Federal Reserve Chair Jerome Powell suggested the US central bank is inclined to hold interest rates steady again at its next meeting while leaving open the possibility of a future hike if policymakers see further signs of resilient economic growth.

The comments effectively affirm market expectations for the Fed to skip a rate increase for a second straight meeting when officials gather on Oct. 31 and Nov. 1. The Fed chief also said a recent run-up in long-term Treasury yields, if they persist, could lessen the need for further hikes “at the margin,” echoing his colleagues and underscoring the importance of tightening financial conditions to the rate outlook over the coming months.

“Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully,” Powell said Thursday at the Economic Club of New York. “We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.”

Yields on two-year Treasuries declined after Powell spoke, while 10-year yields pared an increase that pushed them near the 5% mark. The dollar fell against a basket of major currencies, and the S&P 500 index of stocks, after multiple twists and turns, fell.

“For November, he has clearly sent a signal of pause,” said Laura Rosner, partner at Macropolicy Perspectives LLC. “He expects the economy to cool down in the fourth quarter, and yields are doing some of the work for them.”

Protesters Disrupt

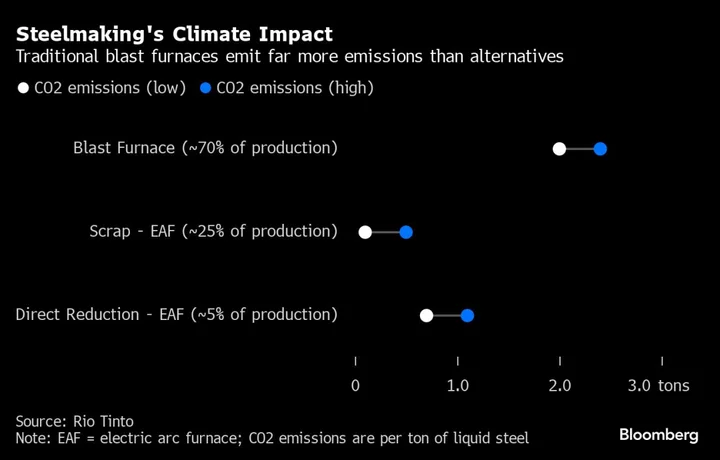

Before beginning his remarks, Powell was briefly escorted out of the room after protesters interrupted the New York event. The demonstrators, who were standing arm in arm, were chanting “end fossil finance” and were forcibly removed from the stage before Powell returned.

Officials left their policy rate unchanged last month in a range of 5.25% to 5.5% and their forecasts showed 12 of 19 officials wanted one more hike this year. Powell was careful not to rule out the possibility of further tightening in his remarks.

“Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy,” he said.

Speaking during a question-and-answer session with Bloomberg TV’s David Westin, Powell added, “I think the evidence is not that policy is too tight right now.”

Core inflation, excluding volatile food and energy prices, has decelerated to just below 4% on an annual basis and just below 3% on a three-month annualized measure.

Economic Strength

At the same time, recent economic data showed US retail sales exceeded forecasts and industrial production strengthened in September, while nonfarm payroll gains have averaged 266,000 over the past three months, a robust pace.

While three- and six-month measures of core inflation are running below 3%, Powell warned short-term measures are often volatile. “In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he said.

Powell also said there’s evidence the Fed’s rate hikes are putting downward pressure on the economy, and said “there may still be meaningful tightening in the pipeline.”

He also cited key risks from geopolitical tensions, which he called “highly elevated.” He said he found the attack on Israel to be “horrifying, as is the prospect for more loss of innocent lives.”

‘Further Softening’

The Fed chair said there are signs the labor market is cooling, though he repeated that a “sustainable” return to 2% inflation “is likely to require a period of below-trend growth and some further softening in labor market conditions.”

The speed of the Powell tightening campaign has been the fastest since former Chair Paul Volcker unleashed his attack on inflation in the late 1970s.

An abrupt rise in longer-term Treasury yields since July has prompted some Fed officials, such as Vice Chair Philip Jefferson, to focus more on overall financial conditions as they consider their next move. Two-year Treasury yields rose to a 17-year high Tuesday, while 10-year notes are near their peak for the year.

Powell said the recent surge is mostly due to rising term premiums, detailing several factors that could be causing the increased yield demand from investors, including the central bank’s quantitative-tightening program.

“They’re revising their view about the overall strength of the economy and thinking even longer term it may require higher rates,” Powell said. “There may be a heightened focus on fiscal deficits. QT could be part of it.”

Read More: Powell Says Run-Up in Bond Yields Mostly Due to Term Premiums

Fed officials have restated their intention to get inflation back to 2%, though minutes of the September meeting now show they are also weighing the risk of too much restraint and sending the economy into a downturn.

“A range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little,” Powell said.

--With assistance from Matthew Boesler.

(Updates with economist comment fifth paragraph.)