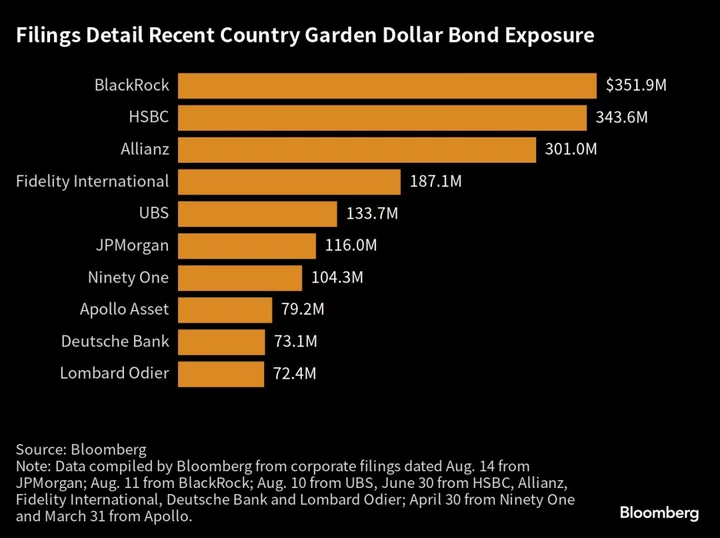

Global investors including BlackRock Inc. and Allianz SE may be key stakeholders to watch in Country Garden Holdings Co.’s debt crisis given their recent exposure to the embattled Chinese property developer’s dollar bonds.

BlackRock held $351.9 million of Country Garden dollar bonds, according to a filing dated Aug. 11. Allianz’s position was $301 million based on a June 30 filing. That was also when filings from others including Fidelity International Ltd. and HSBC Holdings Plc showed they were holders.

According to filings dated April 30 and March 31 respectively, Ninety One UK Ltd. and Apollo Asset Management Inc. also held the developer’s notes.

Other banks with exposure to Country Garden’s dollar notes included UBS Group AG and JPMorgan Chase & Co., based on their filings earlier this month. Deutsche Bank AG and Banque Lombard Odier & Cie SA also had positions, according to their filings in late June.

The filings don’t necessarily reflect current holdings as some might have changed since the documents were filed, and firms may hold bonds on behalf of clients. Rules on how funds disclose their holdings vary by country.

BlackRock, HSBC, Allianz, Fidelity, Ninety One, UBS, JPMorgan, Deutsche Bank and Banque Lombard Odier either declined to comment or didn’t immediately offer comment. Apollo has yet to respond to requests for comment.

Country Garden, formerly China’s biggest developer by contracted sales before a deal slump this year, is at risk of its maiden bond default. The countdown has begun for a 30-day grace period after it missed coupon payments effectively due Aug. 7 on two dollar notes.

Nonpayment would send tremors through China’s debt markets as offshore creditors often rank lower than domestic peers in restructuring. How a potential debt overhaul pans out is pivotal to broader confidence in China’s crisis-ridden property sector, where efforts to sort out debt claims and better protect investors tend to be protracted processes.

Fidelity International, a major holder of Chinese builders’ junk bonds, pared about 7% of its holdings between July 4 and Aug. 3, according to Bloomberg Intelligence.

Country Garden has more than 3,000 housing projects in the country, four times those of China Evergrande Group, which until now has been the epicenter of an unprecedented cash crunch among developers.

In the latest sign of its debt struggles, Country Garden is soliciting feedback on a proposal to extend payment for a 3.9 billion yuan ($535 million) local note originally due Sept. 2 with amortized disbursements over 36 months.

The developer said last week it planned to hold bondholder meetings in the near future regarding repayment arrangements. The firm reiterated it will take measures to defuse risks and protect the legitimate rights of its investors while ensuring home deliveries.

--With assistance from Lorretta Chen.