China’s local government financing vehicles are merging and reshuffling assets among themselves at record speed, as authorities seek to use consolidation to help ease debt pressure and improve fundraising.

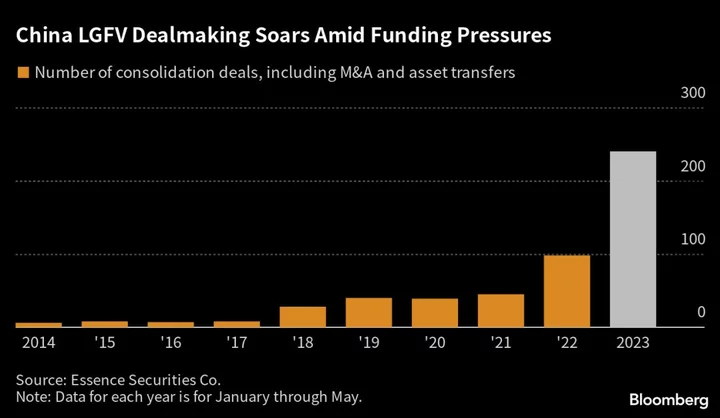

LGFVs, which mostly fund infrastructure projects, were involved in 240 deals including mergers and asset transfers between January and May, more than double on year, according to calculations based on Essence Securities Co.’s LGFV consolidation monthly report. The figure also marks the highest for the period since 2010 when the Chinese brokerage started tracking the data.

Focus has been increasing on the $9 trillion debt market for LGFVs, which have played a key role in Beijing’s efforts to use investment to boost economic growth since the global financial crisis. While none have defaulted on a public bond, the recent last-minute payoff of a note raised fresh concerns about the sector’s debt-servicing abilities. LGFVs received an average 392 million yuan ($55 million) of government subsidies last year, the most since 2013.

Consolidation is an unavoidable trend for LGFVs, according to Li Han, a fixed-income analyst at Citic Securities Co. Combining them can increase LGFVs’ quality and lower risks, he said, while a smaller number of LGFVs can help regulators manage and control them.

Support from local governments could be impacted by their own stretched finances in the wake of pandemic-related spending and slumping home demand. Land sales have long been a primary revenue generator for towns. Half of Chinese cities experienced difficulty making debt-interest payments last year, according to Rhodium Group.

In addition, recent data have increased worries about a fresh slowdown in China’s economic growth.

The Xinhua News agency published a report Monday quoting an unidentified Ministry of Finance official who said local government finances are healthy and safe. Authorities have enough resources to tackle risks, the official added.