A veteran Australian hedge fund manager is scoping out shares of potential takeover targets in the domestic lithium sector, betting that the recent flurry of deals will boost valuations.

A mergers and acquisitions spree that’s swept up miners like Liontown Resources Ltd. and Allkem Ltd. will carry on in Australia, according to Regal Funds Management Pty’s chief investment officer Phil King. The hedge fund manager, who has more than two decades of experience and oversees A$6 billion ($3.8 billion), is bullish on the long-term prospects for the critical electric-vehicle battery ingredient.

“We’re going to see another wave of consolidation,” he said. “We’re focused on those companies that we think are targets.”

The Regal Investment Fund has gained 9.1% year to date, trouncing the S&P/ASX 300 Total Return Index’s 0.7% advance, according to an exchange filing as of Sept. 30.

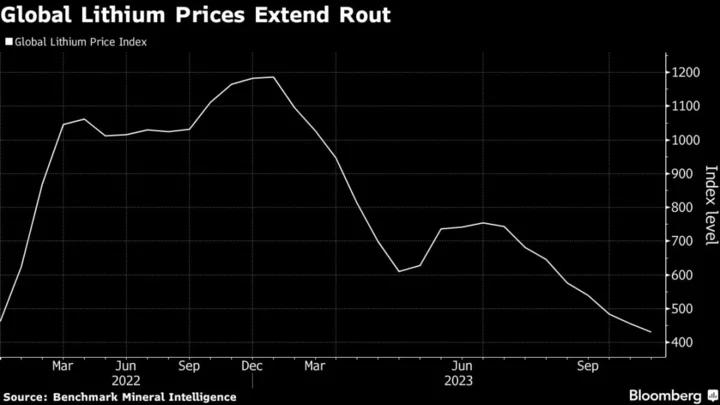

Global miners are rushing to Australia’s lithium sector as a slump in lithium carbonate — a semi-processed form of the metal — helps spark an M&A boom. The deals are seen as more effective in expanding capacity than building new greenfield projects. A decline in valuations for some lithium producers is also making them prime targets for investors trying to find entry points into the clean energy transition and EV supply chain trade.

The world’s top producer Albemarle Corp. had until recent weeks pursued Liontown before billionaire Gina Rinehart’s Hancock Prospecting Pty. muscled its way into a takeover battle. Meanwhile, US-based Livent Corp. has agreed to combine with Allkem. Chinese producer Tianqi Lithium Corp. also made an unsuccessful attempt to acquire Australia’s Essential Metals Ltd.

Regal holds shares of Lithium Power International Ltd., which last week agreed to be acquired by Chilean copper miner Codelco, as well as Pilbara Minerals Ltd. The hedge fund previously owned Pilbara’s stock when the lithium giant was still in its infancy, but sold its early stake and has recently started re-buying the shares. Lithium Power has surged about 19% this year, while Pilbara has risen 3.5%.

The fund also holds Azure Minerals Ltd., another company that has climbed amid the flurry of lithium M&A activity. The stock, which is currently suspended as talks of a potential deal continue, have skyrocketed 980% year to date.

Although lithium prices have faltered recently, “the longer term story is still very intact,” King said. “Every single major motor vehicle manufacturer in the world is either producing or going to produce electric vehicles, and that’ll continue to mean that the demand for lithium will grow strongly.”

The global shift away from fossil fuels is also presenting opportunities in uranium as it is considered a greener source of energy, according to King. His largest exposure to the commodity is through Sydney-listed Canadian company NexGen Energy Ltd., which is up 36% this year.

Regal also recently bought shares of Woodside Energy Group Ltd. and Shell Plc. King said he’s positive on the longer-term outlook for the energy sector and that oil prices should remain high amid the Middle East conflict.

(Adds details on Azure Minerals, updates share moves)