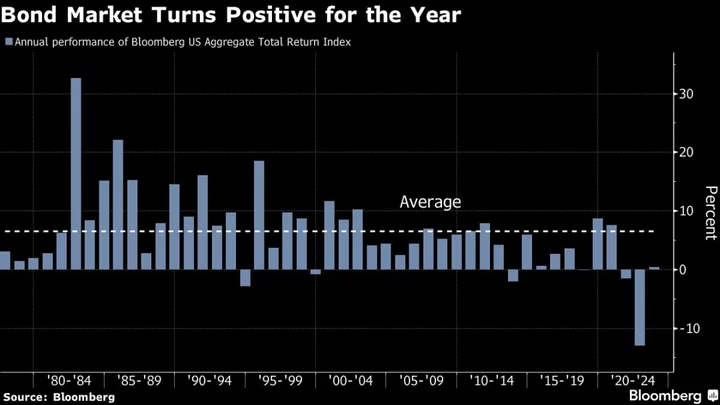

At least for now, the US bond market is on track to avoid the not-so-glorious milestone of a third consecutive year of losses, which by some accounts would have been the worst performance since the 18th century.

Following a softer-than-expected inflation report, the Bloomberg US Aggregate index has gained 1.2% this week through Thursday and is up 0.4% for the year. The benchmark, which tracks $25 trillion of investment-grade government and corporate debt, posted a record loss of 13% in 2022 and declined 1.5% the previous year. The index has never slid three straight years.

Of course, the meager gain means it won’t take much for the market to end the year with a loss. Until a month ago, such a fate seemed inevitable, with 10-year yields briefly hitting 5% for the first time in more than a decade. Four weeks ago, the bond market was nursing a 2023 loss of about 3%.

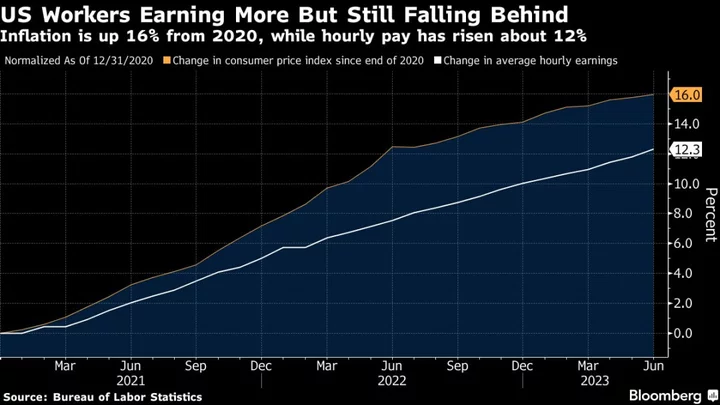

But since then, things have gone in the right direction for bond bulls. The Treasury slowed its increases in sales of long-term securities, the labor market started to show signs of softening and this week’s consumer price report showed what JPMorgan Investment Management’s Priya Misra called an “immaculate disinflation.”

Rates traders are now betting that the Federal Reserve is done hiking, and that it will cut borrowing costs by almost 100 basis points next year, starting around mid-2024.

To be sure, this year has seen plenty of disappointments and false dawns for bondholders. The amount of rate cuts priced in far exceeds the reduction implied by the median estimates of Fed officials at their September policy meeting.

But with the unemployment rate edging up and 10-year yields almost 70 basis points higher than a year ago, the math starts to look more favorable for debt investors.

“Odds are growing that we are at the turning point of the labor market,” said Ed Al-Hussainy, a global rates strategist at Columbia Threadneedle Investments. “Any negative data miss, any hit to risk sentiment will benefit” long-term bonds.