A potential strike by 340,000 unionized workers at United Parcel Service Inc. threatens to unravel progress in tackling two of the US economy’s biggest hurdles in decades: inflation and supply-chain disruptions.

In the absence of a labor deal by Aug. 1, a walkout by members of the International Brotherhood of Teamsters would snarl shipments of the 19 million packages that UPS moves daily in the US. It would also enable competitors such as FedEx Corp. to raise prices to help throttle some of the parcels that would pour into its networks.

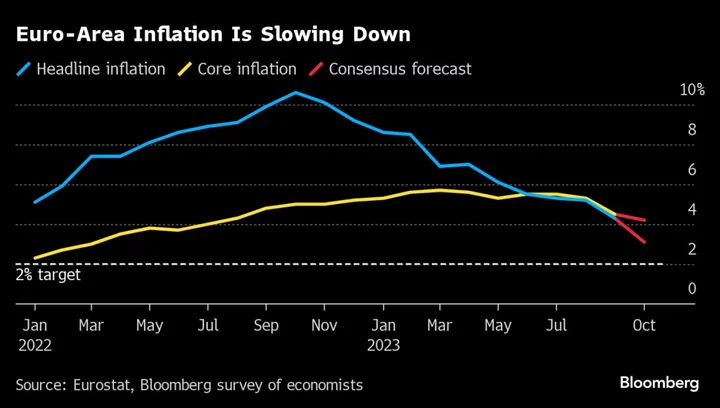

Economists say the strike might raise the inflation rate — which the Federal Reserve has sought to curb via an aggressive tightening campaign after it reached a four-decade high of 9.1% last year. And if the Teamsters’ demand for much-higher wages is met, this could be a harbinger for other outsized salary increases, further complicating the Fed’s effort to get price growth to its 2% annual target.

This could “give other workers the incentive to bargain for higher wages” and prompt a shift in the employer-employee dynamic, said Kathy Bostjancic, chief economist at insurer Nationwide Mutual Insurance Co. Spiking wage costs could prompt consumer-product companies to lift prices that otherwise have been decelerating in recent months, Bostjancic said.

On its own, a walkout could add up to 0.2 percentage point to the annual inflation rate, said Greg Valliere, chief US policy strategist for asset manager AGF Investments Inc. The measure fell to 3% in June.

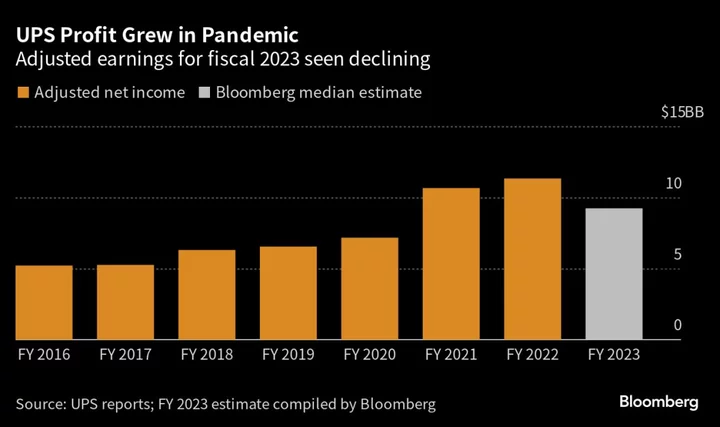

UPS workers are seeking relief from the pandemic era’s surge in price growth: The current labor contract locked in a wage progression from 2018 to 2023.

UPS’s Teamsters also seek monetary recognition for serving during the pandemic as essential workers.

“We’re going to get the best contract,” union President Sean O’Brien told Teamster members July 16. “This is the largest collective-bargaining agreement in the entire labor movement. So you all will set the tone on the direction of organized labor moving forward.”

The talks to renew the five-year contract will resume next week after they stalled July 5. Then, the Teamsters rejected UPS’s offer for part-time wage increases, which O’Brien called “crumbs.”

He has said that part-time wages need to start at more than $20 an hour. Currently, about 100,000 workers employed on this basis make less than that, O’Brien has said.

Neither side has made their offers public, but the union president reportedly said the difference is as much as $6 to $7 per hour.

