Commerzbank AG is talking to sovereign wealth funds about becoming an anchor investor to shore up its defenses against any opportunistic takeover bid and preserve its independence, people familiar with the matter said.

Commerzbank Chief Executive Officer Manfred Knof has approached state-backed funds from Asia and the Middle East in recent weeks to gauge their interest in buying a stake of up to 9.9%, said the people. The bank sees an opportunity to speak with investors as it has recently unveiled a new strategy and its share price is up, they said.

The overtures come amid a German fiscal crisis that’s left the government seeking to plug a hole of some €17 billion in next year’s budget. Germany is Commerzbank’s largest shareholder with a stake of almost 16%, according to data compiled by Bloomberg.

Banking consolidation in Europe has accelerated over the past three years with in-market combinations in Italy, Spain and more recently in Switzerland with UBS Group AG’s rescue of Credit Suisse Group AG.

Commerzbank shares rose 0.5% to €11.30 to 4:46 p.m., erasing a drop of as much as 0.7%.

Commerzbank’s deliberations are ongoing, and there’s no certainty the bank will bring in an anchor investor, the people said. The bank has discussed internally the prospect and implications of the German government selling down its stake, some of the people said.

If the government ultimately decides to sell the Commerzbank stake to another financial institution, the holding could attract interest from lenders such as UniCredit SpA and Deutsche Bank AG, the people said, asking not to be identified because the information is private.

A representative for Commerzbank declined to comment, as did spokespeople for UniCredit, Deutsche Bank and the German Finance Ministry.

State Bailouts

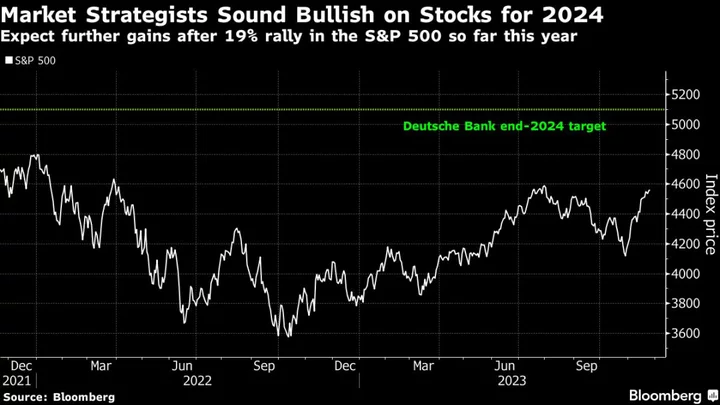

Shares of Commerzbank have more than doubled over the past three years and are now trading close to a five-year high as rising interest rates boost profitability across the financial industry.

That’s encouraged appetite for dealmaking, with French financial group BPCE SA said to be exploring strategic options for its $1.2 trillion Natixis Investment Managers business and various smaller UK lenders in play.

Some European governments have recently seized on the moment to sell off bank stakes they’ve been holding since the bailouts following the global financial crisis more than a decade ago.

Nevertheless, Berlin would have to sell its stake at about €26 a share in order to exit Commerzbank without incurring a loss after accumulating the holding during the crisis. Commerzbank shares closed Thursday at €11.245.

--With assistance from Tommaso Ebhardt, Kamil Kowalcze, Michael Nienaber, Chiara Albanese and Sonia Sirletti.

(Updates to add stock move fifth paragraph.)

Author: Eyk Henning, Jan-Henrik Förster, Dinesh Nair and Steven Arons