Never before have airlines placed such outsize orders as they did this year, breaking one record after another.

Indian airlines alone made close to 1,000 purchases, but the action was spread across the industry. From Irish low-cost carrier Ryanair Holdings Plc to newcomer Riyadh Air and stalwarts like United Airlines Holdings Inc., buyers from around the globe raced to get their hands on as many planes as they could before delivery slots run out.

There’s more to come. The Dubai Air Show kicks off next week, promising to send 2023 off with a flurry of orders for Airbus SE and Boeing Co. The planemaking duopoly has already racked up commitments that stand at the highest since 2014 as they head into the biennial event, where some of aviation’s biggest deals have been signed in the past.

Local champion Emirates is set to make the biggest splash, with President Tim Clark saying he’s in the market for more widebody jets. Back in June, Clark said he’d order as many as 100 to 150 aircraft, looking at both Airbus and Boeing’s largest models.

Joining the action will likely be Riyadh Air, the new Saudi airline building a fleet from scratch. The company, run by former Etihad Airways Chief Executive Officer Tony Douglas, is putting the final touches on what it called a “sizable” order involving narrowbody planes, after previously buying 787 Dreamliners from Boeing for its long-distance routes.

Riyadh Air is likely to order Boeing’s 737 Max, according to people familiar with the matter, who asked not to be identified because talks are ongoing and haven’t been finalized. In an interview this week, Douglas declined to identify the winner.

Other carriers from the region are also in the market for new aircraft. Turkish Airlines has said that it wants to almost double its fleet to 800 aircraft within a decade, while Etihad recently moved into a new, larger terminal at Abu Dhabi’s airport, a good hour’s drive north of Dubai — showing how the airline is back on an expansion course after years of scaling back.

The exuberance that will likely be on display in Dubai contrasts with the cautious steps the industry was still taking two years ago as airlines emerged from the crippling pandemic. Now the pendulum has swung firmly the other way: carriers are racing to lock in scant delivery slots and backlogs are stretching past 2030. Some industry veterans caution that the buying might be overdone.

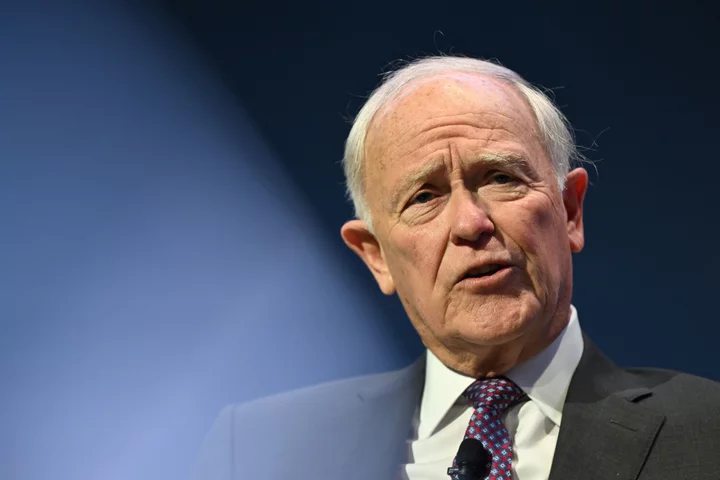

“Their eyes are bigger than their stomachs,” Steven Udvar-Hazy, chairman of Air Lease Corp., said this month. “A certain percentage of these big mega orders will flake out or evaporate.”

Like the Paris and Farnborough air shows in Europe, the Dubai event acts as an important barometer for the health of the industry, as measured by the appetite for deals. The Paris show in June resulted in about 1,300 aircraft sales, and the organizers of Dubai’s expo will be hoping to replicate that success.

Still, some airlines warn of slowing growth and falling ticket prices as inflation and economic uncertainty impact consumer sentiment. Closer to home, geopolitics following the Israel-Hamas war has already affected demand for flying to the region.

This week, Ryanair CEO Michael O’Leary said there was a “very steep fall-off in loads on flights” to Jordan. Bookings to Israel collapsed at the onset of the conflict, he said, similar to the way demand for travel to Central and Eastern Europe temporarily plunged when Russia invaded Ukraine.

Indian Expansion

Carriers in the Middle East also need to contend with rising competition. Air India, now owned by the Tata Group, is trying to win back customers with its nonstop services to the US and Europe, traffic that now often transits through mega hubs in Dubai, Doha or Abu Dhabi.

IndiGo, India’s largest airline, has also been negotiating the purchase of widebody jets to expand long-haul services. A deal to buy about 20 Boeing 787s could be announced at the Dubai show, according to people familiar with the matter. The carrier set records with its order for 500 Airbus narrowbody jets in Paris.

Indigo declined to comment. Airbus and Boeing won’t discuss customer agreements before they’re unveiled.

Clark, the Emirates president, is unlikely to be deterred by any cautionary notes. After all, he’s arguably the only airline boss who managed to turn the Airbus A380 into a success, while most other carriers either retired their superjumbo fleets or brought back the double decker jet in only small numbers. Emirates, by contrast, has more than 100 of the behemoth planes in its fleet.

This year’s edition of the Dubai show could be the final one for Clark, who turns 74 this month. He announced plans to retire in 2019 but then reversed course as the pandemic decimated air travel. He’s likely to stick around at least until the middle of next year, when he hosts the annual general meeting of the International Air Transport Association, the biggest gathering of aviation executives.

Another longtime executive who has been a fixture in Dubai has already left the scene: just last month, Akbar Al Baker, who turned Qatar Airways into one of the world’s premier airlines, said he was stepping down after more than a quarter-century at the helm. He’ll be replaced by Badr Mohammed Al Meer, chief operating officer of Doha Hamad International Airport.

--With assistance from Charlotte Ryan, Kate Duffy, Julie Johnsson and Mary Schlangenstein.

Author: Siddharth Philip and Leen Al-Rashdan