South Koreans are celebrating after the yen fell to its lowest level against the won in 15 years. They’re traveling to Japan in their hordes and almost doubling their purchases of Japanese goods.

But for Park Hanul, the picture isn’t quite as rosy. The 32-year-old Seoul-based employee at a firm that provides aid programs bought about 110,000 yen ($748) over the past month as a side investment. So far, at least, it hasn’t worked out as she expected.

“I was hoping the yen’s value would go up fast,” Park said in a phone interview.

Park is among a legion of South Korean retail investors who are betting the Japanese currency’s slump must end. Yen deposits at South Korean banks jumped to a record in October, according to the latest Bank of Korea data.

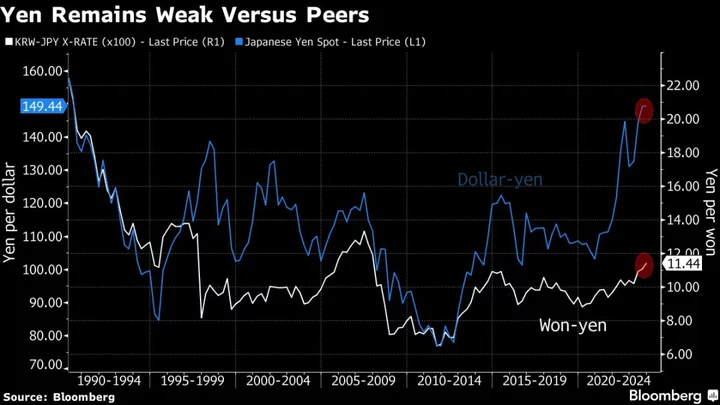

The yen dropped to its lowest against the won since 2008 on Nov. 16. While it has gained nearly 3% from that low, it’s still down 9% this year.

Park says she’s willing to put a further 3 million won ($2,327) into the yen if the Japanese currency keeps weakening.

The optimism reflects expectations that Japan’s central bank will soon start raising interest rates. As much of the rest of the world tightened policy in a bid to tame inflation, Japan went the other way, keeping its policy rate below zero to spur further price rises in an economy that had been beset by deflation.

Investors have kept their focus on the yawning interest rate gap between Japan and its peers, which makes currencies in countries with higher yields look a better bet. Leveraged funds increased their net short positions on the Japanese currency to the most since April 2022 in the week ended Nov. 14. before paring it slightly in the following week.

T. Rowe Price. is betting the yen will remain weak due to its wide rate gap with the US. The “yen may strengthen from 30-year lows versus the US dollar but we do not foresee that interest-rate differential narrowing significantly, the weak yen should continue,” Daniel Hurley, a portfolio specialist for emerging market and Japanese equities, wrote in a note last week.

Despite this cautiousness, South Korean retail investors still see opportunities in Japan. Improving relations between the two nations may partly explain the interest.

Korean President Yoon Suk Yeol has sought to boost ties with Japan after disputes surrounding Japan’s colonial rule of the Korean peninsula flared under his predecessor. Leaders of the two countries held the first formal summit since 2011 on Japanese soil in March this year. In June, Japan reinstated South Korea as one of its preferred trading partners and agreed to restore a foreign currency swap arrangement worth as much as $10 billion.

South Koreans bought the most Japanese equities this year since data became available in 2011. That can be another way to bet on the yen, as unhedged stock purchases benefit if the currency rises.

And inflows into a BlackRock Inc. exchange-traded fund that tracks long-dated Treasuries — but is priced in yen — quadrupled in the second quarter from the previous one.

South Korean tourists to Japan through January to September jumped almost five-fold from the same period last year, close to pre-Covid levels, while travels to other countries were seen still recovering, according to data from the Korea Tourism Organization. Direct purchases of Japanese goods has nearly doubled through the past three years of the yen’s relentless fall, while that of the US eased over the same period, according to the nation’s statistics office.

Lee Joon-gyu, 26, who works in interior design in Seoul, says traveling to Japan is now cheaper than going somewhere in Korea. He booked a trip to Nagoya on a whim just two weeks in advance, and plans to stock up on clothes and liquor while there. His 1 million won gave him 115,000 yen based on last week’s exchange rate. Just two years ago, the same amount of won would have handed him 96,000 yen.

For the yen investors, there’s also hope things might change. Some investors expect the Federal Reserve to lower interest rates next year, which should help the Japanese currency. Growing inflation pressures in Japan are adding pressure on the BOJ to end its ultra-loose monetary policy, which it kept unchanged last month. Its next policy decision is on Dec. 19.

Pacific Investment Management Co., which manages nearly $2 trillion of assets, is buying the yen on a bet the BOJ will have to raise rates.

“Inquiries on the yen at our sales desks have increased quite a lot,” said Moon Junghiu, an economist at KB Kookmin Bank, a South Korean lender.

And despite her yen investment not working out so far, Park, the retail investor, isn’t concerned.

If the Japanese currency doesn’t rise, “I’ll just use it for my next trip to Japan,” she said.

--With assistance from Youkyung Lee.