China’s decision to control the export of two key metals showed it has some power to retaliate against moves by the US, Japan and Europe to cut Beijing off from advanced technology. But it also risks backfiring.

The new export licensing system unveiled late Monday highlighted China’s dominant position in global production of gallium and germanium, which are used to make chips, electric cars and telecommunications equipment. The announcement — just days before US Treasury Secretary Janet Yellen visits Beijing — appears timed to give China leverage as it pushes the White House to remove export controls that risk hobbling the nation’s development.

Yet the measure is a double-edged sword, and may simply accelerate efforts by those countries to reduce dependence on the world’s second-biggest economy. If Beijing did at some point uses these new rules to restrict shipments and cut supply to other nations, prices would likely rise and make it more economical to boost output in Japan, Canada, the US or elsewhere.

“It’s part of the tit-for-tat the PRC is playing with the US and its allies,” said Ja Ian Chong, an associate professor of political science at the National University of Singapore. He was referring to the country’s formal name, the People’s Republic of China. “There may be some initial shock to the markets and firms but over time, should these restrictions persist, markets and firms adjust.”

The move underscores the dilemma facing President Xi Jinping as he seeks to counter US efforts to prevent China from accessing the chips needed to dominate technology like artificial intelligence and quantum computing. Any reciprocal actions only give the US and Europe more ammunition to push for derisking, something Xi’s government has sought to counter.

“China always takes a tit-for-tat approach,” Roy Lee, Taiwan’s deputy foreign minister, said of the new measures, which he called a retaliation to export controls by the US and other democratic nations. These “will become an accelerator for countries including Taiwan, South Korea and Japan to reduce our dependence on China supply of those critical minerals and materials.”

Rare Earth Weapon

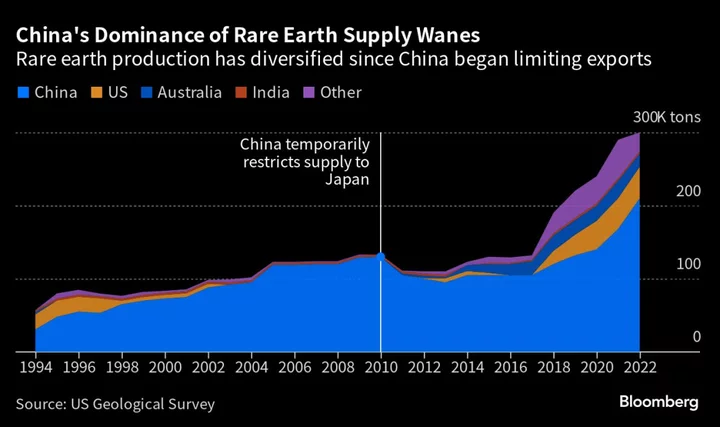

China’s previous efforts to restrict the sale of rare earths have only diminished its market share as other countries work to secure supplies of the metals that aren’t controlled by China.

China first introduced an export licensing system for rare earths in the 1990s while also gradually ramping up taxes, squeezing companies in Japan and elsewhere that relied on Chinese supplies. But the big shift happened in 2010, when Beijing temporary halted exports to Japan in reaction to a collision between a Chinese fishing boat and the Japanese coast guard near islands claimed by both countries.

That incident set off a race to find alternative supplies from China. Output in Australia and the US subsequently increased, pushing China’s share of mining output down to 70% of global supply in 2022 from a peak of 98% in 2010, according to the US Geological Survey.

China currently accounts for about 94% of the world’s gallium production, according to the UK Critical Minerals Intelligence Centre. Still, the metals aren’t particularly rare or difficult to find, though China’s kept them cheap and they can be relatively high-cost to extract.

“Imposing export restrictions risks reducing market dominance,” researchers from Eurasia Group including Anna Ashton wrote in a note. “If implemented as is, China’s new export mineral restrictions could offer fresh impetus for foreign manufacturers to shift production out of China, accelerating the trend of supply chain diversification.”

China said the new licensing system for exports of gallium and germanium, along with their chemical compounds, was aimed at protecting national security — the same justification given by the US and it allies for their export controls.

