Traders are betting on short-term relief for China’s offshore currency, even as global investors predict mounting economic stress will drive the yuan to historic lows.

Read more: Yuan Seen Tumbling 4% to New Low in China Selloff: MLIV Pulse

The People’s Bank of China is pressing ahead with its recent campaign to support the currency via daily fixings. One-month forward points - a measure of the cost to borrow the yuan versus the dollar - jumped the most since 2017 last week. In addition, China announced a slew of measures to woo back equity investors.

“As the PBOC has stepped up its measures to prop up the yuan, dollar-yuan has become a lot more contained,” said Eddie Cheung, senior emerging markets strategist at Credit Agricole CIB Hong Kong branch. “This is causing a measure of expected movement in USD/CNY in the coming one month to pull back from highs, reflecting the view that markets see USD/CNY as being more constrained near term.”

Here are four charts showing how bearish investor sentiment toward the yuan is fading.

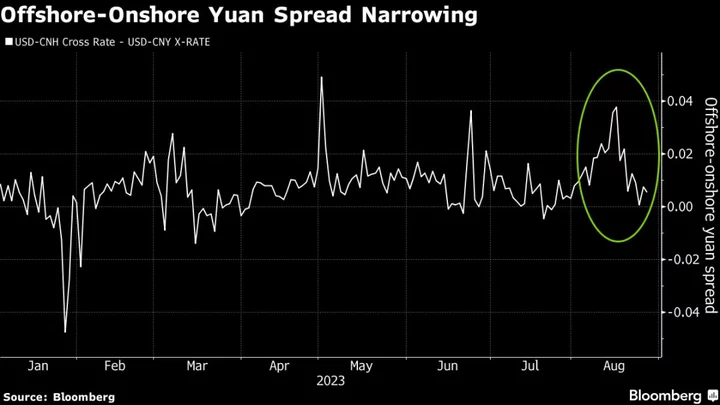

The offshore yuan’s discount to its onshore counterpart has contracted from its mid-August peak. The narrowing gap is seen as a sign of speculators easing short bets on the yuan, as such trades are traditionally more crowded in the overseas market where the currency is less controlled by the central bank.

Risk reversals show the premium to hedge dollar-yuan’s upside over the next month compared with its downside has been falling. The shrinking premium indicates demand to hedge against or speculate on dollar-yuan rallying over that time period is waning.

Dollar-yuan’s short-term tail risk, as measured by the pair’s one-month 10-delta butterflies, is also falling. This signals market participants are reducing the probability of the yuan experiencing outsized moves against the greenback over the next month.

Dollar-yuan’s one-month implied volatility is a measure of the currency pair’s expected movement over that period. Its decline indicates market participants are forecasting a smaller chance of large swings in coming weeks.

--With assistance from Tian Chen.