Stubborn double-digit inflation is set to force the Bank of England into a 12th straight interest rate rise on Thursday even though the end of its lightning-quick hiking cycle is coming into view.

Economists and investors expect the Monetary Policy Committee to back another quarter-point boost in Bank rate to 4.5%, the highest since 2008. The decision is due at 12 p.m. London time, with a press conference led by Governor Andrew Bailey following a half hour later.

The market’s focus will be on whether Bailey and the MPC follow the US Federal Reserve in signaling that a pause in rate rises is near in the UK. However, red-hot price and wage data have raised the risks of the BOE continuing its hiking cycle through the summer.

Following are the key elements expected with the BOE’s announcement:

The Final Hike?

The US Federal Reserve has already indicated it could soon pause its hiking cycle, but the BOE is unlikely to send such a strong signal.

Of the 39 economists surveyed by Bloomberg, there is near unanimity on the BOE voting for a quarter-point increase in rates to 4.5%. The real debate on Thursday will center on whether the rate-setters will go even further in the next few meetings.

While the bulk of economists expect it to be the final hike, markets are bracing for even more tightening, with a strong chance the key rate peaks at 5%.

“We doubt the Bank will want to shut down its options on Thursday,” said James Smith, economist at ING. “Unless there’s some really unwelcome economic news over the next few weeks, we expect a pause in June.”

What Bloomberg Economics Says ...

“Inflation in the UK is proving to be very sticky. That, along with a more upbeat economic outlook, means a 25-basis-point hike is the likely outcome of the Bank of England’s May meeting. We think the central bank will again leave the door open to more rate rises — there have been too many data surprises to confidently call time on the tightening cycle.”

—Dan Hanson, Bloomberg Economics. Click on the PREVIEW.

Vote Split

The vote split is unlikely to provide many more clues on how far the BOE will push rates.

The majority of economists expect the same 7-2 split for an increase that emerged in each of the last two MPC meetings. Silvana Tenreyro and Swati Dhingra are likely to be the two dissenting doves, with the former even suggesting a cut in a speech last month.

“If anything, the risk is that the recent data have spooked the hawks, and we could get a few votes for a larger 50 basis point hike,” said Elizabeth Martins, economist at HSBC.

The language of the minutes will be crucial, with investors looking at whether the MPC keeps its so-called “tightening bias.” In March, the BOE kept the door open to further moves higher by warning that another tightening in policy would be needed if the committee saw “evidence of more persistent pressures.”

Those pressures have lingered longer than the BOE hoped, underpinning expectations for further hikes.

Inflation and Growth Outlook

The majority of economists expect the BOE to raise its inflation forecast for this year, the next and 2025, according to Bloomberg’s survey. That follows a stronger-than-expected reading of 10.1% in March.

Back in February, the MPC said inflation would fall to around 4% by the end of the year following the sharp decline in wholesale natural gas prices. But easing pressures from energy prices have been offset by a surge in food costs.

Economists still expect inflation to decline sharply from April as last year’s jump in energy prices drops out of the annual figures. Some also argue that underlying wage pressures are cooling more quickly than headline pay growth suggests.

The central bank will deliver a brighter assessment of the UK economy and could even wipe out the forecast it had in February for a recession. At the last meeting in March, Bailey said he was feeling “more optimistic” about the UK avoiding a recession with official data and business surveys pointing to a more resilient economy.

The upgrade is “due largely to lower energy prices, the additional fiscal support announced in the Spring Budget and more resilient household consumption,” said Mariano Cena, economist at Barclays.

Banking Crisis

Bailey’s remarks and the BOE’s Monetary Policy Report will contain hints about how the UK is weathering the banking industry turmoil on both sides of the Atlantic.

The BOE and government were forced to find a buyer for the UK arm of Silicon Valley Bank when it became insolvent in the US earlier this year. Britain also was buffeted by the forced takeover of Credit Suisse Group AG and is feeling aftershocks from investor panic over the outlook for a series of banks in the US.

In the past few weeks, JPMorgan Chase & Co. bought the troubled First Republic Bancorp Inc., and shares of PacWest Bancorp plunged.

The Fed warned this week that the turbulence in the sector risks causing a “sharp contraction” in credit availability, which would push up borrowing costs for households and businesses.

So far, Bailey has been sanguine about the situation, noting that it shouldn’t have an impact on the BOE’s monetary policy.

Quantitative Tightening

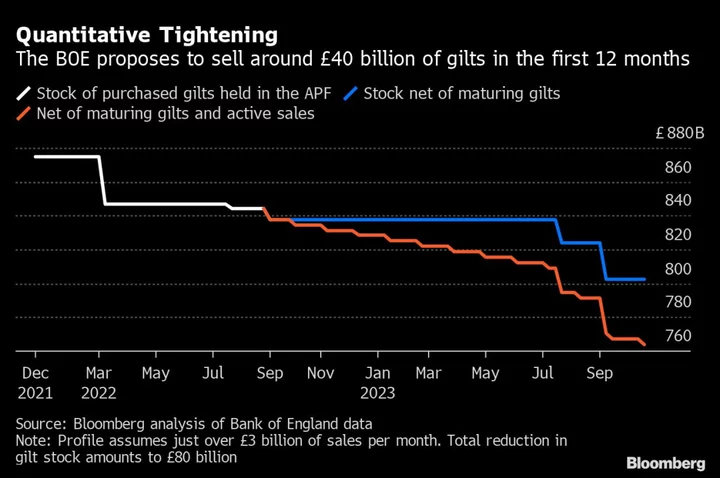

The BOE will weigh up over the summer whether to maintain the pace of quantitative tightening, the reversal of the huge bond purchases it made during more than a decade of quantitative easing.

The central bank has so far unwound more than £60 billion ($75.7 billion) of the vast purchases of gilts it made. That left it with £814 billion of UK government bonds plus almost £4 billion of corporate debt on its balance sheet.

Economists expect the BOE to maintain the pace of its current QT plan, reducing the portfolio of bonds by £80 billion a year with just over half from active sales. It first started the gilt sales last November. Deputy Governor Ben Broadbent said last month that a decision on the next year of QT is due in September.

In the speech, Broadbent launched a staunch defense of quantitative easing, rebuffing claims made by monetarists that pandemic bond purchases helped to fuel inflation.

Read more:

- SURVEY: UK Economists See Just One More Rate Hike From the BOE

- UK Mortgage Costs Risk Heading Higher Again With BOE Rate Hikes

- UK Inflation Sticks Above 10%, Lifting Prospect of Rate Hike

- BOE Chief Economist Says UK Needs to Accept It’s Worse Off

- BOE Deputy Disputes Monetarist View That QE Stoked Inflation

--With assistance from Harumi Ichikura.