One of India’s biggest venture capital firms is turning more cautious in its investment strategy, alarmed by crises at homegrown startups such as ed-tech leader Byju’s.

Blume Ventures, which manages $625 million in assets, is cutting back on “frivolous” investments as it pushes portfolio companies to increasingly shift focus to profitability, co-founder Karthik Reddy said in an interview. About a third of its portfolio, which includes e-commerce and mobility firms, has turned “shaky” over the past year, Reddy said.

Perceived corporate governance lapses are sending shockwaves through the South Asian nation’s fledgling startup economy. Byju’s, once India’s most valuable upstart, is in turmoil after missing a deadline on financial statements, skipping payments on a $1.2 billion loan and losing its auditor and some of its board members.

The chaos at Byju’s has forced “the entire ecosystem to think about what could be wrong in every portfolio company,” said Reddy, whose firm backs Byju’s rival Unacademy, as well as scores of consumer startups including delivery firm Dunzo and gadget marketplace Cashify. “You get these questions from your investors as well.”

A Byju’s representative said the company didn’t have an immediate comment. Byju’s was valued at $22 billion late last year. Last month, one of its main investors, Prosus NV, slashed the value of its stake in a move that pegged Byju’s total valuation at about $5.1 billion.

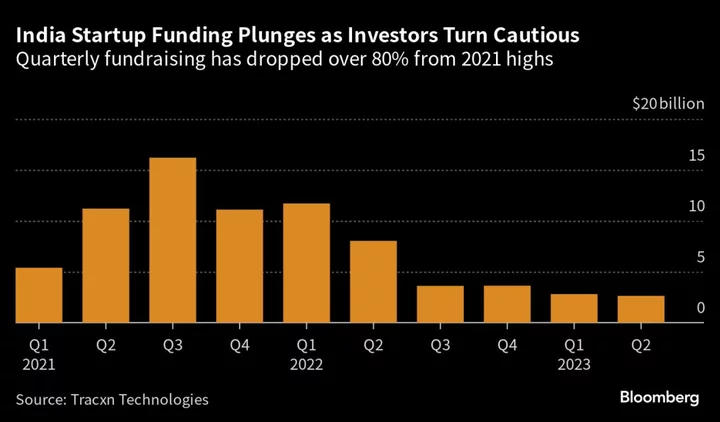

The perceived mis-steps in governance resulted from a venture capital boom that lasted through 2021. Funding has dried up since as slowing economies, rising interest rates and higher levels of inflation prompted venture investors to pull back.

Indian startups raised $5.4 billion in the first half of 2023, a decline of more than 70% from the same period last year, according to Tracxn Technologies. Already in 2022, funding dropped to about $27 billion from $43 billion in 2021.

“There is very little early-stage investing happening right now,” Reddy said. Blume, based in India’s financial capital of Mumbai, typically provides seed funding to upstarts.

That cautiousness dovetails with several small startups shutting down amid the funding winter. Investors have become more prudent and firms such as Blume are wary of writing a cheque for just “another e-commerce, marketplace or influencer marketing idea,” Reddy said.

--With assistance from Sankalp Phartiyal.