OCI NV is considering the Middle East and US as possible alternative listing venues, as the Dutch chemical company looks to assuage shareholder concerns about its stock price.

The company’s board approved a comprehensive review of all its business lines to unlock value, which includes evaluating its Dutch listing, it said in a statement on Tuesday. The decision follows a letter from activist investor Jeff Ubben in March, which urged the company to explore strategic options including asset sales.

“A lot of our new investments” are in the Middle East and the United States, Chief Executive Officer Ahmed El-Hoshy said in an interview after the statement.

OCI trades at a “discount to its sum of its parts and to some of its global peers,” El-Hoshy said. Some shareholders of the company, which went public in Amsterdam in 2013, have voiced frustration with the listing venue, he said.

Ubben’s Inclusive Capital Partners holds a stake in Fertiglobe Plc and is one of OCI’s largest shareholders. El-Hoshy said the company is in constructive talks with Ubben and that he hasn’t requested a board seat.

“Some of our larger shareholders also see the trading discount valuation and they’re basically seeing that there are several parts of the business that are undervalued,” said El-Hoshy. The discount is visible “when you look at how Fertiglobe trades versus our methanol and energy assets and our hydrogen strategy and where our fertilizer assets trade,” he said.

Fertiglobe Plc, the Middle Eastern fertilizer venture that OCI jointly controls with Abu Dhabi National Oil Co, listed in Abu Dhabi in 2021. Fertiglobe’s stock has risen 36% since its listing. OCI’s shares have declined 33% in the year so far, compared with a 7% decline in German fertilizer maker K+S AG.

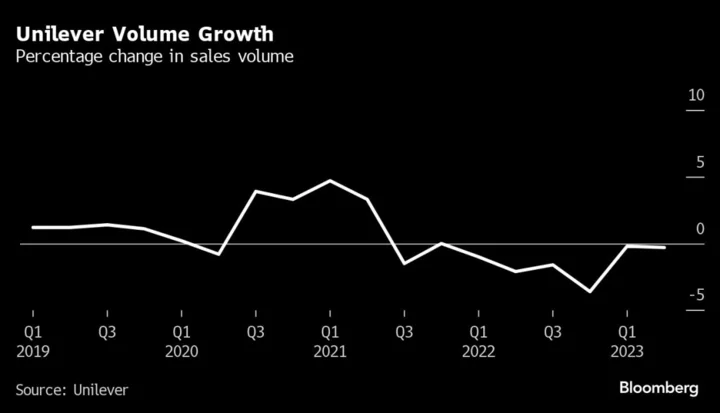

The company’s adjusted earnings before interest, taxes, depreciation and amortization dropped 65% to $336.2 million in the first quarter, due to lower selling prices and volumes. OCI’s adjusted Ebitda missed analysts’ average estimate of $467.2 million.

“At the end of the day we do agree with” Ubben, he said. “There are significant parts of our business that are undervalued and there are ways to crystallize value.”

(Updates throughout with comments from CEO interview)