China’s demand for electric vehicles has delivered the nation’s homegrown carmakers a seemingly unassailable and irreversible lead over all foreign rivals in the world’s biggest auto market.

Led by the likes of BYD Co. and Geely Automobile Holdings Ltd., Chinese firms grabbed more than 50% of total auto sales for the first time in July, according to Bloomberg’s analysis of data from the China Automotive Technology and Research Center.

That growth is coming at the expense of legacy German, US and Japanese automakers from Volkswagen AG to Ford Motor Co. and Toyota Motor Corp. UBS AG analysts earlier this month warned western carmakers are set to lose a fifth of their global market share because of the rise of more-affordable Chinese EVs.

As Chinese buyers increasingly favor local manufacturers, foreign firms are in retreat. South Korea’s Hyundai Motor Co. is selling production facilities, Ford has cut jobs and Stellantis NV last year shuttered its only Jeep factory in China. Mazda Motor Corp.’s Chief Executive Officer Masahiro Moro earlier this year openly fretted about falling sales and faltering earnings in China.

“China is progressing with a scary speed,” Moro said. “Our sales in China, as well as earnings, will suffer.”

BYD alone holds an 11% share of China’s auto market. It’s strategy of selling a wide range of EVs at price points ranging from the budget Seagull and Dolphin to the top end of the market has helped fuel its rapid growth. Eleven of the 20 top-selling brands in China are now from local companies.

The market share of US brands, including the likes of Tesla Inc., Buick, Ford and Chevrolet, has fallen to the lowest level since the data started in 2008. Without EV pioneer Tesla, which opened its Shanghai factory in 2019, the picture would be even worse.

While German brands are faring slightly better, cracks are appearing. VW earlier this year lost its mantle of China’s top-selling car brand to BYD — dogged by a lack of electric models — while Mercedes-Benz Group AG has been caught up in a bruising price war. To get back in the game, VW in July struck a $700 million deal for a 5% stake in loss-making Chinese EV upstart Xpeng Inc., including an agreement to make at least two new VW-badged battery-powered models for the Chinese market.

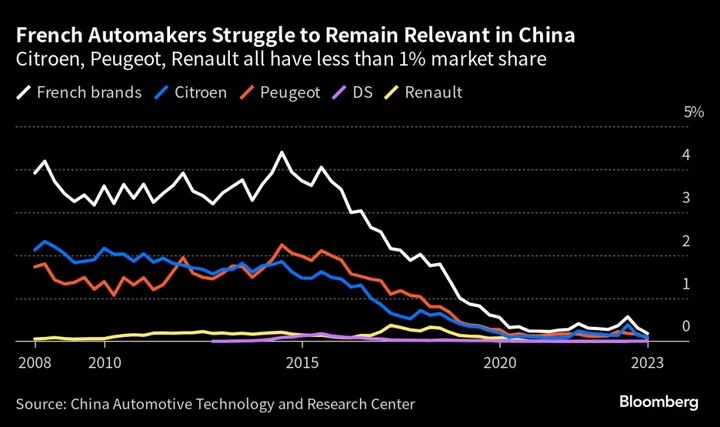

Among the losers, French automakers have seen their popularity collapse in the past decade to the point they are also-rans, with Citroen, Peugeot and Renault all having less than 1% market share. It’s small wonder Stellantis CEO Carlos Tavares is shifting his strategy in China, without completely leaving. By exiting factories and relying more on partners, it leaves it with something more asset-light and less of a cost burden.

--With assistance from Linda Lew.