Federal Trade Commission Chair Lina Khan is going after a common acquisition strategy for private equity firms, putting the industry on notice with a new lawsuit that US regulators are scrutinizing “roll-up” deals involving small companies that compete in local markets.

The FTC sued US Anesthesia Partners Inc. and its private equity partner Welsh Carson Anderson & Stowe LP on Thursday, alleging they engaged in a scheme to monopolize the market for anesthesiologists in Texas using the “roll-up” strategy. It’s the first time the agency has targeted such deals, which usually are small enough to avoid antitrust review.

Welsh Carson systematically bought up more than a dozen anesthesiology practices, becoming the dominant provider of the services in Texas, including in Houston and Dallas, according to the complaint. The company then increased prices and secured promises from other providers that they would stay outside the market, the FTC alleged.

“Private equity firm Welsh Carson spearheaded a roll-up strategy and created USAP to buy out nearly every large anesthesiology practice in Texas,” Khan said in a statement. “These tactics enabled USAP and Welsh Carson to raise prices for anesthesia services — raking in tens of millions of extra dollars for these executives at the expense of Texas patients and businesses.”

In a statement, USAP called the FTC complaint “misguided,” saying it would harm patient care.

“The FTC’s intended outcome threatens to disrupt and restrict patients’ equitable access to quality anesthesia care in Texas and will negatively impact the Texas hospitals and health systems that provide care in underserved communities,” said Dr. Derek Schoppa, a USAP board member. “The FTC’s civil complaint is based on flawed legal theories and a lack of medical understanding about anesthesia.”

Welsh Carson disputed the FTC’s allegations, saying USAP’s rates haven’t exceeded the rate of medical cost inflation.

“We are confident we will prevail as the FTC’s claims are without merit in fact or law,” Welsh Carson spokesperson Amy Stevens said.

‘Cha-Ching’

According to the FTC complaint, internal communications show executives at USAP and Welsh Carson were focused on “captur[ing] significant synergies” with the acquisitions. “Following one acquisition, a USAP executive put it more bluntly: ‘Cha-ching!’” the agency said.

UnitedHealth Group Inc., the largest US insurer, complained about the increased prices, according to the FTC.

“You’ve basically taken the highest rate of all in one distinct market and then peanut butter spread that across the entire state of Texas,” a UnitedHealth executive wrote.

USAP is one of the largest anesthesiology providers, serving more than 2 million patients a year. The company has a large presence in Texas, Colorado and Florida.

Welsh Carson has $31 billion in assets, according to data compiled by Bloomberg, and says it primarily invests in health care and technology.

Expanded Scrutiny

Khan has said her agency is “looking closely at the role of private equity,” noting research that shows its investments in nursing homes have led to higher death rates. In an op-ed published Thursday in The Financial Times, Khan said the FTC will focus on parent companies and investors “if they directly participate or conspire to participate in anti-competitive conduct.”

Private equity funds raise money from institutions and wealthy investors to buy large stakes in companies and, typically, overhaul their management. After several years, the private equity firms generally sell the company or take it public. The industry has trillions of dollars in assets under management.

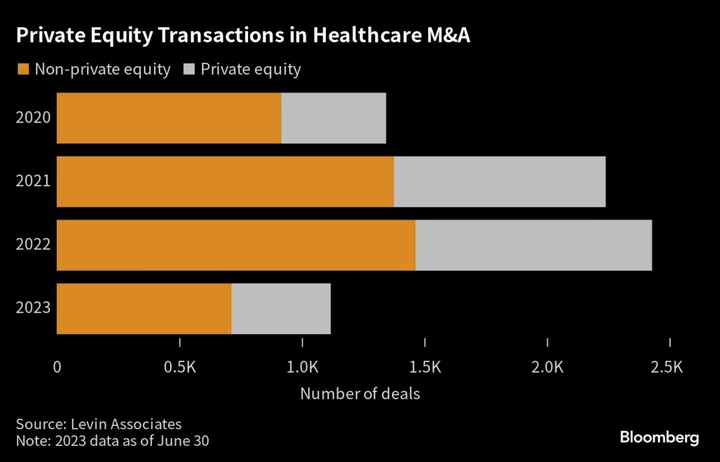

The health-care industry has been a particular favorite of private equity. Last year, private equity transactions accounted for about 40% of health-care mergers and acquisitions, according to Levin Associates, which tracks health-care deals. A 2020 study published in the Journal of the American Medical Association found that anesthesiology practices were a particular focus on private equity buyouts – accounting for about 20% of deals, more than any other physician practice group.

The case is FTC v. US Anesthesia Partners, 4:23-cv-03560, US District Court, Southern District of Texas (Houston).

--With assistance from Madlin Mekelburg.

(Updates with Welsh Carson comment in seventh paragraph.)