Europe’s car-financing businesses are trading in their cheap bonds for more expensive debt — which means higher car loan rates for customers.

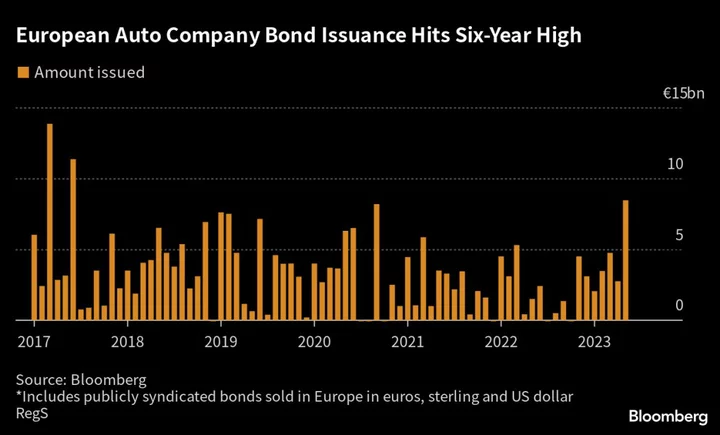

BMW AG, Mercedes-Benz Group AG and others sold €8.45 billion ($9 billion) in bonds in European markets last month, marking the biggest month for auto debt issuance in six years, according to data compiled by Bloomberg. They’re paying dramatically higher rates for debt, and analysts say it’ll trickle down to consumers, who will face more costly vehicle financing.

“Higher bond yields for auto companies means the cost of car leasing will go up,” said Antoine Lesne, head of ETF strategy and research at State Street Global Advisors Ltd. That means “more pain for the consumer,” he said.

Debt is the lifeblood of the financing arms of Europe’s biggest automakers, which tap public bond markets and other sources of cash to offer consumer financing. To be sure, not all of the bond proceeds are used for in-house lending and automakers also use debt to finance general operations. Even so, some analysts say that the rates are an early indication of where consumer financing costs are headed.

Read More: Carmakers Set to Lose Pricing Power in Muted Global Economy

The average yield on European carmaker bonds has climbed to 4.15%, essentially a measure of how much it would cost the industry to sell new notes, according to a Bloomberg index. That’s about twice the interest rate that companies are paying on existing debt, currently at 2.14%, the data show.

In the US, Toyota Motor Corp. sold around $2 billion of fixed-rate notes in May, while American Honda Finance Corp. and General Motors Co. brought a combined $3.75 billion in deals the previous month. The average yield for US investment-grade issuers climbed to 5.3% at the end of May from 5% a month earlier, according to Bloomberg index data.

BMW’s lending arm, BMW Finance NV, recently issued €2 billion of bonds with coupons of between 3.25% and 3.625%. That compares with fixed-rate euro bonds coming due this year with coupons of at least 3 percentage points less than the new ones, implying an extra €50 million cost per year, according to Bloomberg calculations.

The broader question for the industry is whether consumers will be able to afford costlier car loans with inflation already eroding incomes, or if they’ll opt to drive older vehicles for longer and delay new purchases.

Some analysts have speculated that automakers may choose to keep interest rates low, even if it erodes the profitability of their financing units, in hopes of making up the difference with higher sales.

“To retain revenues, automakers will have to lower prices to get to a price point that’s stabilized or minimize the loss in revenue. It’s all about elasticity,” said Anna Wong, chief U.S. economist at Bloomberg Economics. “The most likely thing is the sum of the higher lending cost will be shared between the automakers and the consumers.”

So far, consumers have been resilient despite faster inflation.

The backlog of orders that carmakers built up during the pandemic has made for solid quarterly results as supply chains normalize, with auto sales in Europe rising for nine months straight. But demand has shown signs of waning in the region’s economic powerhouse — domestic orders at German carmakers fell 30% in the first four months of the year — and analysts say companies are bound to lose some of their pricing power.

Read More: Europe’s Economic Engine Is Breaking Down

“Higher funding costs absolutely impact profitability at auto companies’ financial arms,” said Bloomberg Intelligence credit analyst Joel Levington. “Auto manufacturers will need to decide how to work around affordability. Do they give up pricing, add incentives or offer cheap rates as mechanisms for purchasing a vehicle?”

In-house lending is a key part of the business model for European automakers, with analysts at Bernstein estimating that it accounts for up to 30% of overall earnings. Rising rates will be a headwind to captive finance companies that have had record results in recent years.

Operating profit for Volkswagen Financial Services plunged in the first quarter after two years of exceptional earnings that were linked to cheap borrowing costs and supply shortages that drove up used-car values.

A Volkswagen spokesperson said the carmaker will make financing terms as attractive as possible, but it would have to pass on some of the costs to customers. It has also announced a new corporate structure for its financial units that would give it other means of accessing funding such as taking deposits from savers.

Automakers tend to be popular among investors, given their safe debt profile, which gives them the ability to sell bonds at rates lower than other companies.

Almost all of Europe’s major carmakers have investment-grade ratings, and recent bond sales from BMW Finance NV and Volkswagen International Finance NV saw strong demand.

--With assistance from Albertina Torsoli, Ronan Martin and Richard Annerquaye Abbey.

(Updates headlines and adds US details, analyst comments throughout.)