After being beaten down by a dominant dollar this year, the weakest links in the currency world are making a comeback — much to the relief of central banks.

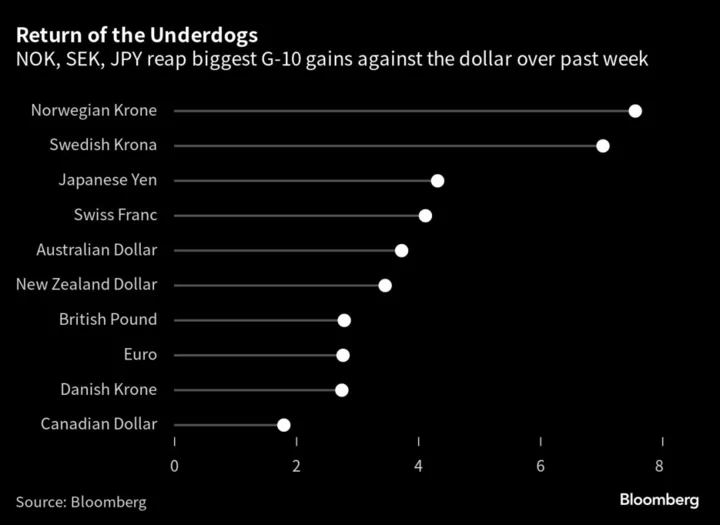

The Japanese yen, Norwegian krone and South African rand have turned from the worst-performing major currencies this year to become the best in the past week, along with Sweden’s krona. The sharp turn of fortunes has come on the back of softer US inflation that is weakening the greenback.

With traders now confident that the Federal Reserve is close to the end of its interest-rate hiking cycle, a spike in risk appetite saw some of the biggest currency moves of recent times. The krona rallied the most in a week since 2009 to turn positive for the year, while the krone and rand gained the most since 2020. The yen posted its best performance since the beginning of 2023.

This spells relief for policymakers, who in all these countries have been warning over severe currency weakness. That had led several central banks to mull supportive measures in recent weeks, including market intervention.

“This could be the start of an important adjustment in markets,” said Chris Turner, head of currency strategy at ING Groep NV. “There may be a few bumps along the road, but lower US short-dated yields should allow these underdogs to come back — especially since they have all been quite undervalued.”

With deeply negative real rates as interest rates lagged inflation and struggling economies, Japan, Sweden and Norway have been unable to compete with the draw of US markets. Authorities were increasingly having to talk up the possibility of intervention.

Japanese officials were monitoring the yen with a “strong sense of urgency” as it neared levels that triggered intervention late last year. In Sweden, policymakers said investors shouldn’t bet on prolonged currency weakness and introduced a strategy to hedge a portion of reserves, while Norway’s central bank reduced the pace of foreign currency purchases. South Africa’s bank said it was monitoring weakness in the rand, after a record low.

“The rallies will be welcomed by domestic policymakers,” said Lee Hardman, currency strategist at MUFG Bank Ltd.

Many money managers have been calling for a downtrend in the dollar for months. MUFG’s Hardman is betting that sustained greenback weakness heading into the second half of the year will keep the rally in the yen, krona and krone going.

“All three currencies are deeply undervalued so there is room for the rebound to extend further,” he said, forecasting dollar-yen at 130.00 by year-end.

Read more: Fund Titans Are Betting on Everything Gaining Against the Dollar

The sharp moves will have burned others. Hedge funds had been building up yen short positions in the past three weeks to the highest in a year. Against the rand, in recent days someone bought “any dollar within reach of the mouse button,” said Warrick Butler, head of foreign-exchange trading at Standard Bank in Johannesburg, hoping they are not still sitting “in a world of pain.”

Some investors remain skeptical about jumping in on the trend. Short positions in the yen remain historically high, cracks in Sweden’s housing market are still a huge source of concern and the dollar’s high-carry appeal may hamper any sustained weakening.

For example, Iain Cunningham, fund manager at Ninety-One Asset Management, is continuing to short the krona. He’s unconvinced that the recent draw-down in the dollar will sustainably turn around the krona story given Sweden’s domestic vulnerabilities.

“One has to be a little bit careful about this euphoria of selling the dollar at the moment,” said Fredrik Repton, fund manager at Neuberger Berman, citing the worsening outlook for Europe’s economy in comparison to the US and the dollar’s high-carry attractiveness. “I wouldn’t chase this narrative with both hands, even though I do think over the short term it can still work.”

--With assistance from Naomi Tajitsu and Colleen Goko.