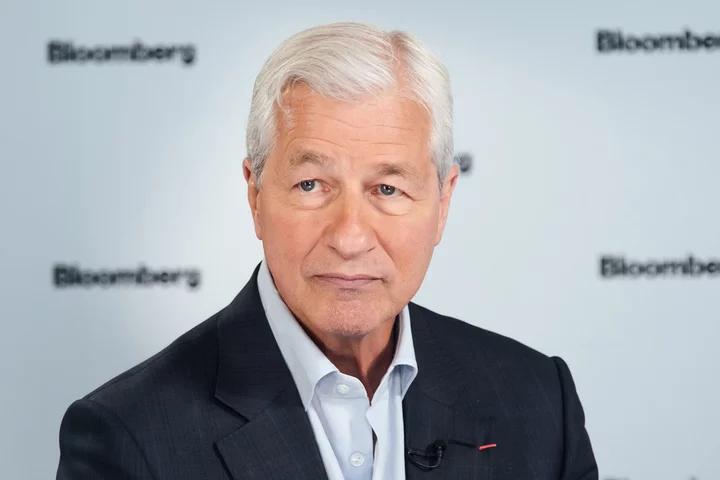

When Jamie Dimon takes center stage at JPMorgan Chase & Co.’s China summit Wednesday, he’ll be confronting a business landscape that looks vastly different from his visit four years ago.

Back in 2019, the last time the flagship event was held in person, the US bank and its Wall Street peers were gearing up to cash in on China’s long-awaited opening of its $60 trillion financial sector.

This year, the conference is being held against the backdrop of a US-China relationship that’s at its worst in decades. A sluggish Chinese economy and Beijing’s increased crackdowns on foreign businesses is forcing global banks to rethink their ambitions in the country, with revised profit goals and job cuts.

“I think it’s pretty obvious that right now everybody’s taking a very low-profile approach to whatever they’re doing with the sole exception of Jamie Dimon,” said Peter Alexander, managing director at Shanghai-based consultancy Z-Ben Advisors Ltd.

This will be the first major event held by a global bank in mainland China since the country exited its zero-Covid policy, after three years of virtual events. More than 2,600 bankers and clients will gather for two days at the Jing An Shangri-La hotel in the finance hub of Shanghai, a shift from its usual venue in Beijing.

The Wall Street bank will try to put on a good face despite the tensions. The conference opens with a talk titled “We are Back!” by Asia-Pacific Chief Executive Officer Filippo Gori, signalling the firm will emphasize its standard line on China: that it has a long-term commitment to the country despite headwinds.

The event agenda is littered with business heavyweights from both the US and China, including the chief executive officers of Pfizer Inc., Baidu Inc. and Starbucks Corp. Former US secretaries of state Henry Kissinger — who turned 100 this month — and Condoleezza Rice are set to do a virtual roundtable.

New York rival Morgan Stanley meanwhile is holding a China-focused event of its own in Hong Kong from Tuesday to Thursday, with about 500 executives from 260 Chinese companies and more than 1,500 global investors attending.

The conferences are going ahead even as the risks and uncertainty of doing business in China are greater than ever. Beijing’s recent actions have spooked foreign executives, after officials raided the offices of consulting firms and detained a Japanese pharmaceutical employee. China’s new ambassador to the US said the relationship between the two nations is facing “serious difficulties and challenges.” Tensions have mounted over spying allegations, Taiwan’s sovereignty and US technology export controls.

“The macro environment has deteriorated from three years ago,” said Nelson Yan, head of product and dealing at Fosun Wealth International Holdings Ltd. “So this event will be like a stepping stone for foreign investors to come back to China and see what’s happening there.”

Dimon is quick to emphasize the importance of China, and has taken steps to appease Beijing in the past. In 2021, he apologized for a quip that JPMorgan would outlast the Chinese Communist Party, saying that the bank hoped to be in the market for a long time. JPMorgan research that called certain Chinese stocks “uninvestable” last year was later revealed to be published in error.

“You’ve got an individual in Jamie Dimon who’s literally seen everything,” Alexander said. “He’s going to have the confidence in his convictions, either right or wrong. He’s not going to bend to the will of a headline, or even a call from some of his largest shareholders.”

There’s plenty at stake for JPMorgan in China, where it has exposure of more than $10 billion. The bank just gained full ownership of its China mutual fund joint venture this year, after adding ownerships of a local futures unit in 2020 and a securities unit in 2021.

Still, the once-bright outlook for China has dimmed. Onshore deal flow has dwindled, and JPMorgan had to cut about 30 investment-banking jobs in Asia-Pacific in late February, with a majority of them in Greater China, people familiar with the matter said. Morgan Stanley is putting on hold plans to build a brokerage onshore as it embarks on job cuts, while Bank of America Corp. plans to ask about 40 bankers in Asia to look for jobs in other divisions.

Most global investment banks are still losing money in China even after investing billions in their own operations and in joint ventures, according to Bloomberg Intelligence. JPMorgan is one of the few exceptions, posting net income of 263 million yuan ($37 million) last year at its onshore securities unit. JPMorgan also tops Z-Ben’s ranking for global asset managers in China, based on domestic and international fund flows from the country.