Coming soon: Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

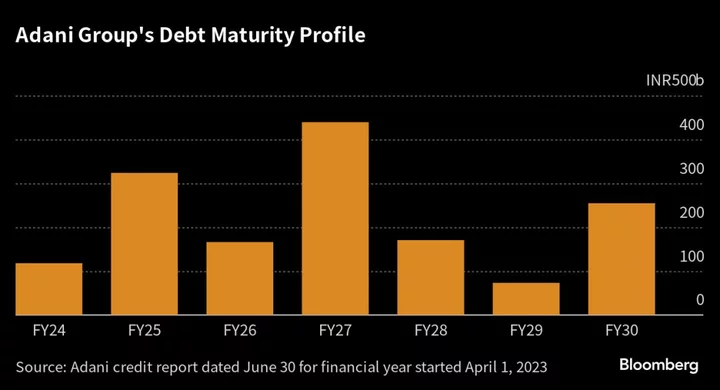

The Adani Group said cash and profit generated from its sprawling infrastructure business can cover all the debt maturing each year in the coming decade, messaging that’s part of the Indian conglomerate’s latest effort to shore up investor confidence months after a damaging short seller attack.

In a credit report released Thursday, the power-to-port conglomerate founded by billionaire Gautam Adani said its cash flow generated from business operations and balances stood at 778.9 billion rupees ($9.4 billion) as of end-March. That provides enough liquidity for the company to cover its debt due this financial year.

Should the conglomerate manage to maintain such cash flow and cash holdings going forward, that would be sufficient to service its expected obligations each year in the next decade, according to the presentation.

Nearly 60% of its debts were from banks, while the rest are bonds raised from both Indian and offshore markets. International lenders saw their share in the Adani’s total bank credit jump to 28% from 18% a year ago. The group’s total debt stood at 2.3 trillion rupees by end-March, up from 1.89 trillion rupees a year earlier.

On Wednesday, the conglomerate said it posted record profit in the quarter ended June on the back of its infrastructure and renewable energy businesses.

Showcasing a stronger cash position and bumper earnings underscores the continued effort by the embattled conglomerate to get over from the broadside in January by Hindenburg Research. The US short seller accused the company of widespread corporate malfeasance — allegations that wiped out at one point more than $150 billion in market value from its listed companies, but has also been vehemently denied by Adani.

The company’s disclosure of improved debt servicing capabilities also comes at a time when investors are waiting for the findings from the country’s markets watchdog. The Securities and Exchange Board of India has looked into some of the allegations made by Hindenburg and has asked the nation’s Supreme Court for an extension to wrap up its probe by the end of August.

Read more: Adani Flags Improving Debt Metrics to Bolster Confidence

(Updated throughout.)