Stocks in Asia are set for a muted open after a mixed US session that saw Treasuries and the dollar rally on signals of a cooling jobs market and renewed concerns about the health of regional lenders.

Equity futures in Hong Kong advanced, while those for Japan and Australia were little changed and US contracts were stable in early Asian trade. The S&P 500 slid 0.2% on Thursday following jobs and inflation data, while the tech-heavy Nasdaq 100 added 0.3% after Google parent Alphabet Inc. showcased its artificial intelligence tools.

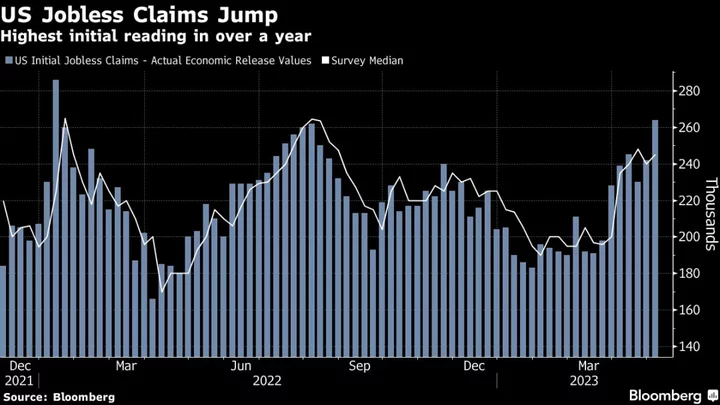

Data showed US initial jobless claims reached the highest since October 2021 while producer prices rose 0.2% in April, trailing economists’ estimates for a 0.3% increase. The reports signal the Federal Reserve’s policy-tightening campaign may finally be having an effect on inflation as the central bank walks a tightrope between reining in rising prices and tipping the economy into a downturn.

Commodities slumped on the bearish economic indicators and renewed concerns about China’s economic recovery after credit and new loans fell in April from the previous month. However, US-listed Chinese stocks climbed the most in three months after earnings from JD.com boosted e-commerce stocks, and US National Security Adviser Jake Sullivan met with China’s top diplomat Wang Yi in a move to ease rising tensions between the nations.

Haven assets traded stronger, with the dollar rising the most in two months and Treasury yields falling. The policy-sensitive two-year rate fell to 3.9%, while 30-year bonds extended a rally following a stronger-than-expected auction.

“Inflation has peaked and is trending lower as growth weakens,” according to Don Rissmiller, chief economist at Strategas. The data support a Fed pause, he said, though there are other risks.

“While the US does not appear to be in recession right now, there are some signs of cracks starting to appear, and global pressures remain,” he wrote.

Swaps traders are pricing in more than 75 basis points of cuts in 2023 after this week’s economic reports, which included a slightly better-than-expected consumer price readout on Wednesday.

“Today’s data is a step in the right direction from the Fed’s perspective,” Kara Murphy, chief investment officer of Kestra Investment Management, said in an interview. “But these numbers are really volatile week-to-week and we’re coming off of extraordinarily strong levels. There’s a lot more that has to happen.”

Economic indicators are “moving in the right direction, but none of it is enough to say that the Fed’s job is done,” she added.

Sentiment seemed fragile with investors still worried about the US debt-ceiling and stability of the banking industry. A Friday meeting between President Joe Biden and House Speaker Kevin McCarthy was postponed as staff negotiations continued.

Jamie Dimon said “we need to finish the bank crisis,” in a Bloomberg Television interview, adding regulators should do “whatever they need to do to make it better.” JPMorgan’s chief executive officer predicted more regulations were ahead for lenders.

Elsewhere, the Bloomberg Commodity Index is set for its fourth weekly decline on the weak US and Chinese economic data, its longest such streak since September.

The Bank of England raised its benchmark lending rate to the highest level since 2008 and said further increases may be needed if inflationary pressures persist.

Key events this week:

- US University of Michigan consumer sentiment, Friday

- Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were up 0.1% as of 7:19 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.3%

- Hang Seng futures rose 0.7%

- Nikkei 225 futures were little changed

- S&P/ASX 200 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.5%

- The euro was little changed at $1.0917

- The Japanese yen was little changed at 134.54 per dollar

- The offshore yuan was little changed at 6.9613 per dollar

- The Australian dollar was unchanged at $0.6702

Cryptocurrencies

- Bitcoin was little changed at $27,023.45

- Ether was little changed at $1,796.86

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.38%

Commodities

- West Texas Intermediate crude rose 0.8% to $71.45 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Peyton Forte and Emily Graffeo.