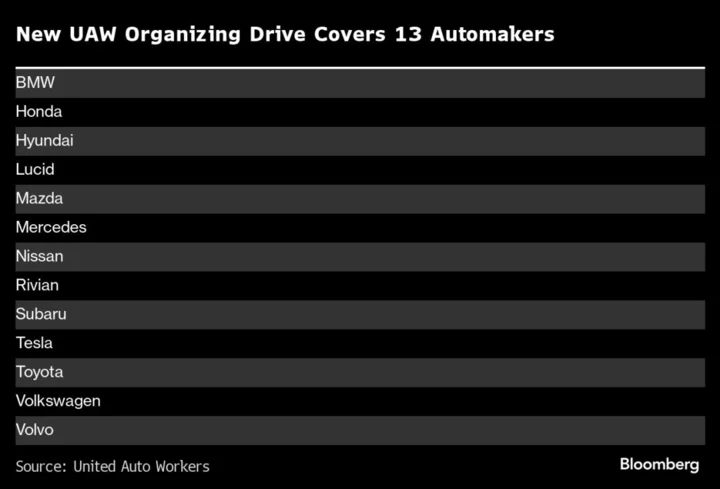

Workers at UPS aren’t the only ones demanding more pay. Companies across industries, including railroads, airlines, automakers and even Hollywood movie-makers, face hefty wage increases as unions seek to recover buying power for their members.

In Canada, a strike by British Columbia dockworkers has stymied trade out of that nation’s West Coast ports, including Vancouver.

Logistics Effect

The supply-chain impact from a potential UPS strike is harder to estimate and the damage will depend on how long it lasts.

Shippers have more alternatives for sending packages than they did during the last UPS strike in 1997.

At that time, the parcel industry moved about 16 million packages a day and UPS accounted for 70% of that volume. About 80% of packages were sent by businesses to other businesses.

Last year, it handled about 75 million packages daily and UPS shipped roughly 28% of those, according to ShipMatrix, a parcel-industry consultancy. With the advent of e-commerce, more than half of parcels now are sent to homes.

In case of a strike, shippers with brick-and-mortar stores may encourage shoppers to pick up items instead of having them delivered. Companies will likely have already increased inventory of key parts and supplies to reduce their shipping need to ride out a possible UPS strike, said Mike Skordeles, head of US economics for Truist Wealth.

“Businesses will essentially treat it like a hurricane,” Skordeles said. “They’re preparing ahead of this, such as front-loading orders and transportation for critical components.”

The strike threat comes when there’s slack in the parcel industry’s capacity. Volumes have cooled from pandemic-era highs, when homebound consumers spent some stimulus money on goods instead of services.

Amazon.com Inc., which is UPS’s largest customer, expects only minimal disruptions from a strike, partly due to of the summer lull and also because it has reduced its reliance on third-party carriers by building out its own last-mile delivery network.

It launched in 2018 a Delivery Service Partner program, which encouraged people to start their own small businesses by hiring drivers and leasing vans to deliver Amazon packages. Globally, there are now more than 3,000 delivery partners with some 275,000 drivers making Amazon deliveries.

The retail giant also has Amazon Flex, an Uber-like app drivers can download to make money delivering Amazon packages in their own vehicles.

Price Effects

Still, parcel-shipping prices will likely rise if the Teamsters walk out, with increases passed along to consumers, said Bart De Muynck, chief industry officer at supply-chain data firm Project44 Inc. Lead times for deliveries will lengthen, creating inefficiencies, he added.

FedEx tried to court UPS customers earlier this year. But not many large customers took up the offer because the company wanted long-term commitments on volume.

Changing couriers can be costly for companies because shippers have designed their warehouse operations and systems to mesh with UPS’s. They also receive discounts based on volume, which they could lose in the switch, said Micheal McDonagh, president of the parcel unit at AFS Logistics LLC.

The timing of the strike could impact back-to-school sales. But the peak season for parcel really starts in November, ahead of the holiday-shopping season. Even if there were a strike, it would likely be over by then.

“If it’s going to happen, now is more of a less impactful time for it to happen,” said Jim Tuchler, president of Gifts for You LLC in Chicago, whose company’s volume jumps about eightfold during the holiday season.

--With assistance from Spencer Soper.