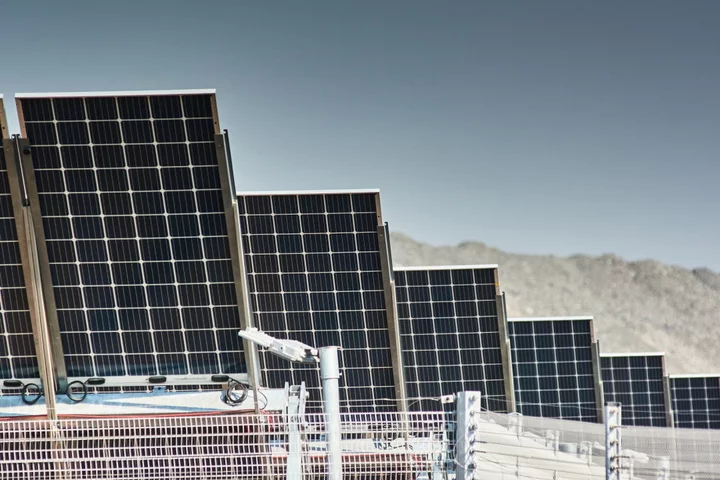

South African food producer RFG Holdings Ltd. will complete solar installations at seven of its production facilities over the next 18 month, accelerating its renewable energy program as the state-owned power utility struggles to meet demand for electricity.

The group is planning capital expenditure of 280 million rand ($14.6 million) for the 2023 financial year, including new generators and the replacement of existing ones in response to so-called loadshedding, according to its results report published on Wednesday. RFG spent 37.8 million rand on diesel for back-up power in the six months through April 2 and at current levels of blackouts its weekly average fuel cost is about 2 million rand, the company said.

RFG is among a growing number of businesses that are being forced to supply their own electricity as Eskom Holdings SOC Ltd. implements daily blackouts.

Read More: RFG Holdings 1H Net Income ZAR217.3m Vs. ZAR159.2m Y/y

Eskom to Announce New CEO Within Next Month (May 23, 5 p.m.)

Eskom is expected to appoint a new chief executive officer within the next month, Public Enterprises Minister Pravin Gordhan said.

“The process of identifying a group CEO is already under way and in the next month or so there should be some announcement in this regard,” Gordhan told lawmakers on Tuesday.

Eskom has been headed by acting CEO Calib Cassim since February. He took over from Andre de Ruyter, who left after alleging in a television interview that the utility is losing about 1 billion rand ($52 million) a month to corruption and theft, aided by people linked to the nation’s governing party.

Read More: South African Minister Gordhan Hits Back at Former Eskom CEO

Bigger Power Cuts for Longer (May 23, 11:19 a.m.)

Eskom was unable to decrease the intensity of rolling blackouts after generating units at four power plants broke down.

The utility said on Tuesday that instead of dropping outages to 3,000 megawatts during the day, it will continue loadshedding at stage 4 — in which 4,000 megawatts is removed from the grid — from 5 a.m. to 4 p.m., with stage 5 cuts overnight, until further notice. The delay in returning units to service at Arnot, Kendal, Kriel, Lethabo, Matla, Tutuka and two generating units at Hendrina power stations added to the current capacity constraints, it said in a statement on Twitter.

Netcare’s Fuel Costs Surge (May 22, 9:45 a.m.)

South Africa’s largest private health-care network expects diesel costs to more than quadruple to 165 million rand this year as it runs generators to help contain the impact of rolling blackouts.

Generator diesel costs increased to 67 million rand in the six months through March from 10 million rand a year earlier because of the consistently high number of power cuts and increased fuel costs, Netcare Ltd. said in its earnings report on May 22.

The majority of Netcare’s acute-care hospitals have the capacity to operate independently of the grid, the company said. The company has uninterrupted power supply systems and a fleet of 200 backup diesel generators support all of its facilities, and it’s invested in installing a solar power base across 72 sites, capable of generating 18 to 20 gigawatt hours per year.

Read More: Netcare 1H Net Income 618M Rand Vs. 415M Rand Y/y

Siemens Urges South Africa to Encourage Private Investment (May 22, 9:03 a.m.)

South Africa needs private investment in its rail lines and ports if it’s to benefit from the global energy transition by moving the green metals it mines efficiently to international markets, said Sabine Dall’Omo, the chief executive officer of the sub-Saharan Africa unit of Siemens AG.

“Rail and port systems in South Africa and across the continent are in dire need of investment for maintenance, security, and expansion,” Dall’Omo said in a statement on May 22. “Public-private partnerships or other forms of investment can help ensure the necessary capital flows to properly maintain this infrastructure for everyone’s benefit.”

--With assistance from Mpho Hlakudi and Paul Vecchiatto.