London Stock Exchange Group Plc expects income growth for the year to reach the upper end of its guidance range after half-year earnings that fell slightly short of estimates but showed growth in all areas of the business.

The bourse reported adjusted operating profit of £1.4 billion ($1.8 billion) for the first half of the year, compared with a consensus estimate of £1.5 billion compiled by Bloomberg. The results were broadly flat compared to a year ago.

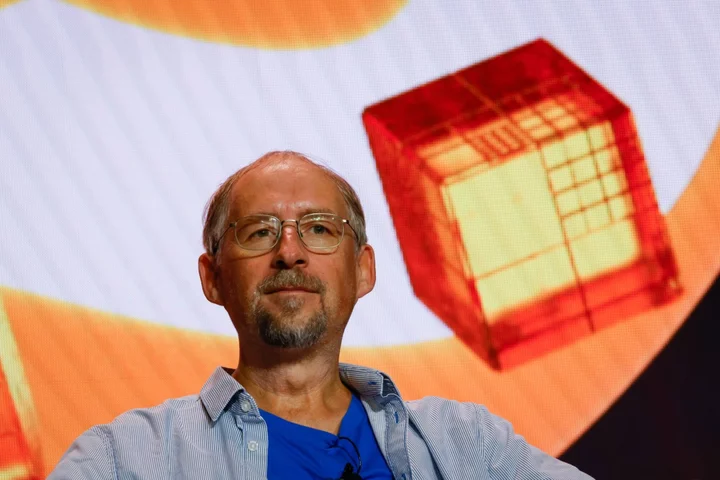

“Data and analytics is growing faster than it has for many years,” said Chief Executive Officer David Schwimmer. “Post trade once again demonstrated the critical role it plays in helping customers manage risk in uncertain markets, delivering outstanding growth.”

The data and analytics business grew 7.6% from the same period a year ago while post-trade was up 19.2% and capital markets income increased 1.5%.

The group expects full-year total income, excluding recoveries and the effects of currency movements, to grow at the upper end of its range of 6% to 8%.

LSE now makes most of its money from data services, having completed the $27 billion purchase of Refinitiv in 2021. It also signed a tie-up with Microsoft Corp. last year to bolster its capabilities in cloud computing. The parent company of Bloomberg News competes with Refinitiv to provide financial news, data and information.