The announcement nevertheless sparked concern in Europe about potential disruption to supply chains in the short term and is likely to spur discussion about how to reduce the bloc’s reliance on China.

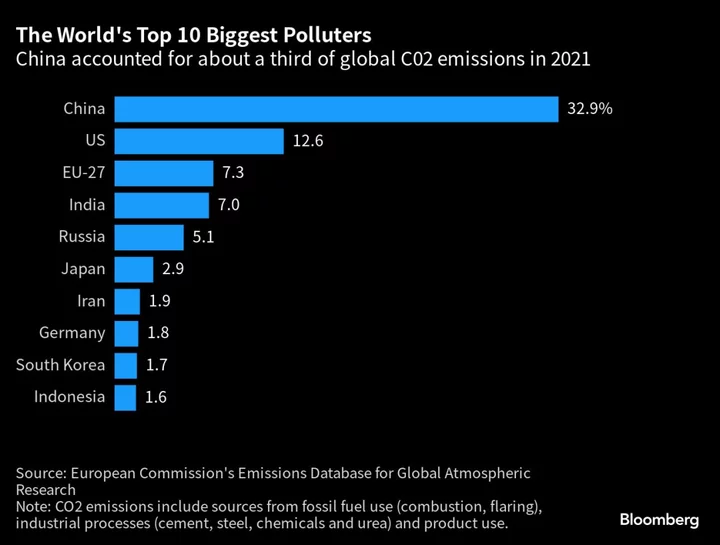

The European Union announced a new economic security strategy last month and launched a Critical Raw Materials Act to ease financing and permitting for new mining and refining projects, and also to strike trade alliances to reduce the bloc’s dependence on Chinese suppliers. If the new rules were used to restrict exports, that escalation of tensions could threaten the bloc’s ability to transform its economy to become more environmentally friendly.

The immediate effect of the changes seems to be limited, according to a statement from the Korean industry ministry on Tuesday, which noted that there are other supplies of the two metals.

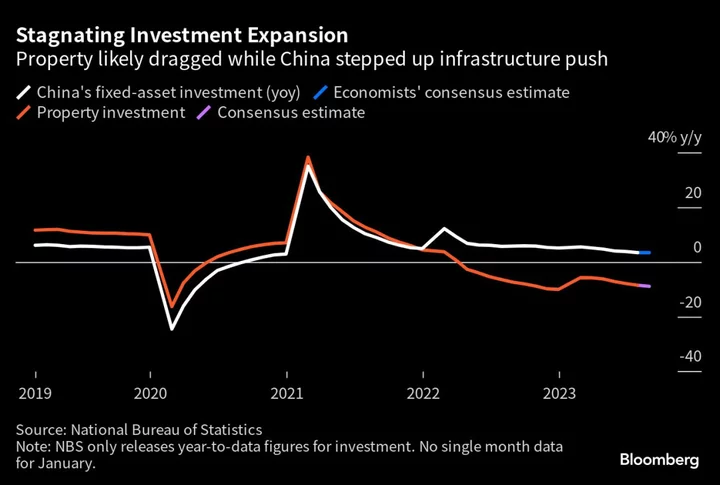

However even if China doesn’t use this new rule to limit exports at some point in the future, it arguably has more to lose than the US, particularly as its mounting economic challenges raise questions about whether it will ever take over as the world’s biggest economy.

Beijing’s most effective tool to sanction others is to cut off access to its huge market, or limit exports of strategically important goods. But this further drives the decoupling from China that Beijing wants to avoid, as it would undermine its stated goals of ensuring the nation is dominant in new technologies and essential in global supply chains.

At the moment, however, the growing ideological struggle between the US and China is taking precedence over globalization, Morris Chang, the founder of chip giant Taiwan Semiconductor Manufacturing Co., said at an industry event in Taipei on Tuesday.

“Right now national security and technology and economic leadership take priority over globalization,” he said. “The relations between US and China are more about competition than collaboration.”

--With assistance from Rebecca Choong Wilkins, Betty Hou and Jennifer Creery.

(Updates with details on reaction in Taiwan, Europe and South Korea from the 6th paragraph.)