The Czech central bank should raise interest rates further to prevent high inflation from becoming entrenched in the economy, board member Tomas Holub said on Sunday.

Holub has been calling for higher borrowing costs since the central bank’s revamped leadership halted rapid monetary tightening last summer. He and two other board members unsuccessfully sought a rate hike at the central bank’s May 3 monetary meeting, while the remaining four policymakers voted for no change.

Czech monetary conditions are “relatively tight,” but the central bank should nevertheless show it’s determined to cool the economy more, according to Holub.

“Raising interest rates is a tool in the fight against inflation expectations,” he said in a debate on the public TV. “We may have missed the optimal timing, but if there’s a risk of a wage-price spiral, then sending such a signal still has meaning for me.”

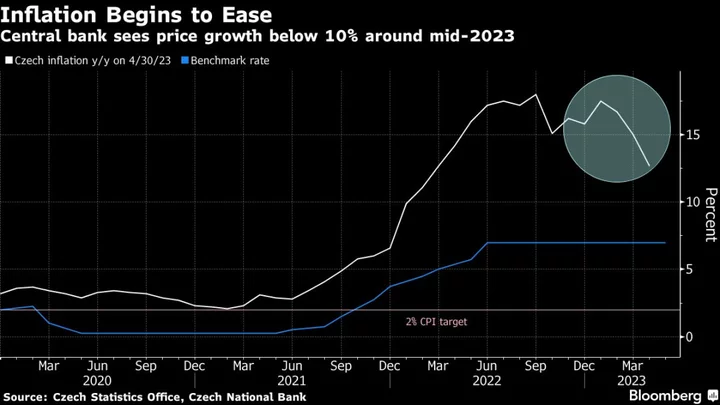

Czech inflation is slowing from the highest levels in about three decades, with the annual rate dropping to 12.7% in April from 15% the previous month. The central bank expects price growth to return to single digits around mid-year and reach the 2% goal by mid-2024.

The majority of board members, including Governor Ales Michl, have argued that monetary policy is sufficiently restrictive, pointing to declining household consumption, slowing credit growth and a cooling property market. Still, Michl has said the board will again discuss in June whether to raise borrowing costs further.