s inventory.

The phone’s emergence coincides with a high-profile visit by US Commerce Secretary Gina Raimondo to Beijing and Shanghai. Her agency has been at the forefront of curbs on Chinese entities including Huawei.

“This new phone has huge significance. Though it is evident that Huawei was able to build this model only by sourcing and production in a roundabout way, regardless of what it went though to achieve this, Huawei did it,” said Shi Junbo, a fund manager at Hangzhou XiYan Asset Management Co.

Chinese chip firms and Huawei suppliers including Lontium Semiconductor Corp., Cambricon Technologies Corp. and Anker Innovations Technology Co. climbed between 8% and 11%. Biwin Storage Technology Co. and Guangdong Leadyo IC Testing Co. surged their 20% daily limits. Top Chinese chipmaker Semiconductor Manufacturing International Corp. climbed as much as 6.4% in Hong Kong.

“But in terms of the sentiment lift for the industry today, that shares have been at their lows probably is the more important factor than the phone. One model is probably not going to be enough to have a lasting impact on the sector,” Shi added.

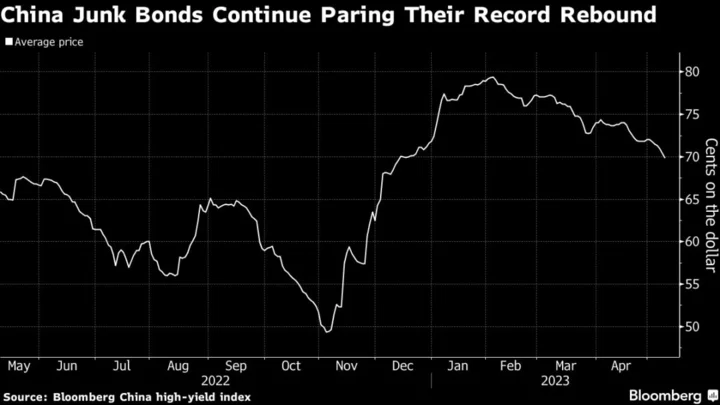

The rally was unusual not just for a lack of evidence to support the online enthusiasm, but also because it coincides with warning signs of Chinese financial and economic stress — in part because of US pressure.

Huawei is one of several Chinese companies at the center of Washington-Beijing tensions, the target of sanctions over allegations it aids China’s military. The company, once the world’s biggest telecommunications provider, has been pulling out the stops since the Trump administration added Huawei to its Entities List in 2019.

Huawei began by assigning thousands of engineers to try and replicate American technology, for instance in wireless chips. And it also began putting in place the infrastructure to ensure its future survival.

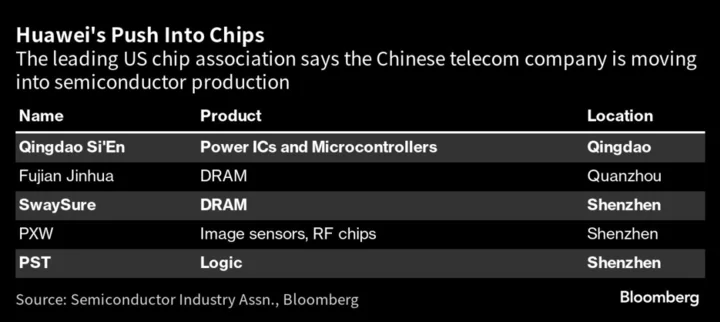

The leading association of global chip companies warned this year that Huawei is building a collection of semiconductor-fabrication facilities across China, a shadow manufacturing network that would let the blacklisted company turn its chip designs into reality.

Read more: Asian AI Chip Stocks Climb as Nvidia, Google Expand Partnership

It remains unclear how Huawei could have found workarounds to some of the most sweeping restrictions on China that the US has ever imposed. Many in America have said Huawei enjoys broad government support, in part because of its critical role in domestic infrastructure and its stature overseas. When then-Chief Financial Officer Meng Wanzhou was detained in Canada, Beijing officials intervened to secure her freedom.

Now, investors hope that Huawei can inspire its peers, several of which also labor under sanctions of varying severity. The Mate 60’s launch will be a catalyst for more homegrown, high-end smartphones, and trigger demand in the supply chain especially amid a downturn in semiconductors, Huajin Securities analysts including Sun Yuanfeng wrote in a note.

“It paves the way for Huawei to recover its shipments even quicker in its home country, with an almost zero-cost launch event,” Canalys Senior Vice President Nicole Peng said. “If the rumors are true, it means Huawei’s R&D capabilities have largely exceeded the industry development timeline, which means it creates huge disruption to the semi industry and its competitors.”

--With assistance from Debby Wu.