Not even 2023’s eye-watering rallies can lure badly burned exchange-traded fund investors back to crypto after last year’s beating.

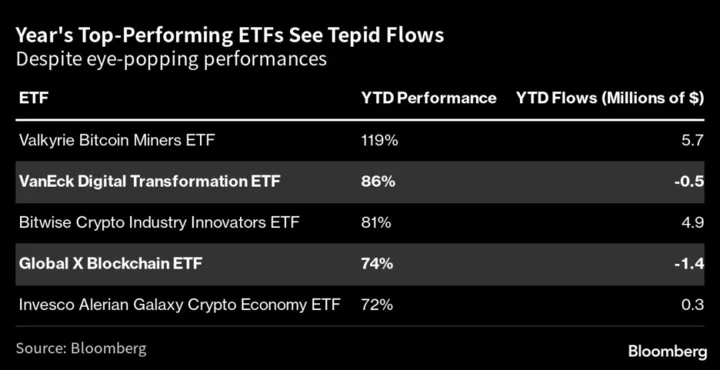

The top five best-performing non-leveraged ETFs in 2023 are all crypto-linked, led by the Valkyrie Bitcoin Miners ETF (ticker WGMI)’s 119% rally. However, the group has attracted just $12 million of inflows so far this year — a fraction of the $118 billion that’s poured into the industry overall.

The tepid appetite subverts a time-tested adage of investing: Flows follow performance. And it speaks to how hesitant investors — especially the retail cohort — have been to wade back into risky assets following the infamous collapses of a number of crypto companies as well as a precipitous crash in prices.

“Equity people have just turned off crypto, period,” said Stephane Ouellette, chief executive of FRNT Financial Inc, an institutional platform focused on digital assets. “You’ve got long-term believers left in the space in a time where no one really has dollars to invest — so those people are holding. The wave of selling is for the most part over so it’s just like a bunch of holders left.”

Cryptocurrencies and many related projects crashed in 2022 as companies folded and billions of dollars of wealth evaporated.

“There is quite a bit of shell-shock after what happened last year in all risk assets,” David Spika, president and chief investment officer of GuideStone Capital Management, said in an interview. “So I would think investors are going to be very leery about getting back into very risky assets anytime soon.”

The five best-performing funds in 2023 — the Valkyrie Bitcoin Miners ETF, the VanEck Digital Transformation ETF (DAPP), the Bitwise Crypto Industry Innovators ETF (BITQ), the Global X Blockchain ETF (BKCH) and the Invesco Alerian Galaxy Crypto Economy ETF (SATO) — have been atop the performance leaderboard all year as crypto prices overall have made a big rebound.

Yet, two of them — DAPP and BKCH — have seen outflows despite gains of more than 70% each. And each of the other three is on pace for way smaller intakes than they took in during all of 2022, when the multitude of scandals dented trust in the digital-assets industry.

“Typically investors chase returns so high returns often match up with high fund flows. With crypto ETFs, however, most of the outperformance year to date has been a recovery from the weak performance in 2022 and not necessarily from strong fundamentals,” said Roxanna Islam, associate director of research and head of sector and industry research at VettaFi.